Leveraged Loan Insight & Analysis – 10/30/2023

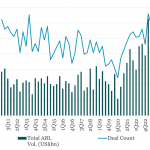

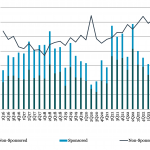

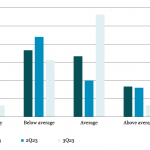

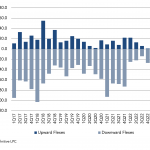

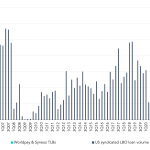

ABL Deep Dive: Numbers don’t tell entire story Over US$126bn in asset based loan volume was completed in 1-3Q23 which at first glance suggests record total for the first nine months of the year – something lenders are certainly not feeling. And there are several reasons for this. In 3Q23 alone,… Subscribe to Read MoreAlready