Middle Market & Private Credit – 9/23/2024

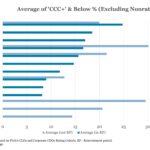

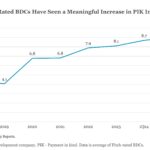

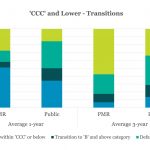

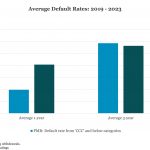

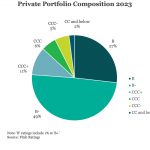

U.S. MM CLO Spotlight – August 2024 Click here to download report. ‘CCC’ Exposure Slightly Up Exposure to assets with Fitch IDRs or credit opinions of ‘CCC+’ or below, excluding nonrated assets, increased by 20 bps to 18.4%, compared to last month and is up by 3.3% compared to a year ago…. Subscribe to Read