Leveraged Loan Insight & Analysis – 2/21/2022

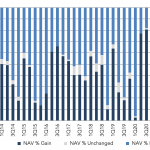

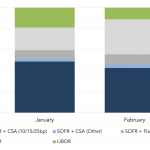

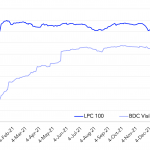

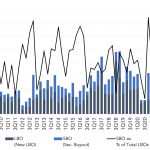

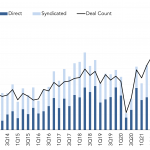

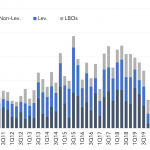

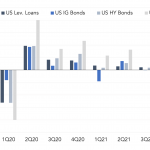

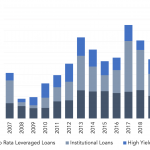

BDCs post further NAV gains BDC earnings season is underway, with funds that have filed to date posting positive performance overall in 4Q21, topping off a strong year for the asset class. BDC earnings climbed in 2021 against a backdrop of robust portfolio company performance and record origination activity. BDC origination activity was bolstered…