Leveraged Loan Insight & Analysis – 4/8/2024

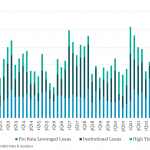

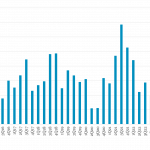

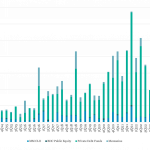

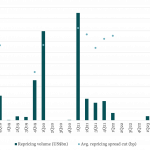

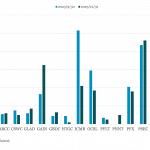

1Q24 US Leveraged volume up 46% year over year; Highest quarterly total in over 2 years US leveraged lenders completed US$347.5bn of issuance across the high yield bond and leveraged loan markets in 1Q24, a 46% increase compared to the same time last year and the strongest quarterly results since 4Q21. More interesting was the…