Leveraged Loan Insight & Analysis – 1/9/2023

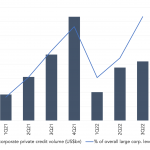

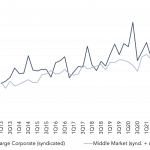

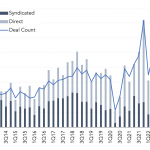

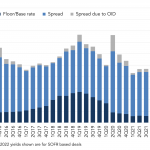

Syndicated middle market loan volume falls 10% in 2022 In 4Q22, syndicated middle market lending posted its lowest quarter since 1Q21 amid bouts of market volatility and economic uncertainty. Issuance declined to US$35.5bn in the most recent quarter from US$40.1bn in 3Q22 and was also far below the US$52bn posted in 4Q21. On a full-year…