Leveraged Loan Insight & Analysis – 7/18/2022

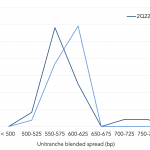

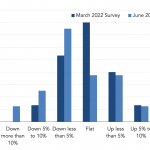

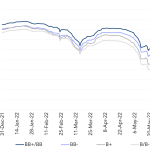

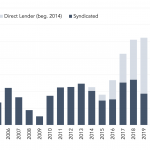

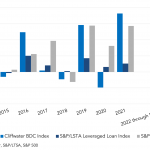

Unitranche minimum spread threshold shifts up One of the main themes of the loan market in 2Q22 was the disconnect between the broadly syndicated loan market and the direct lending market. Increased volatility and recession fears hit the institutional loan market and investors pushed back, resulting in much higher pricing. In the direct lending market,…