Private Debt Intelligence – 9/23/2024

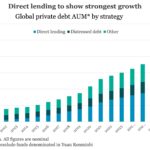

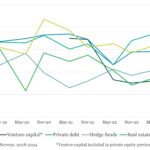

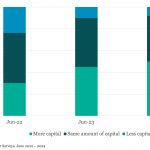

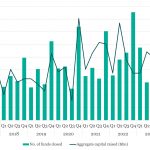

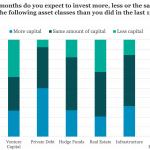

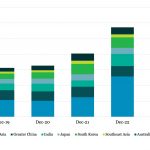

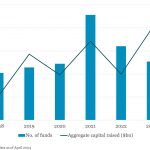

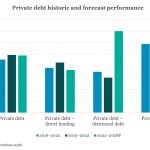

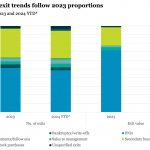

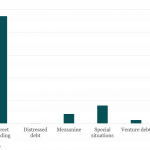

Direct lending drives private debt growth Read more in Preqin’s Insights+ Report: Future of Alternatives 2029. Fund managers and investors alike have high hopes for private debt, with GPs launching strategies or acquiring specialist managers and LPs overwhelmingly maintaining or increasing allocations to the asset class (99% in our last Investor Survey)…. Subscribe to Read