Featuring Charts

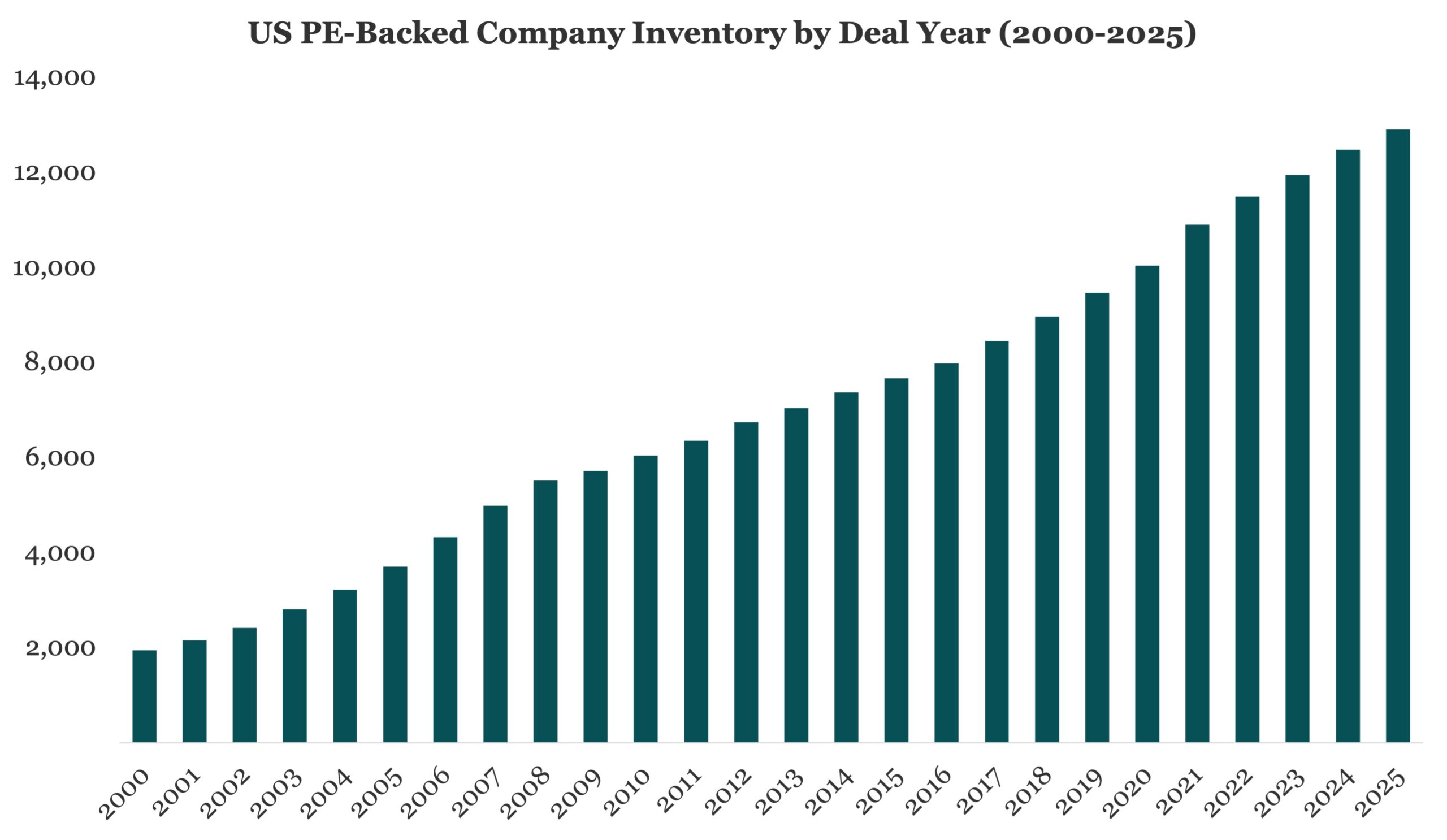

Chart of the Week: Inventory Check

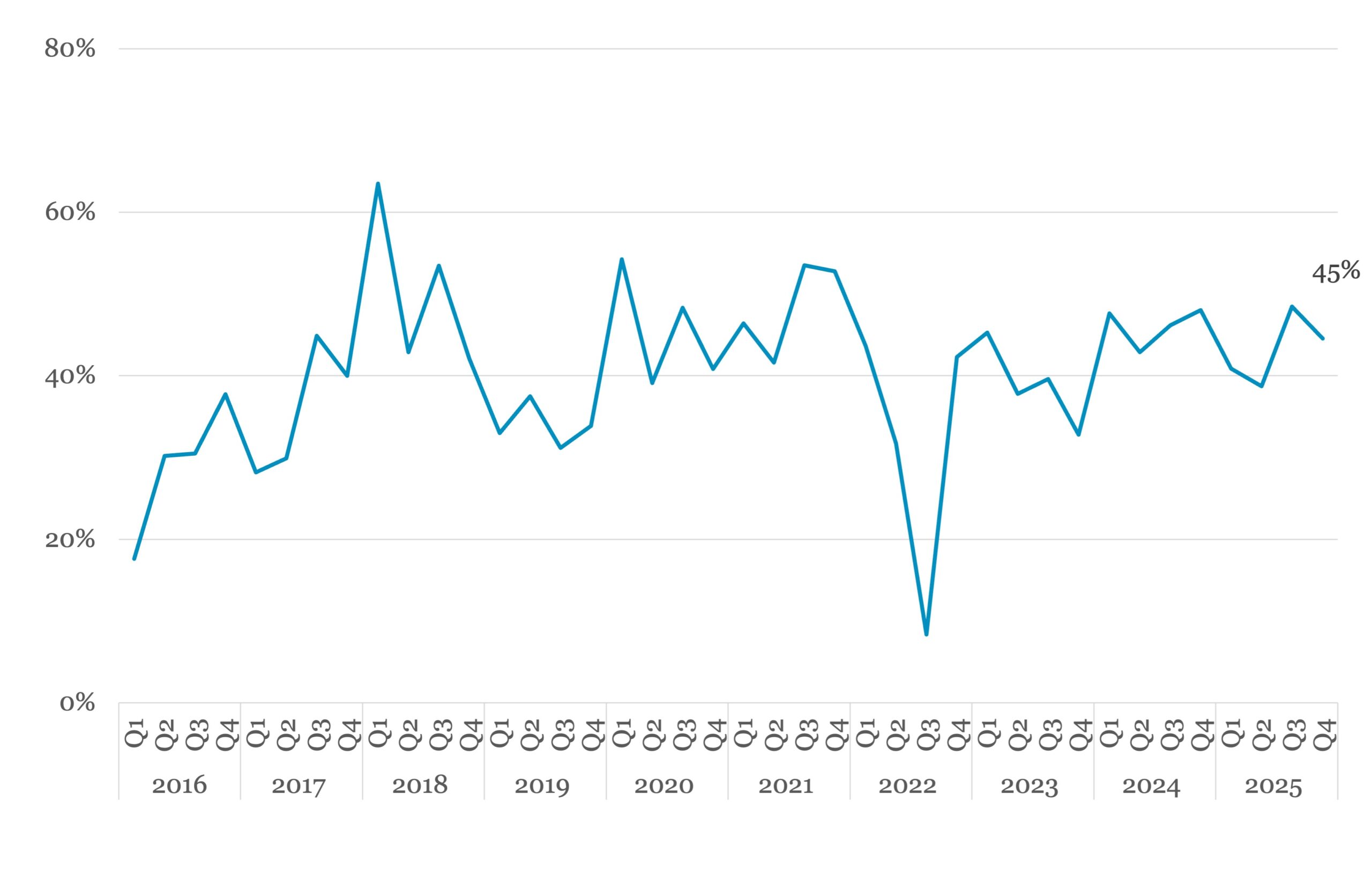

Private equity remains an attractive option for investors through cycles. Source: PitchBook

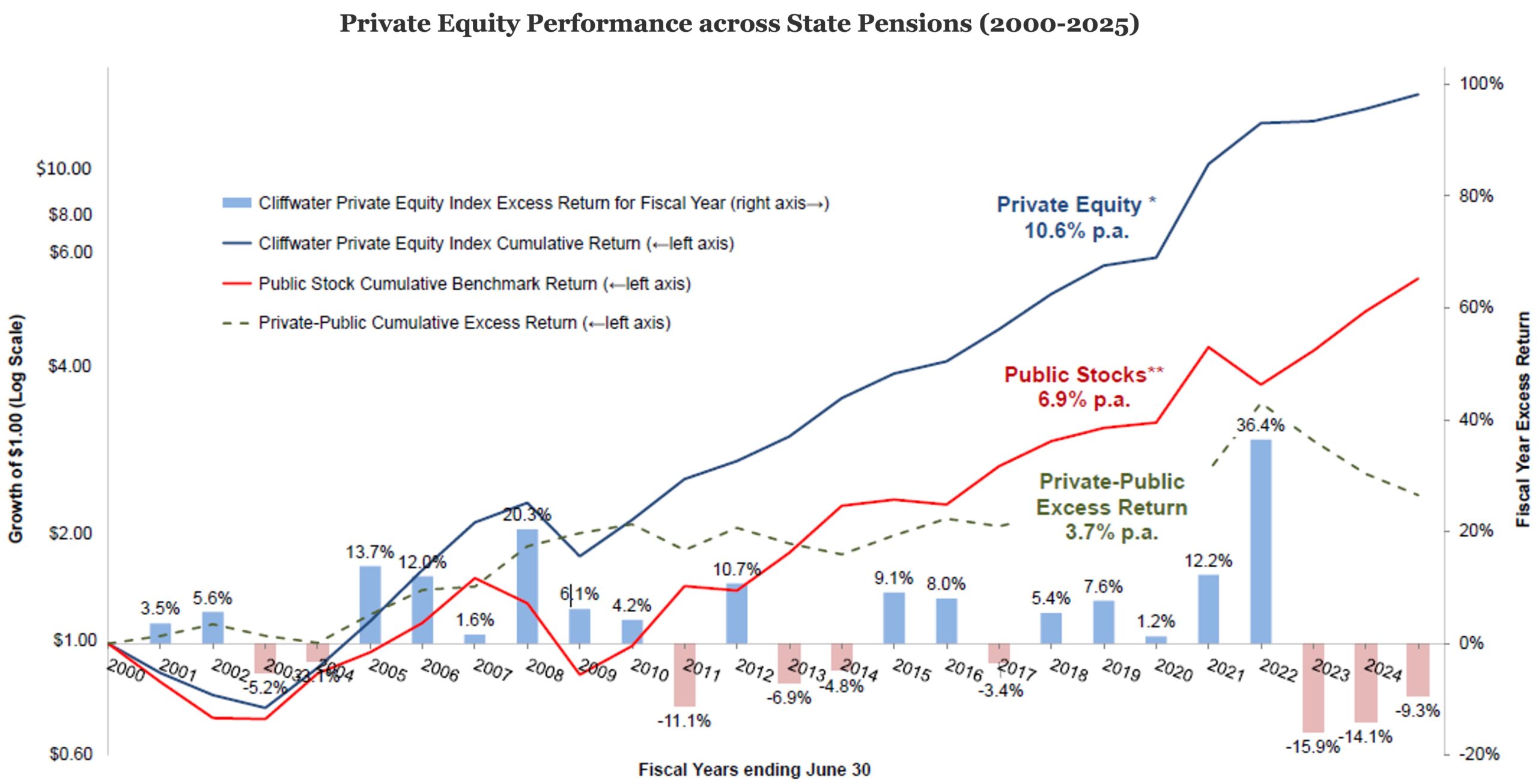

Read MoreChart of the Week: State of Returns

For over two decades private equity has outperformed public stocks in state pension plans. Source: Cliffwater

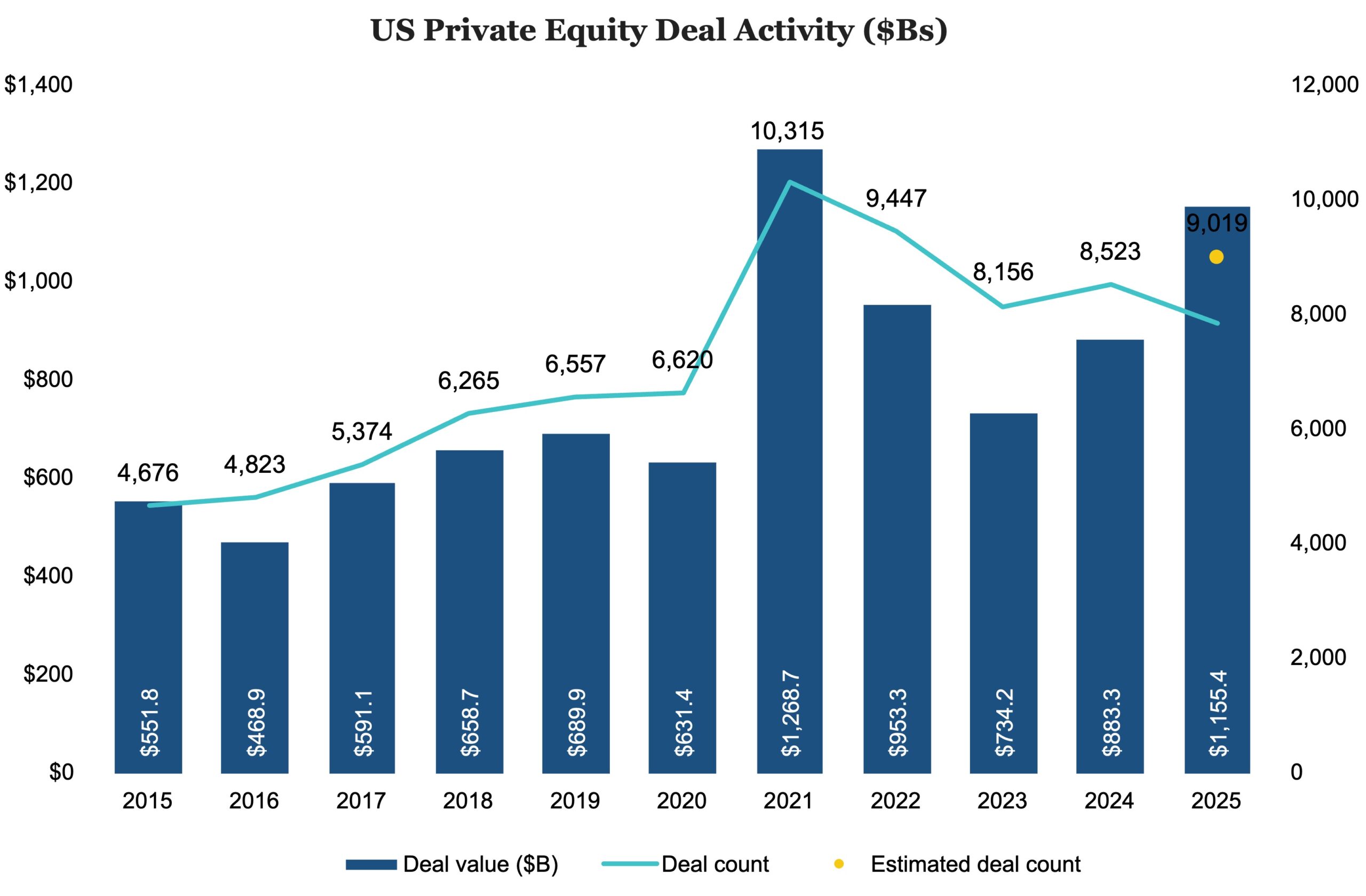

Read MoreChart of the Week: Back in the Game

While PE deals transacted shrunk since 2021, deal values rose over past three years. Source: PitchBook

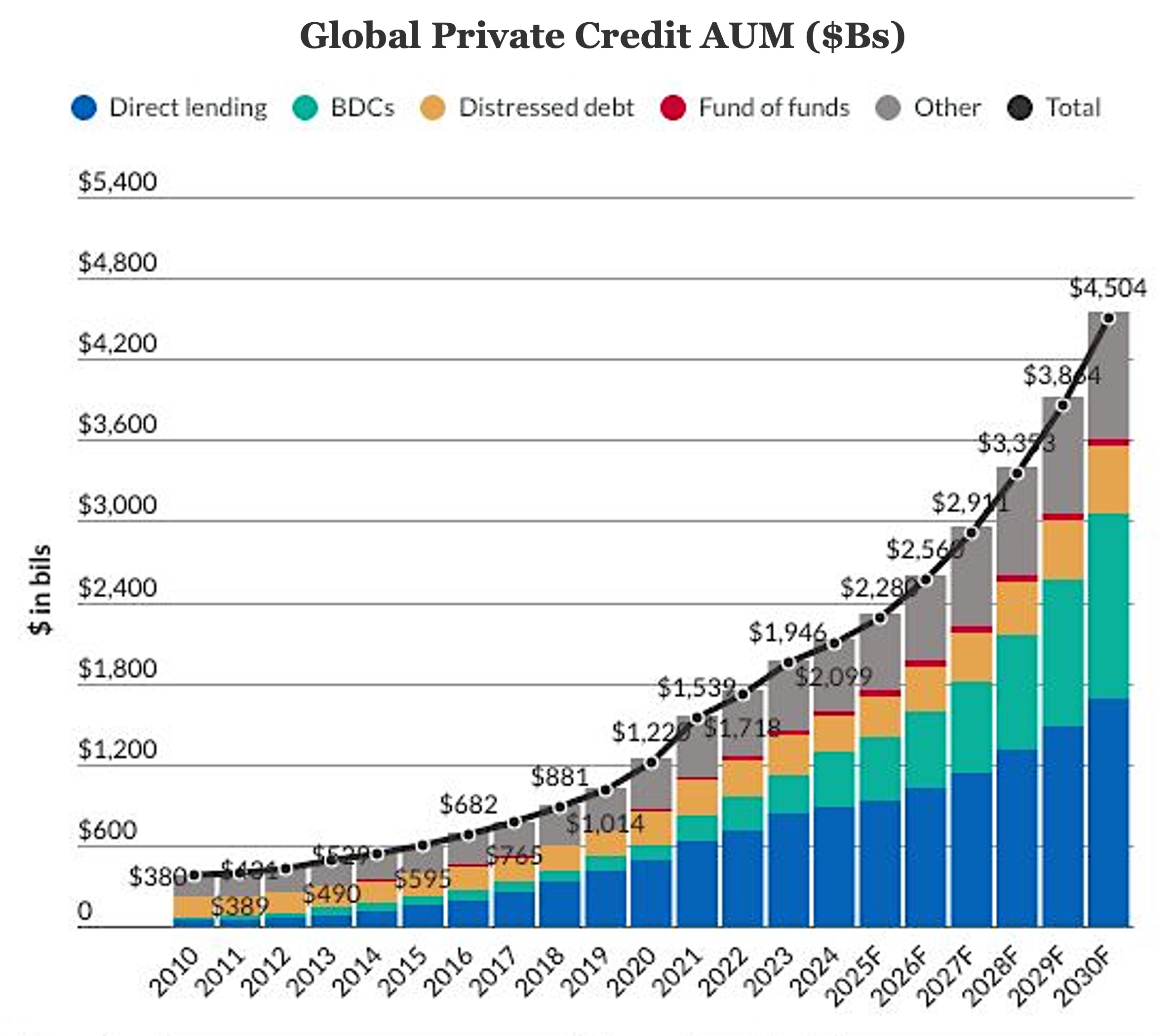

Read MoreChart of the Week: Private Credit Doubles

Direct lending and BDCs expected to lead the growth of private credit. Source: Fitch Ratings

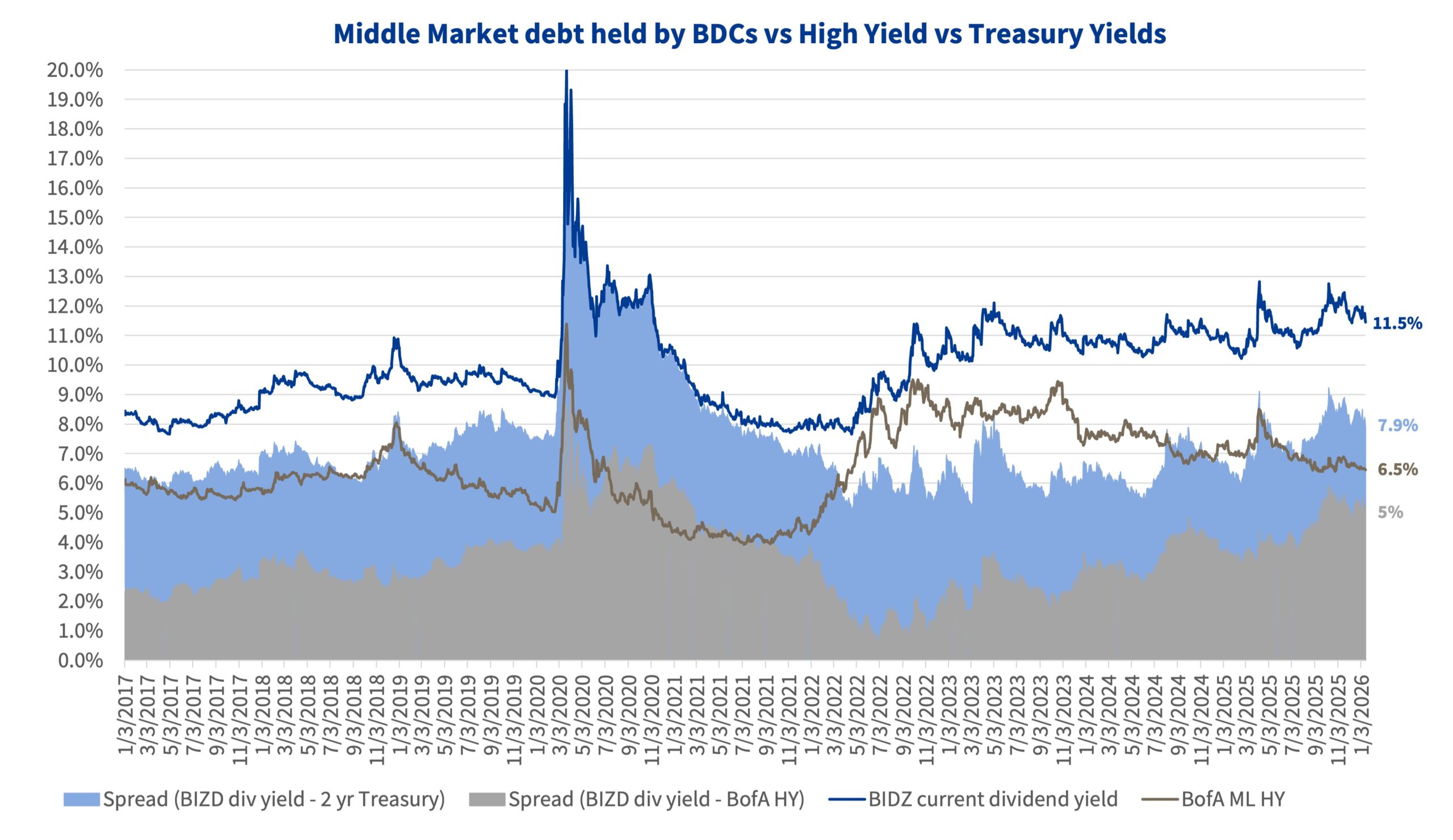

Read MoreChart of the Week: Premium Outlet

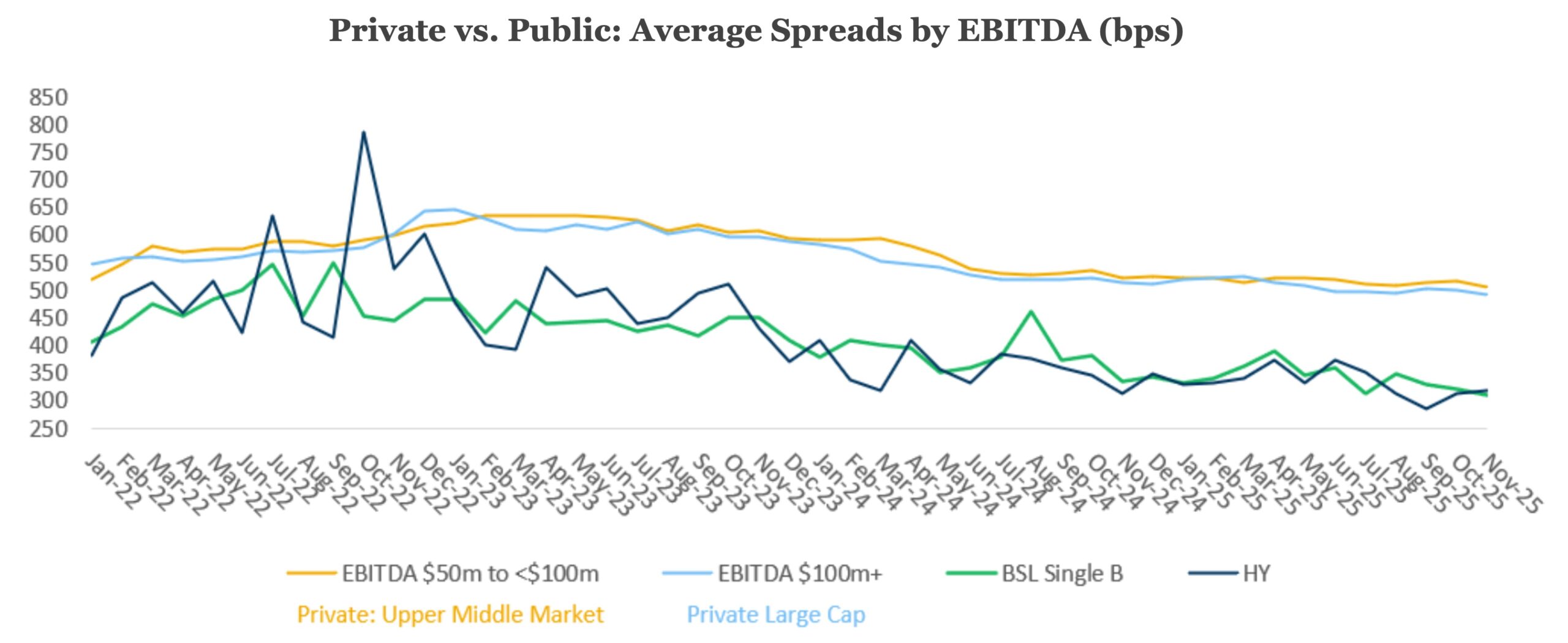

The private credit yield advantage over BSL widens as single-B spreads shrink. Source: KBRA DLD Research, PitchBook LCD

Read MoreChart of the Week: Easing Down

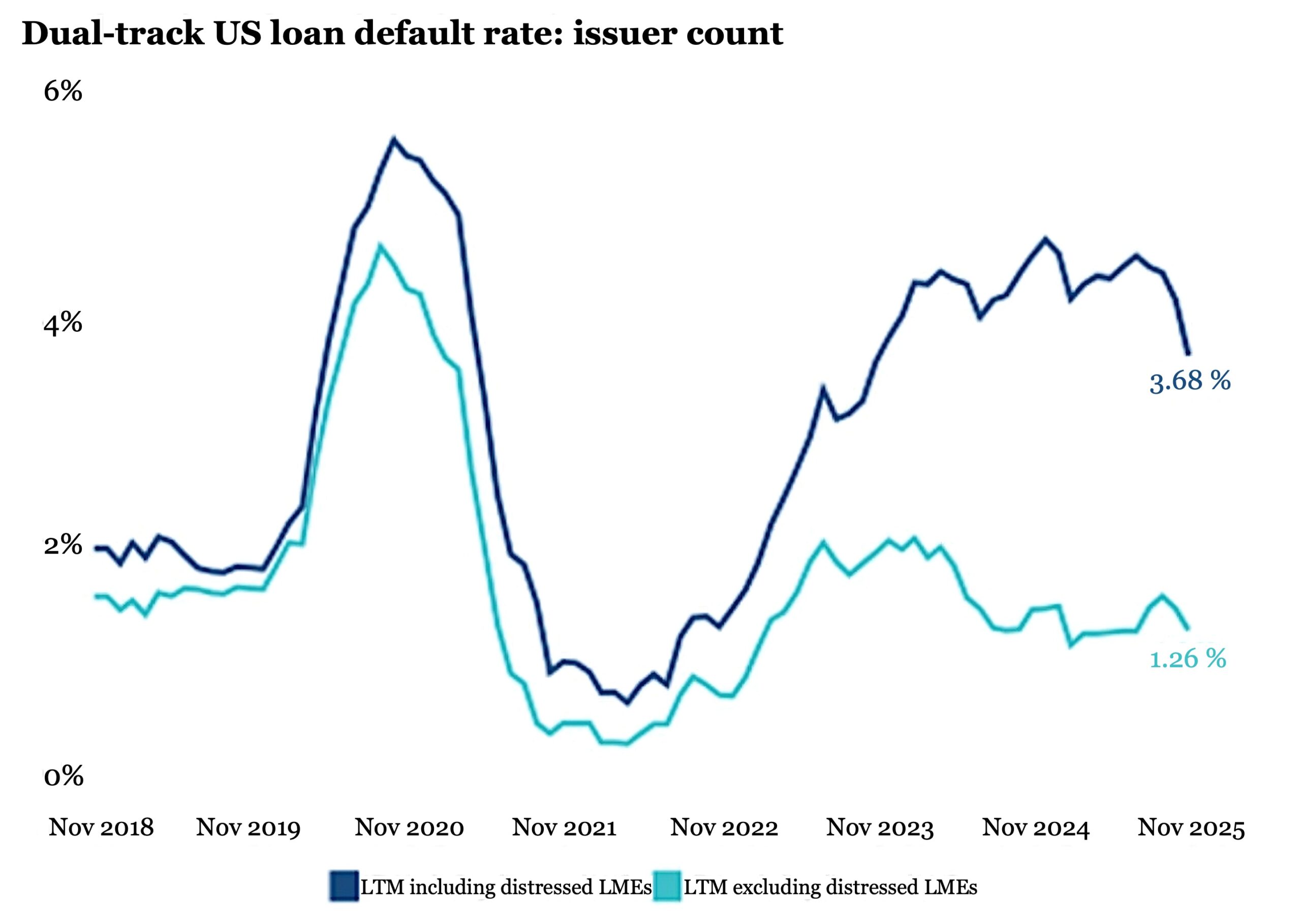

Defaults for the overall leveraged loan market are at lowest point since 2023. Source: The Daily Shot, PitchBook/LCD, Morningstar LSTA US Leveraged Loan Index

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

Middle Market & Private Credit – 1/26/2026

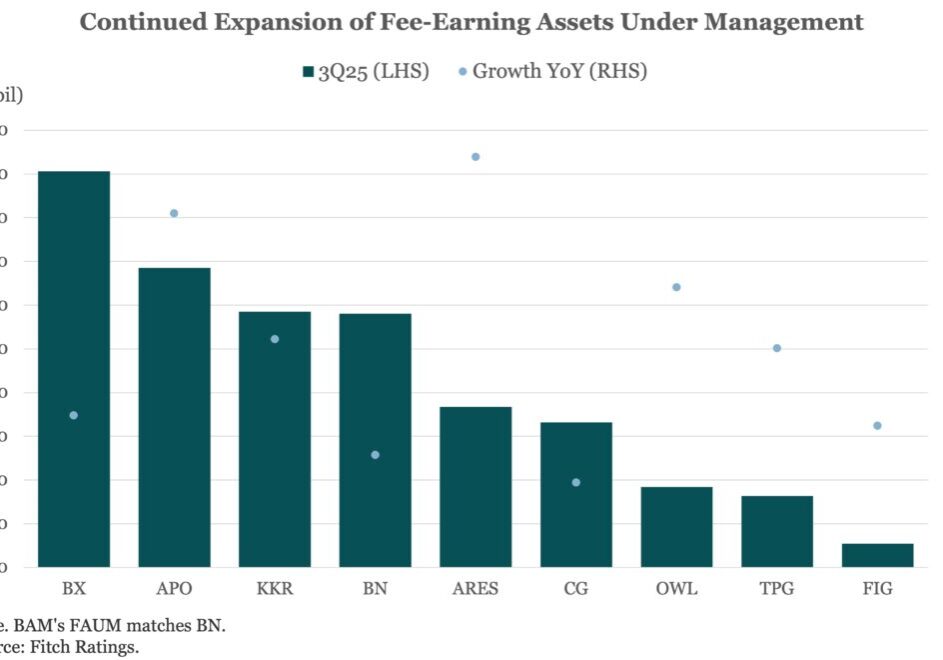

U.S. Alternative Investment Manager Ratings Stable Despite Challenging 2026 Click here to learn more. Fitch Ratings expects the credit profiles of rated alternative investment managers (alt IMs) to remain stable despite a difficult backdrop. Rated alt IMs benefit from investor consolidation, as periods of uncertainty increase demand for scaled, multi-strategy platforms…. Subscribe to Read MoreAlready

Leveraged Loan Insight & Analysis – 1/26/2026

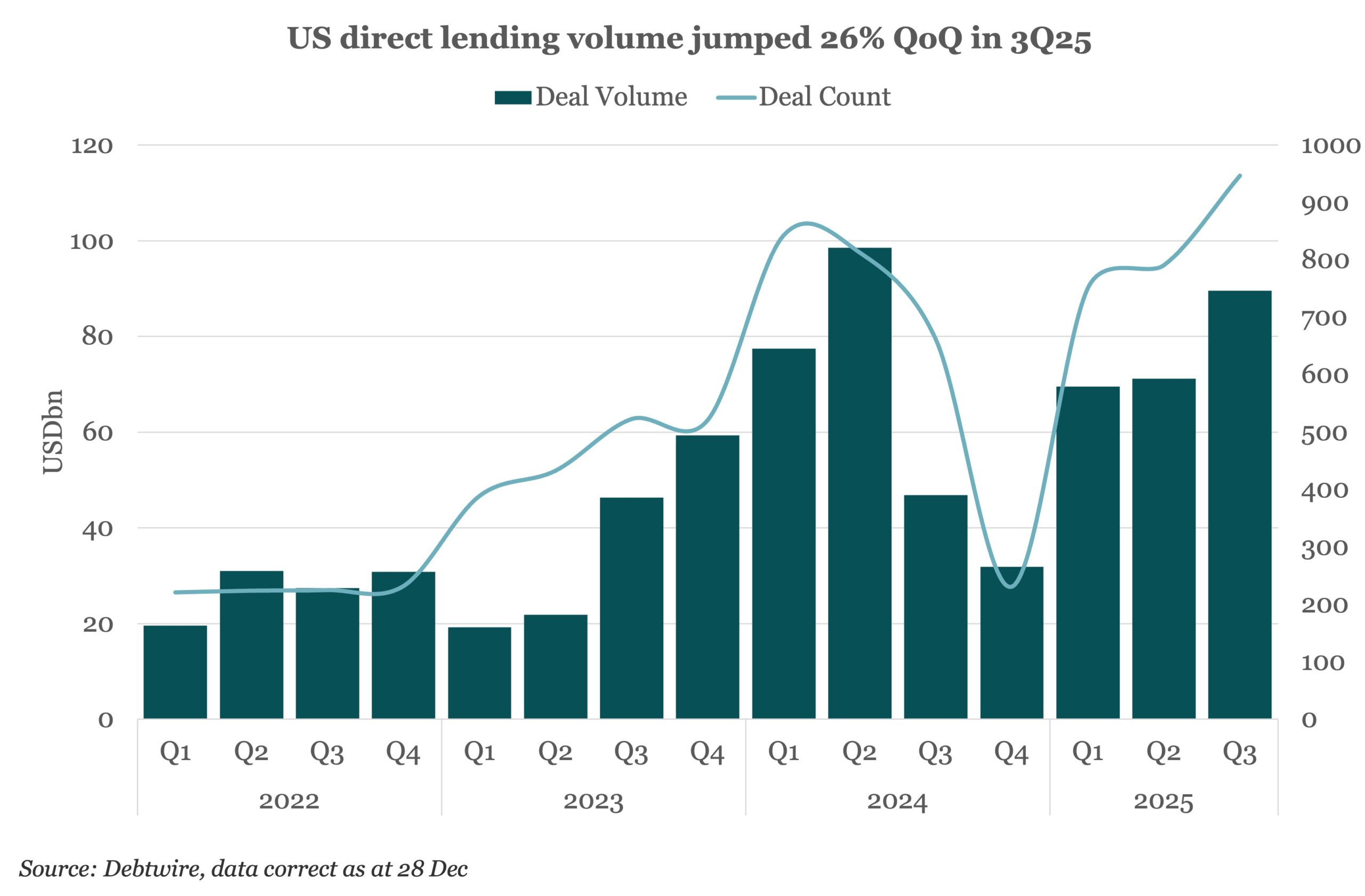

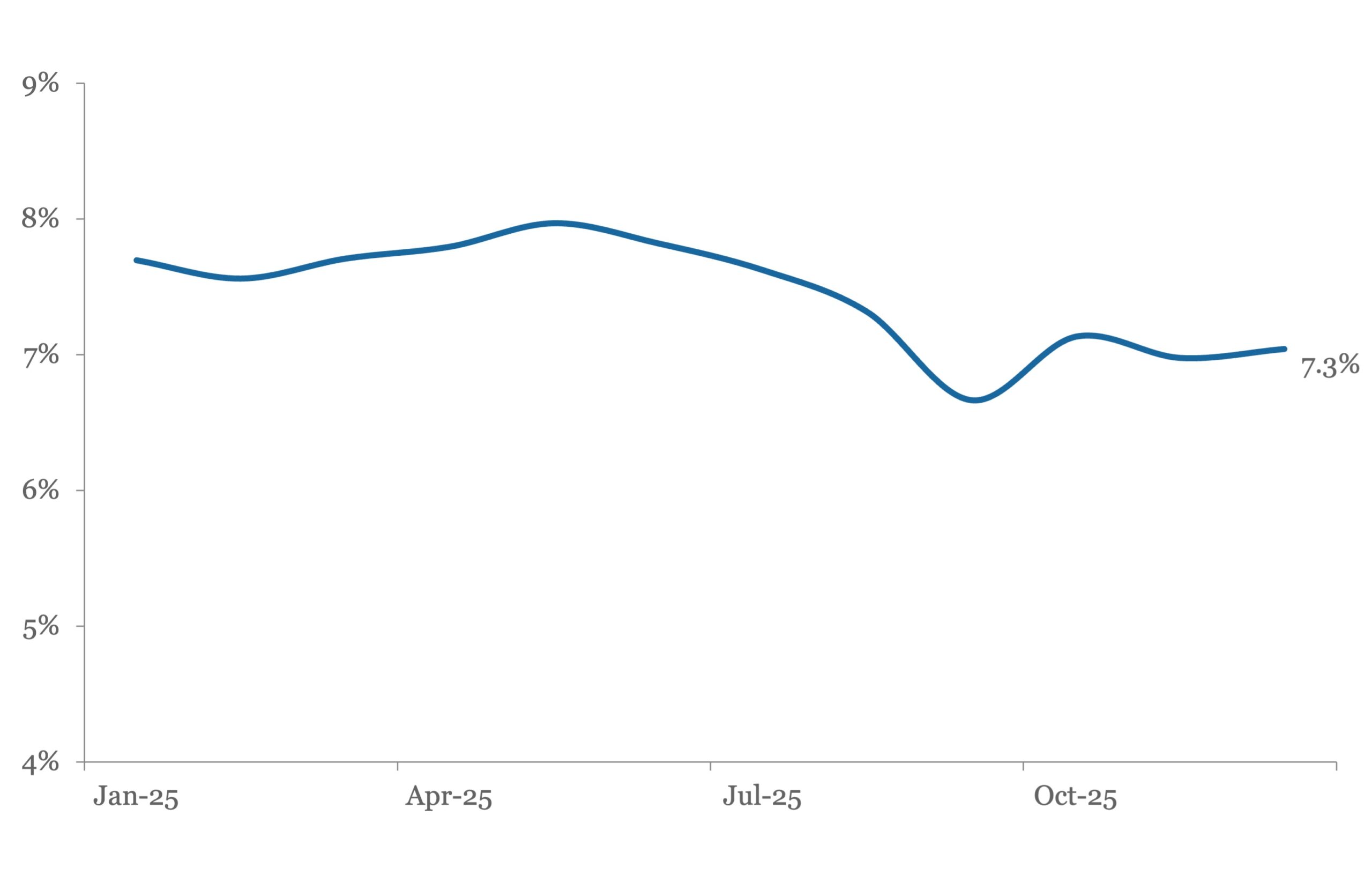

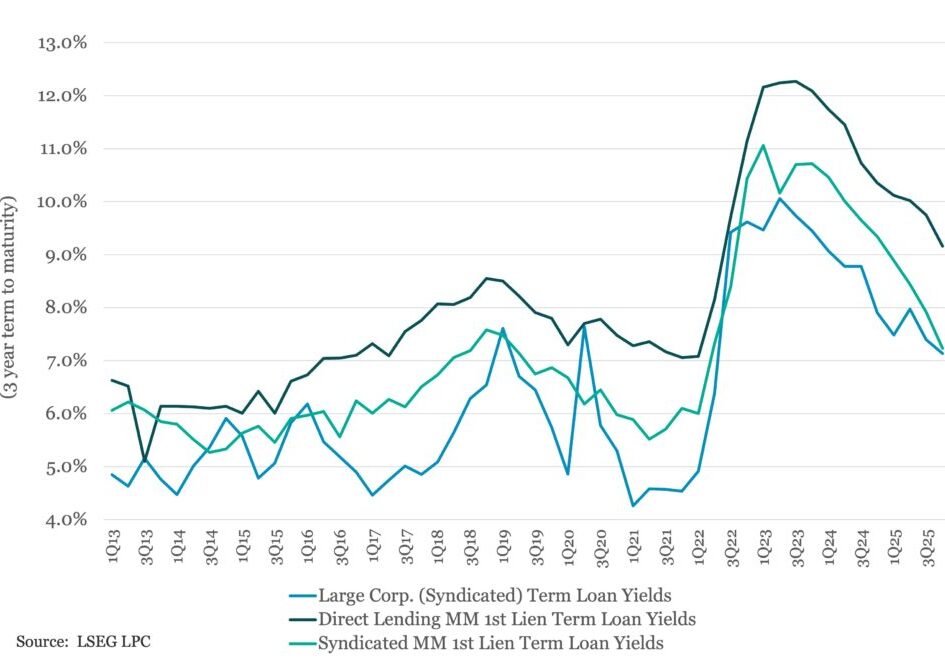

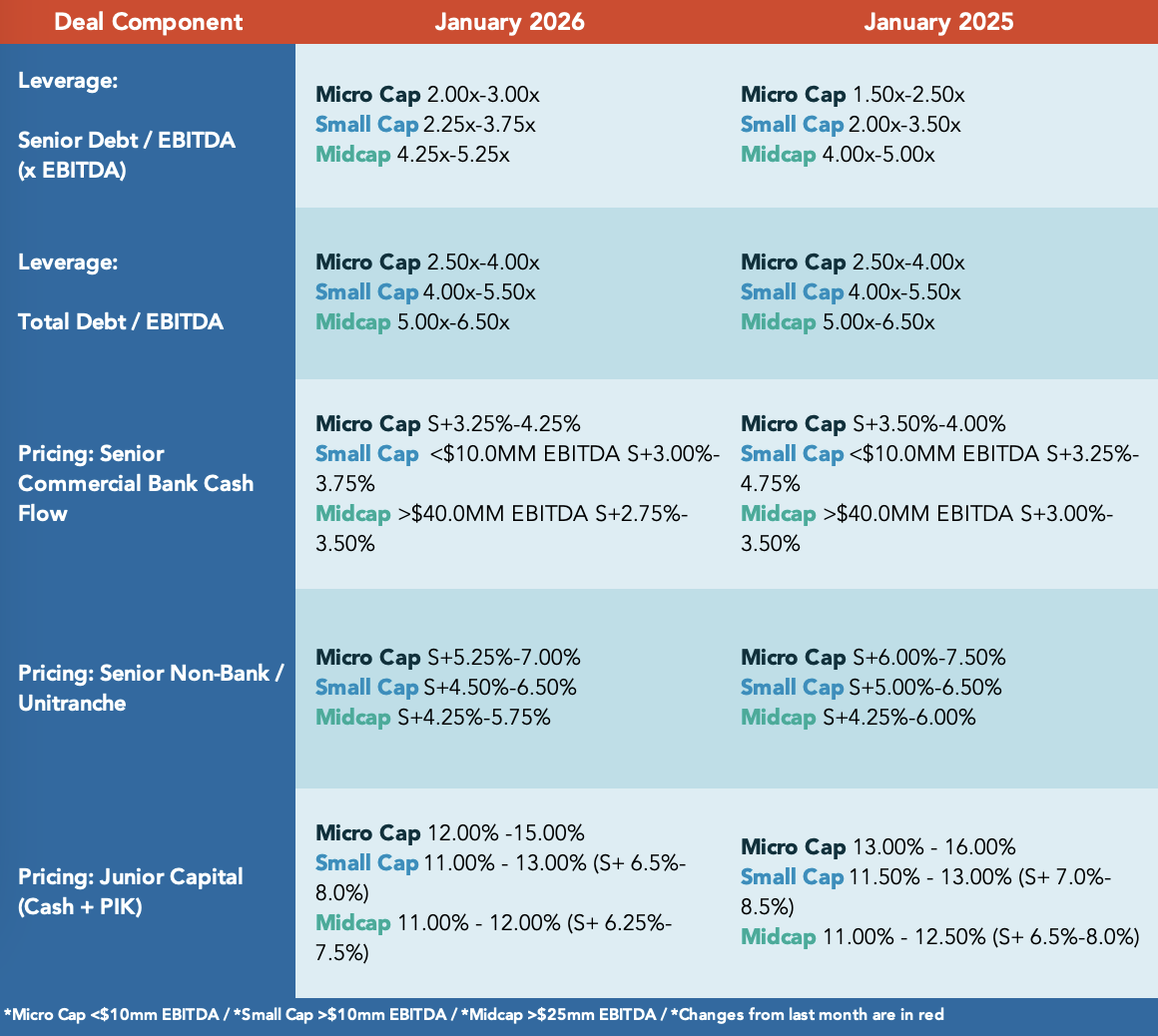

Yield premium on direct lender arranged MM sponsored deals tightened in 4Q25 Yields for large corporate and middle market(MM) sponsored loans – whether executed via the broadly syndicated or direct lender loan markets – tightened in 4Q25 amid abundant lender liquidity and inadequate supply of new deal flow to meet demand…. Subscribe to Read MoreAlready

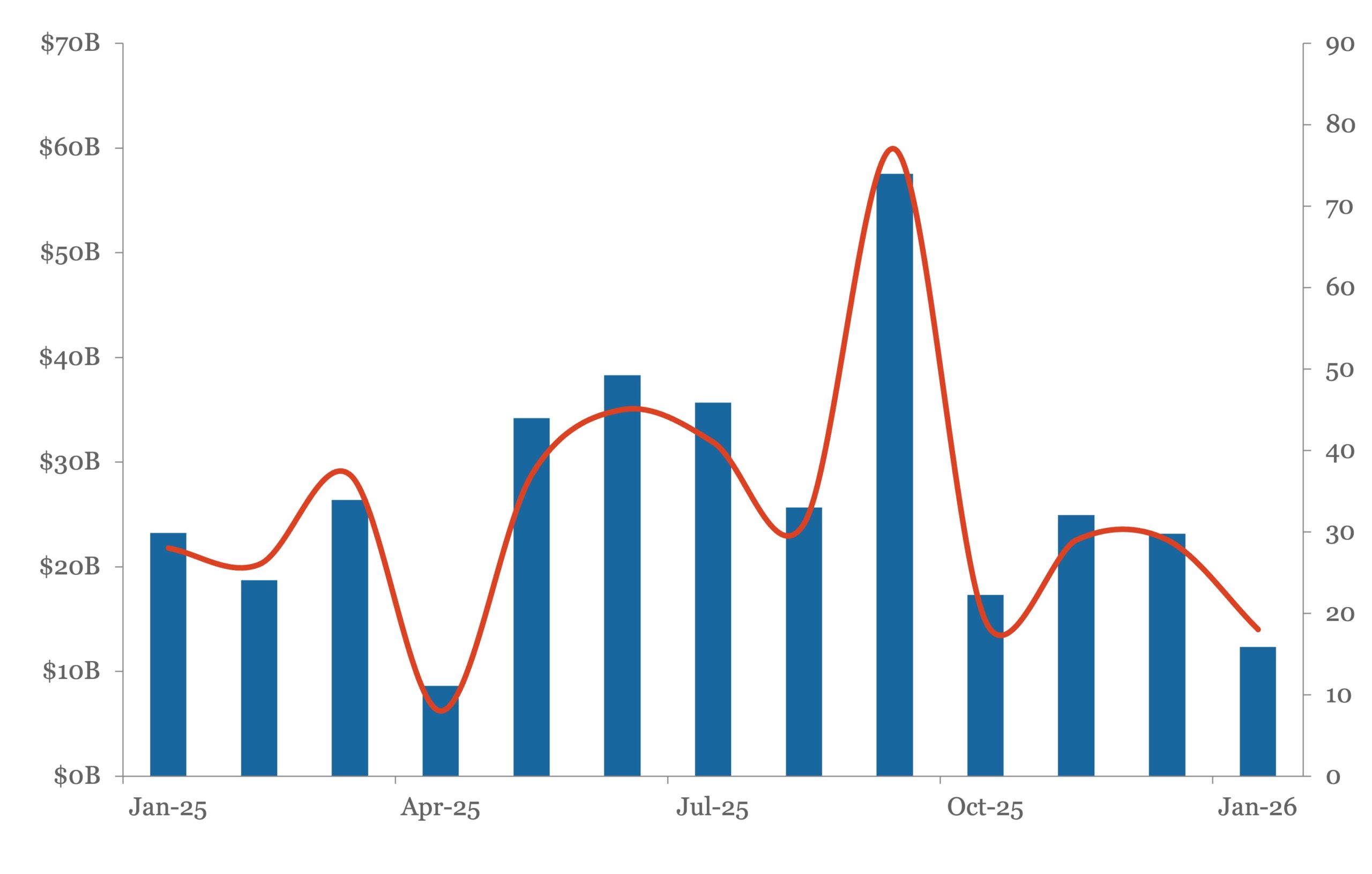

Bloomberg: Leveraged Lending Insights – 1/26/2026

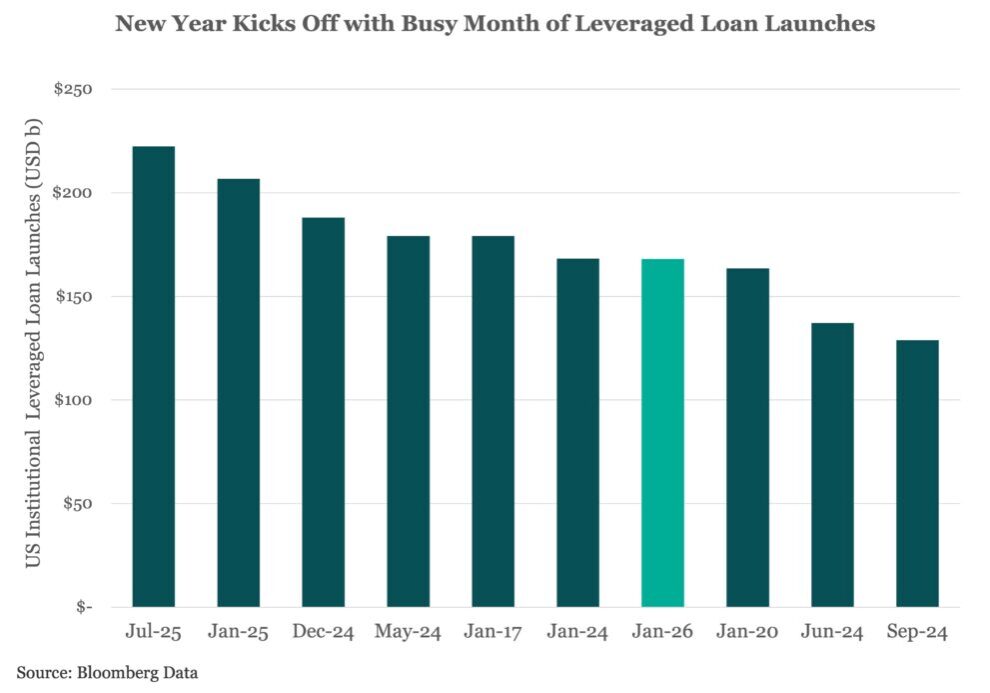

New Year Kicks Off with Busy Month of Leveraged Loan Launches At $168.0b in launches through January 28th, the US institutional leveraged loan market has been off to a hot start in 2026, good for the seventh busiest month of launches on record. Following $57.5b launches during the week ending January 16th, issuers continued to…

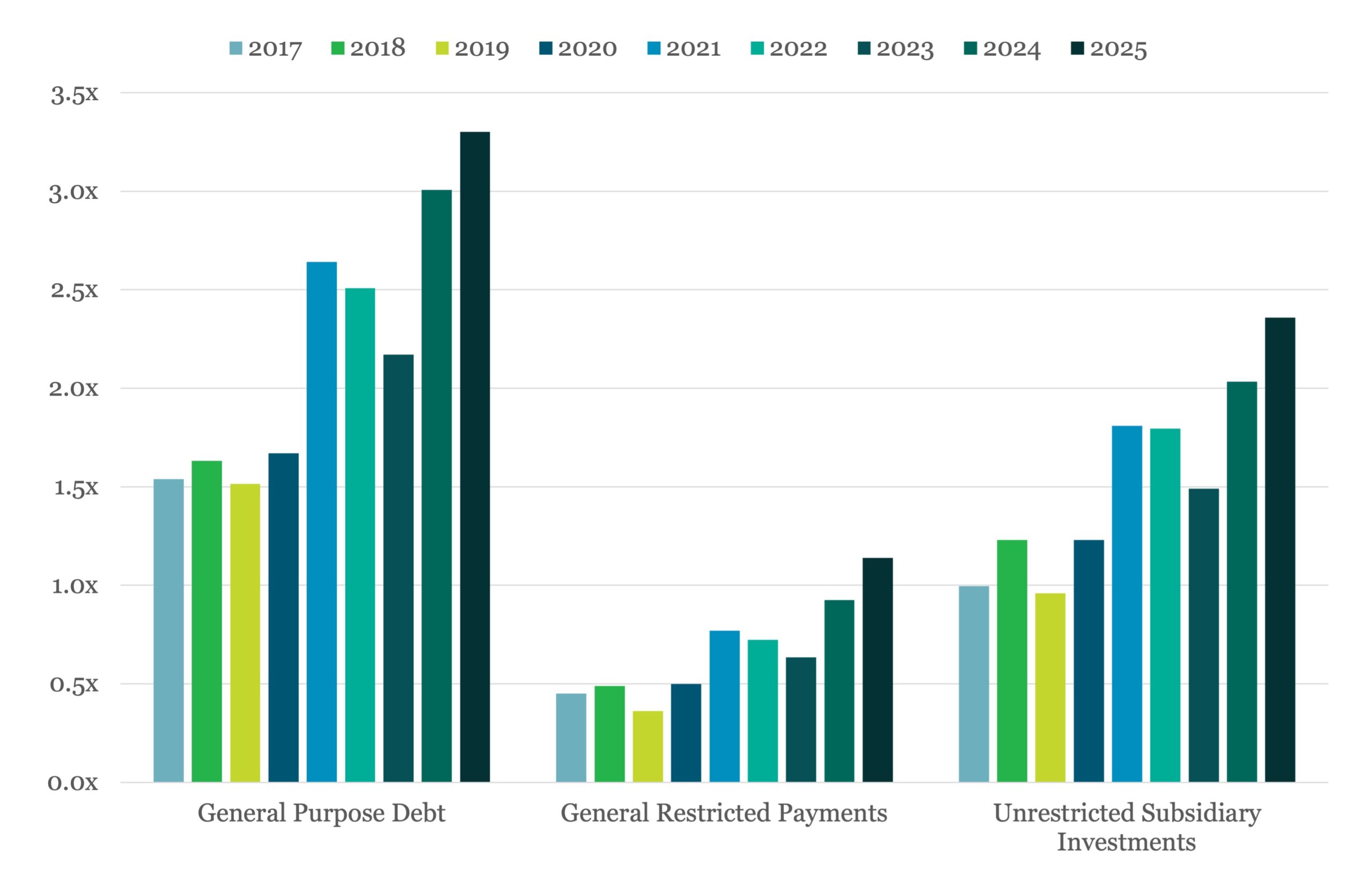

The Pulse of Private Equity – 1/26/2026

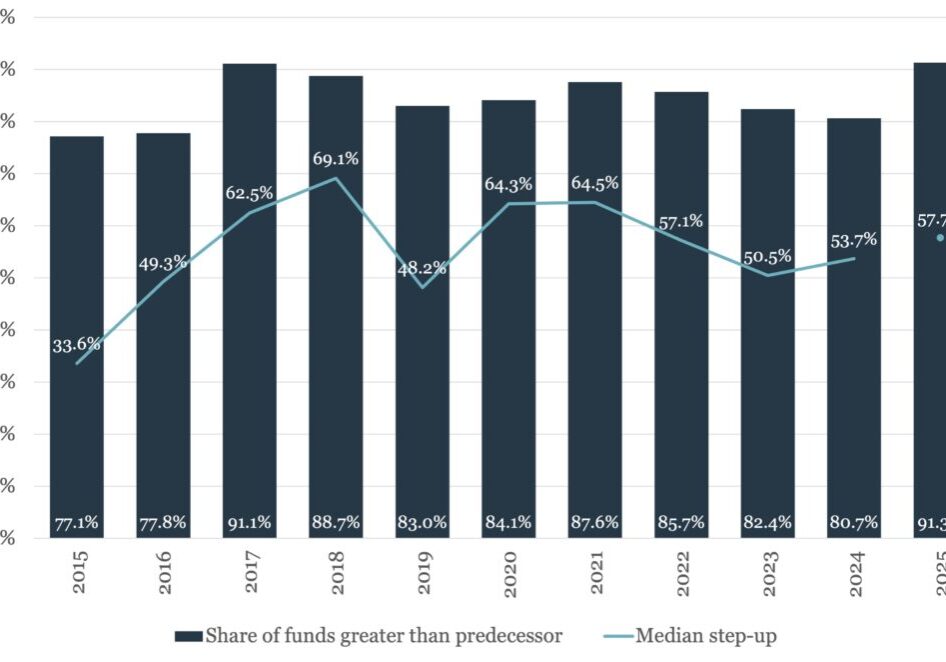

Median step-up from previous PE middle-market fund in fund family Download PitchBook’s Report here. As capital continues to concentrate among fewer managers, conditions have favored those raising larger vehicles. Eight funds of $1 billion or more held final closes in Q3, the most of any quarter this year…. Subscribe to Read MoreAlready a member? Log in

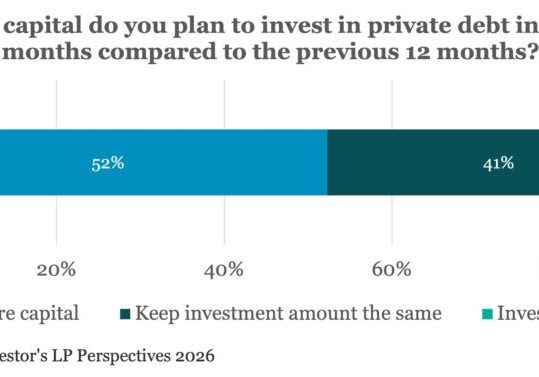

PDI Picks – 1/26/2026

Investors still warming to private credit Our research finds more than half of LPs are wanting to increase their investment into the asset class. With the economic and geopolitical backdrop in 2026 continuing to be volatile – and, in some ways perhaps, becoming even more turbulent than last year – is there a danger of…

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.