Middle Market & Private Credit – 10/27/2025

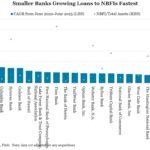

Rapid US Non-Bank Loan Growth Raises Risk of Wider Losses for Banks Click here to learn more. U.S. regional banks’ recent losses tied to non-bank financial institutions (NBFIs) may signal broader risk from this fast-growing loan segment. While these cases may be fraud-related and idiosyncratic, rapid expansion of NBFI exposures increases the chance that concentrated…