Debtwire Middle-Market – 2/2/2026

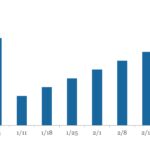

The blue line in the chart is the current dividend yield of the *VanEck BDC Income ETF (currently at 11.9% as of 30 January, versus its five-year peak of 12.8% on 8 April 2025) that tracks the overall performance of publicly traded business development companies (BDCs, are lenders to privately held middle-market businesses that tend to…