The Pulse of Private Equity – 2/16/2026

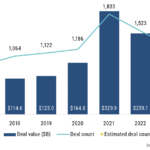

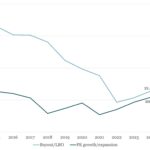

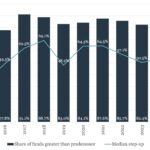

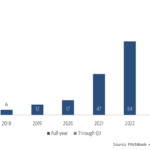

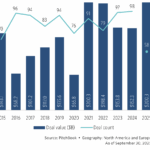

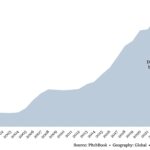

Technology PE deal activity Download PitchBook’s Report here. Technology PE deal activity experienced an outsized year, with deal value higher by 67.4% YoY even though deal count rose by a relatively more modest 13.4%…. Subscribe to Read MoreAlready a member? Log in here...