Leveraged Loan Insight & Analysis – 5/29/2023

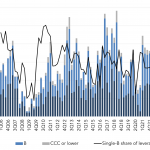

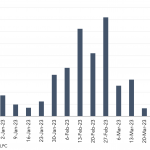

US Single-B volume share increases in 2Q23 Completed US loan volume to issuers with a Single-B rating totals US$30.5bn so far in 2Q23, comprising 25% of leveraged volume. This is up from last quarter’s 22% share and is the highest since 1Q22’s 28%…. Subscribe to Read MoreAlready a member? Log in here...