Middle Market & Private Credit – 11/10/2025

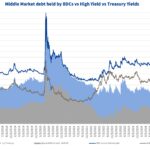

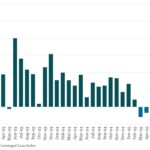

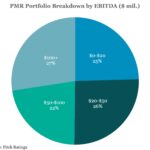

U.S. Business Development Companies Outlook 2026 Click here to download report. Fitch Ratings has a ‘deteriorating’ sector outlook for U.S. business development companies (BDCs) in 2026, due to pressure on earnings and dividend coverage from declining interest rates and elevated payment-in-kind (PIK) income…. Subscribe to Read MoreAlready a member? Log in here...