Middle Market & Private Credit – 6/10/2024

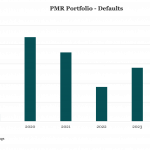

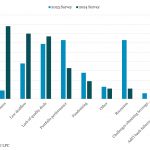

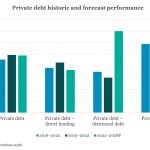

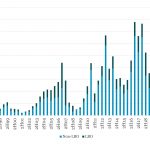

U.S. BDC Earnings, Credit Headwinds to Persist in 2024 Fitch-rated U.S. business development companies (BDCs) face persistent headwinds in 2024, with rising paid-in-kind (PIK) income and continued markdowns of investments during 1Q24 signaling additional credit issues and resultant net investment income (NII) pressure…. Subscribe to Read MoreAlready a member? Log in here...