Leveraged Loan Insight & Analysis – 10/10/2022

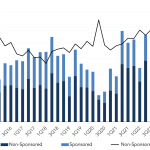

Syndicated middle market loan volume falls 37% q-o-q in 3Q22 3Q22 syndicated middle market loan issuance tumbled by 37% quarter over quarter amid increased economic uncertainty and market volatility. Lending activity fell to US$35bn in 3Q22 from US$55bn in 2Q22 and was also far below the US$50bn posted in 3Q21. On a year-to-date basis, issuance…