Middle Market & Private Credit – 2/16/2026

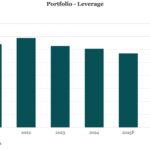

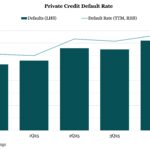

U.S. Private Credit and Middle Market Performance Monitor: 4Q25 Click here to learn more. Fitch’s Privately Monitored Ratings (PMR) Portfolio – 4Q25 In the charts above, Fitch presents aggregate data for issuers in its PMR portfolio. Fitch privately rates these issuers on behalf of asset managers…. Subscribe to Read MoreAlready a member? Log in here...