Leveraged Loan Insight & Analysis – 3/20/2023

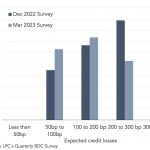

BDC credit losses expected to top 100bp in 2023 The majority of respondents (68%) in Refinitiv LPC’s Quarterly BDC Survey expect credit losses to top 100bp in 2023, with 31% of survey participants predicting losses above 200bp. The weighted average non-accrual rate for public and private BDCs combined ended 4Q22 at 1.48%, up from 1.26%…