Leveraged Loan Insight & Analysis – 8/7/2023

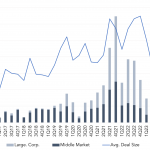

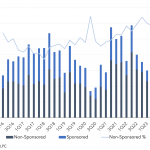

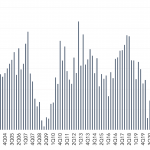

Sponsored large corporate direct lending volume dropped 28% in 2Q23 US sponsored large corporate direct lending loan volume totaled US$12.5bn in 2Q23, 28% lower than 1Q23’s level. The US$12.5bn total represented a 17% share of overall US large corporate sponsored loan volume, its lowest share since 3Q21…. Subscribe to Read MoreAlready a member? Log in