Leveraged Loan Insight & Analysis – 6/21/2021

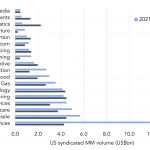

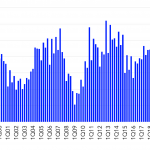

Business services is top sector for US syndicated mid-market loan volume so far this year Through deals of June 18, year-to-date syndicated middle market volume totals US$60.2bn, 30% higher than the US$46.3bn recorded during the same period last year. The top industry so far this year is the business services sector, which has notched US$13.4bn…