Leveraged Loan Insight & Analysis – 5/2/2022

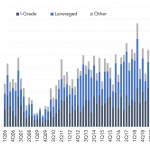

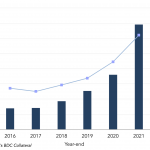

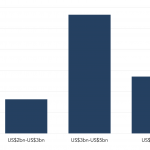

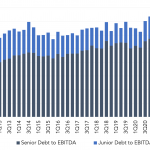

Unitranches help move senior leverage higher on direct lender middle market technology sector LBO deals The increasing popularity of the unitranche loan structure backing direct lending middle market LBOs in the technology sector drove senior leverage levels higher than those in the broadly syndicated market last year. Tech sector deals have seen persistently high purchase…