Leveraged Loan Insight & Analysis – 9/20/2021

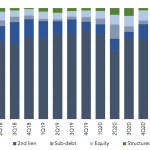

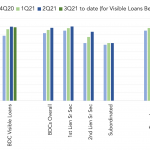

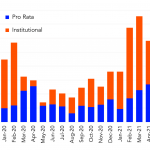

BDC newly originated second lien exposure climbs in 2Q21 BDC’s increased their second lien exposure to 12.1% of new originations in 2Q21, up from the 7.5% tracked in 1Q21. In comparison, first lien assets were relatively flat at 71.6% of originations, while equity positions slipped to 10%. At the fund level, second lien originations as a…