The Pulse of Private Equity – 1/12/2026

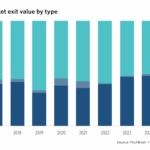

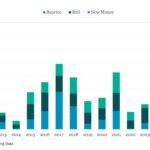

Share of PE middle-market exit value by type Download PitchBook’s Report here. Middle-market companies offer a wide array of exit options, as their smaller size makes them attractive targets for acquiring niche or local markets, enhancing business capabilities, and increasing market share…. Subscribe to Read MoreAlready a member? Log in here...