Leveraged Loan Insight & Analysis – 11/29/2021

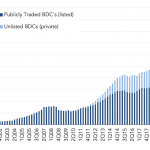

Total assets in BDCs climb to over US$180bn Total assets in BDCs climbed to over US$180bn in 3Q21, as publicly traded BDC assets increased to US$111bn, up from US$104bn in the prior quarter. In the same period, private/unlisted BDC assets grew to US$70bn from US$57bn. On the private side, Blackstone Private Credit Fund led the…