Featuring Charts

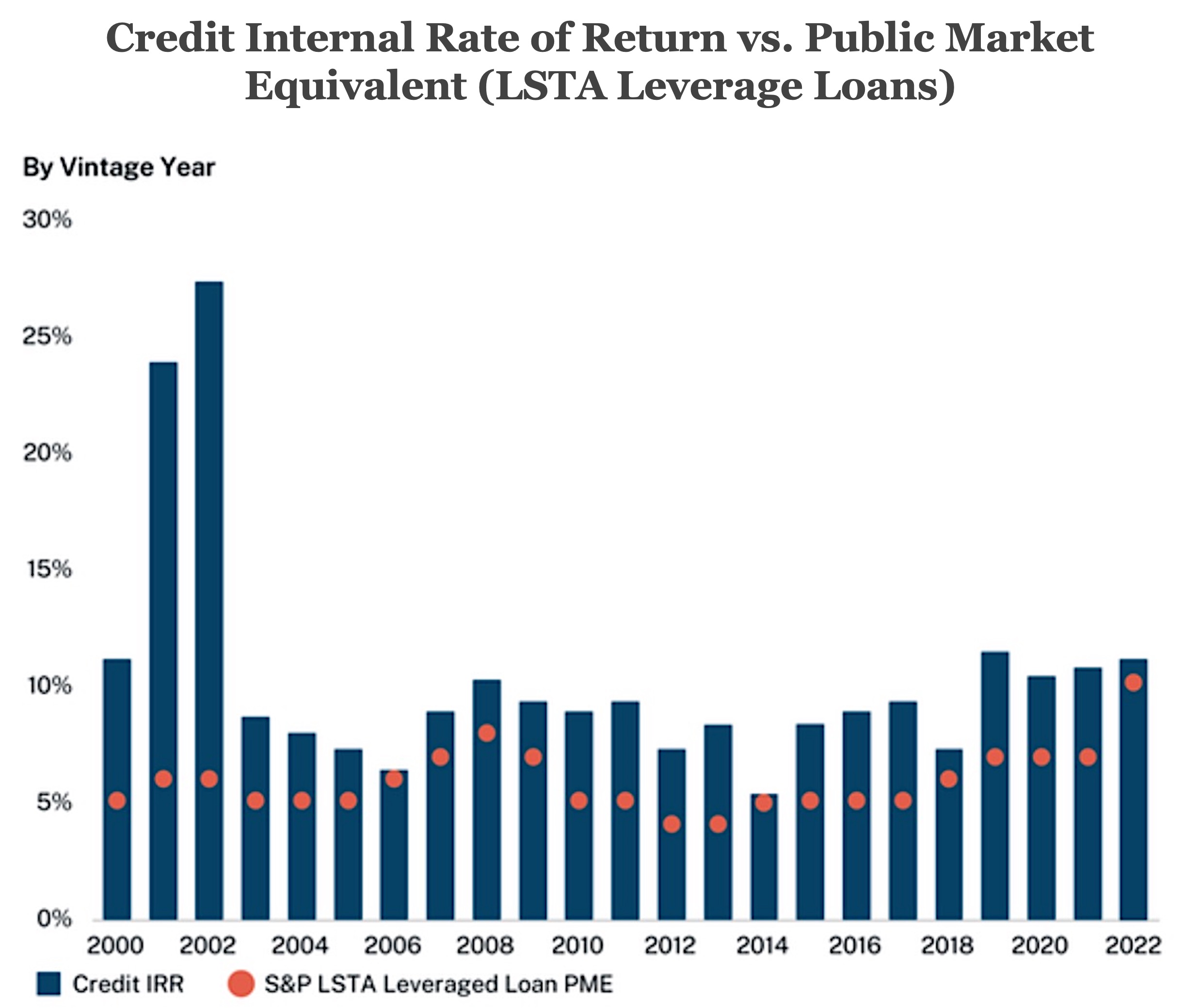

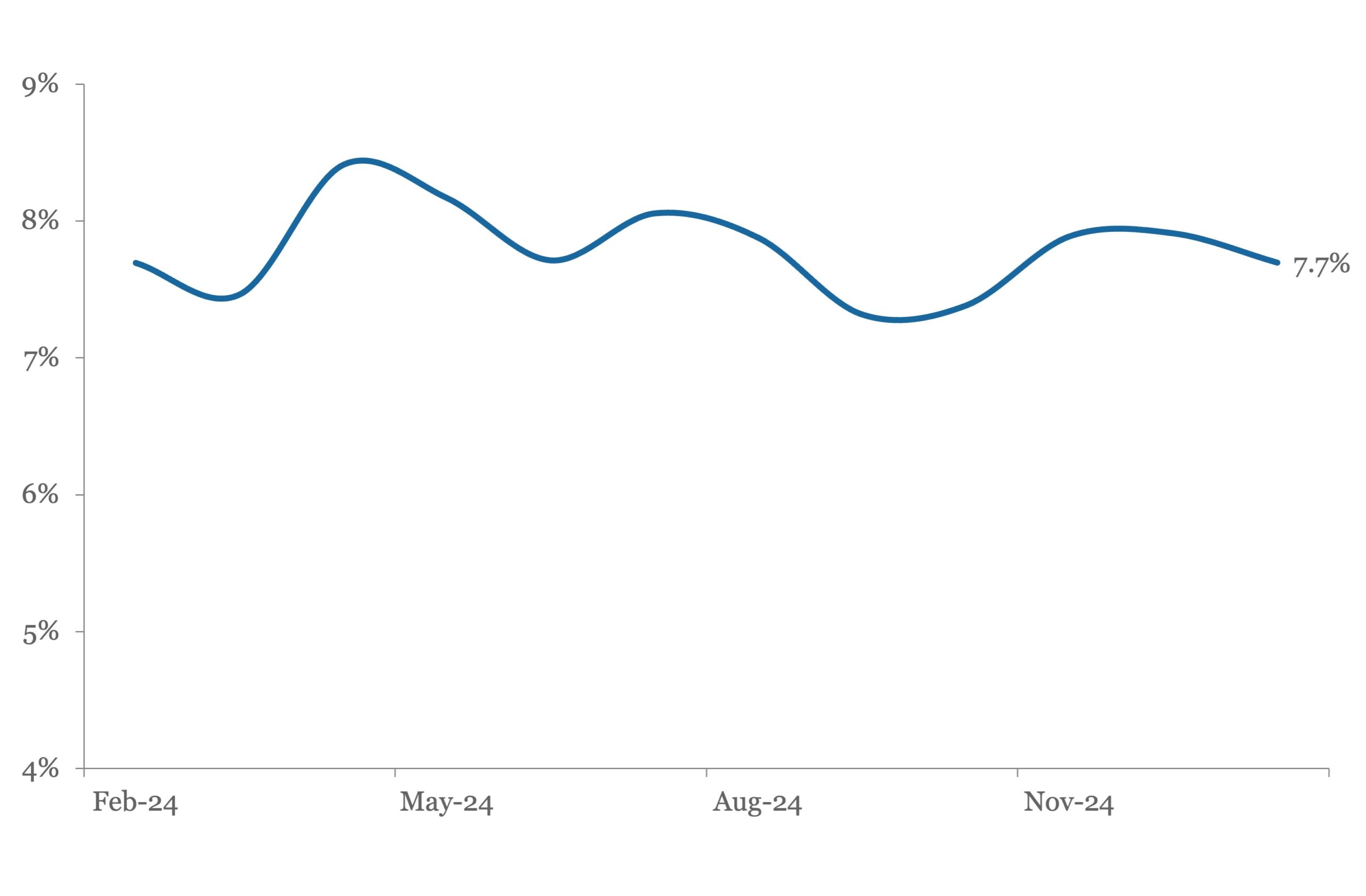

Chart of the Week: Liquids Lag

Return performance of broadly syndicated loans consistently lags private credit. Source: Hamilton Lane, Bloomberg, The Daily Shot.

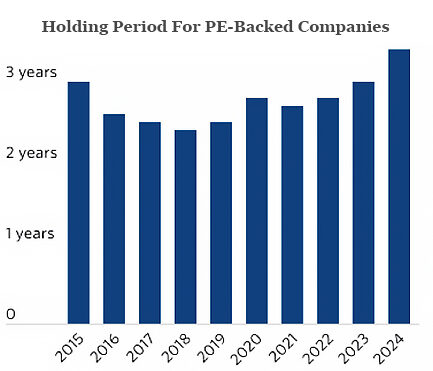

Read MoreChart of the Week: Working From Home

Slower M&A has extended time PE-owned companies in portfolios to ten-year high. Source: PitchBook

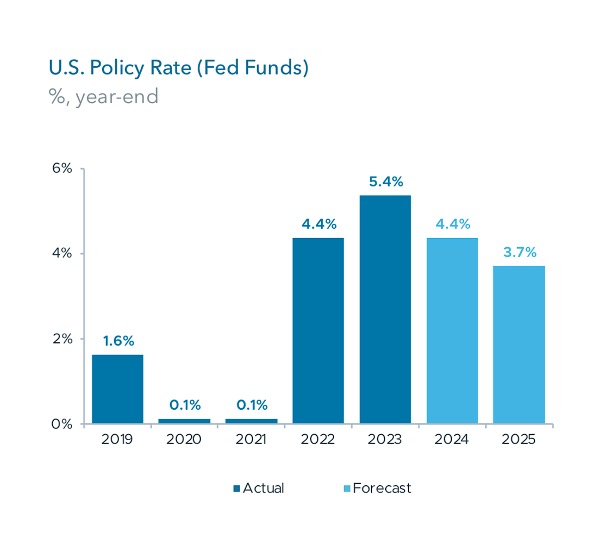

Read MoreChart of the Week: Home in the Range

The threat of tariff-triggered inflation should keep Fed Funds rates range-bound. Source: iCapital, Bloomberg, Federal Reserve.

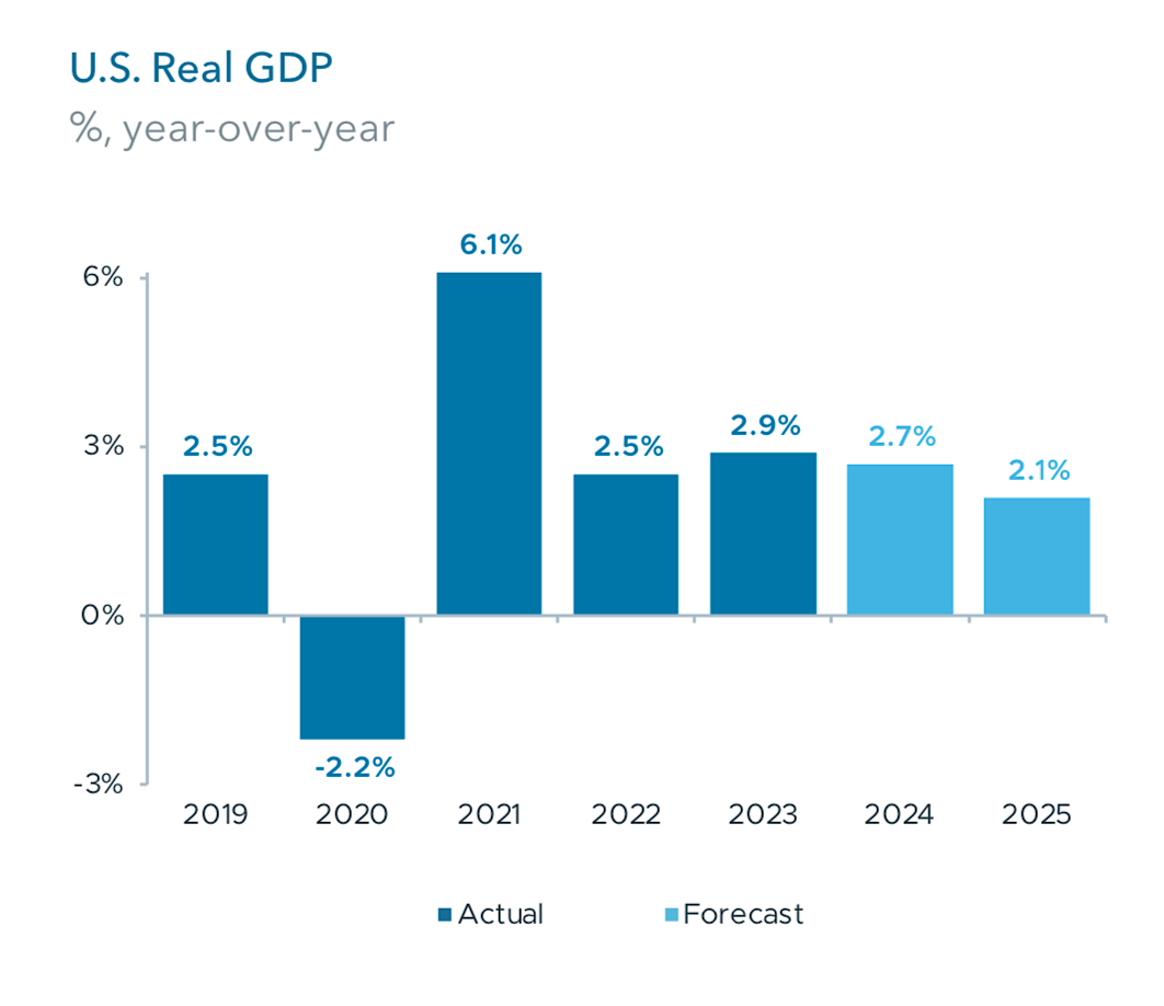

Read MoreChart of the Week: Still Growing

The strength of the US economy since Covid is expected to continue this year. Source: iCapital, Bloomberg.

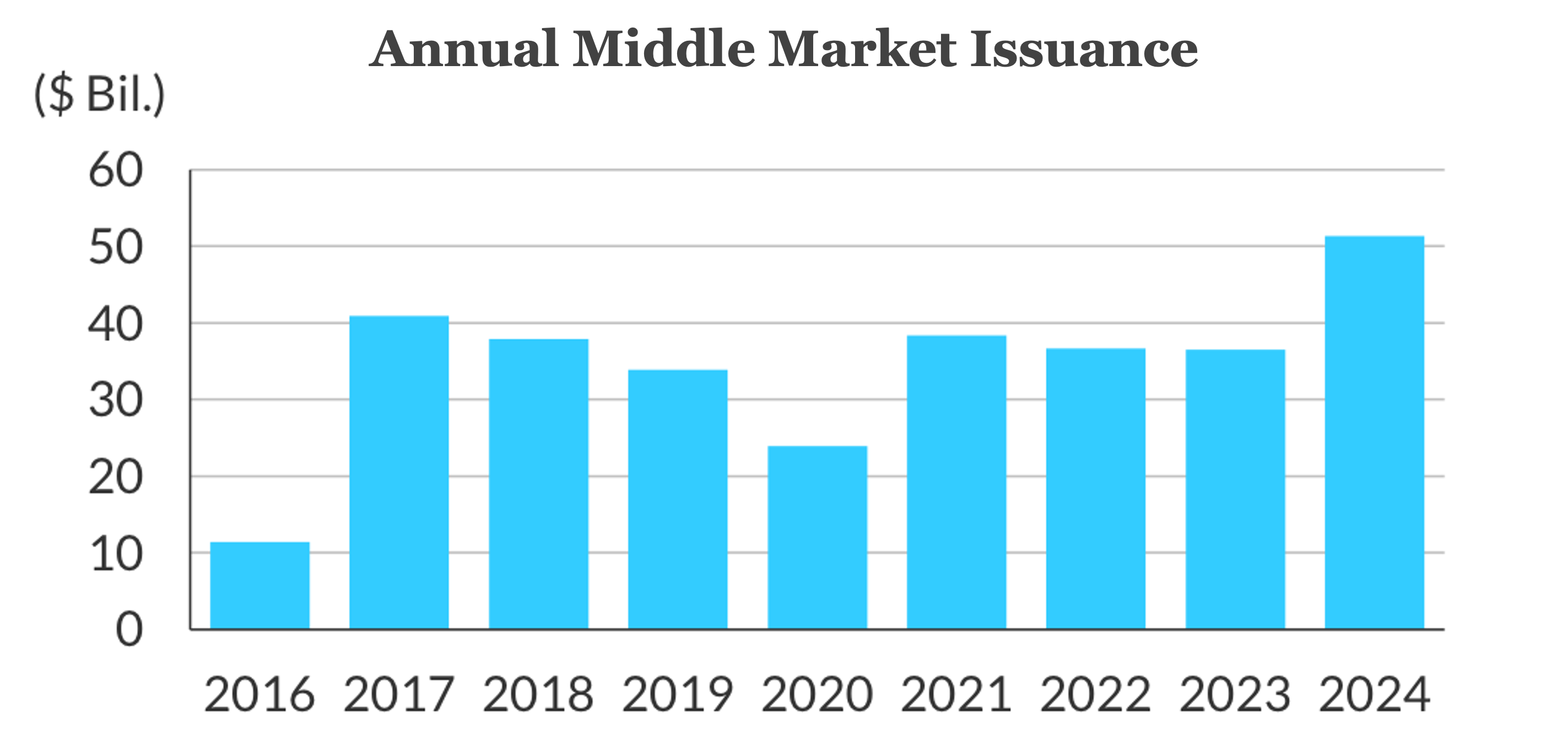

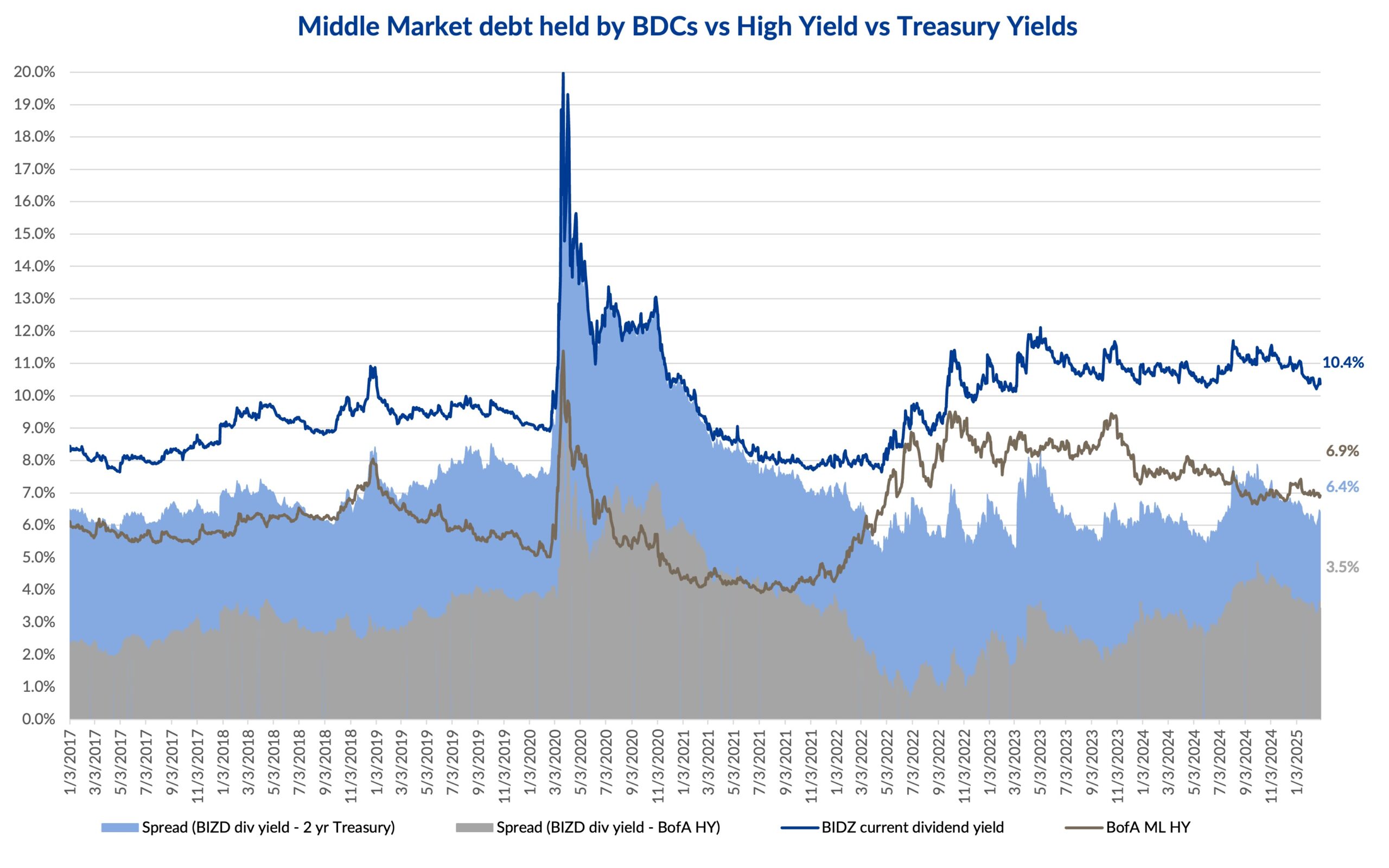

Read MoreChart of the Week: Up the Middle

Total middle market loan volume for 2024 at $51.3 billion was the highest in eight years. Source: Fitch Ratings, Lev Fin Insights.

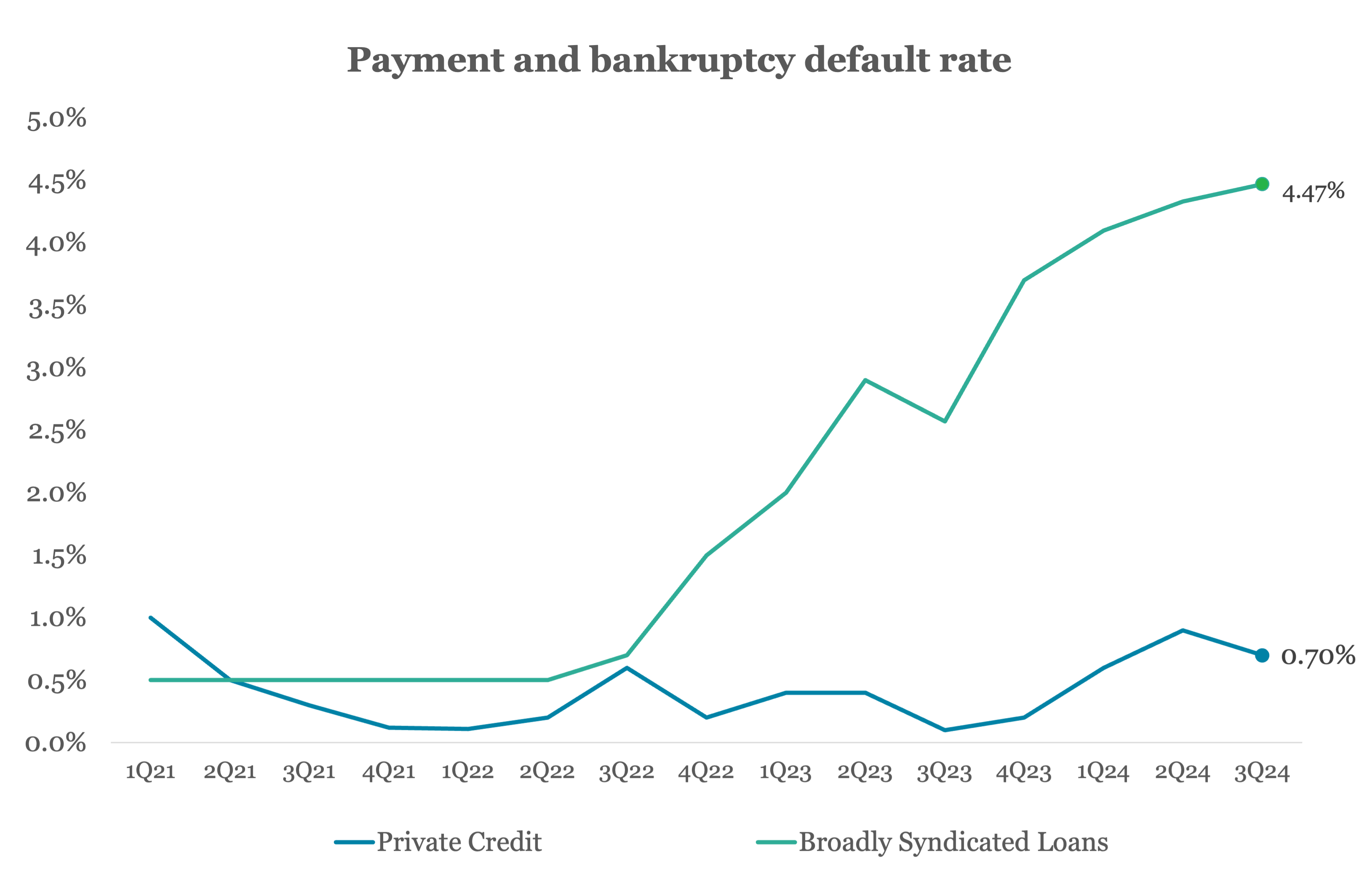

Read MoreChart of the Week: Wide Dispersion

BSL defaults at 3Q 2024 were more than six times those in private credit. Source: Proskauer (Private Credit), Fitch Ratings (BSL), as of September 30, 2024.

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

PDI Picks – 3/3/2025

Tried and trusted approach embraced by LPs Many are expecting a recovery in private credit capital formation in 2025, but it’s the long-established direct lending strategy that’s expected to benefit most. “Higher for longer” interest rates are not good news for everyone – ask placement agents for example. These are the professionals that make their…

Bloomberg: Leveraged Lending Insights – 3/3/2025

US Leveraged Loan Issuance Slows in February February’s $95b of US institutional leveraged loan issuance declined 49% from January’s $186.4b and represents the lowest volume since last August’s $27.7b. While it was a significant slowdown from last month, February issuance was up 51% from the same month a year ago, and year-to-date issuance is at…

Leveraged Loan Insight & Analysis – 3/3/2025

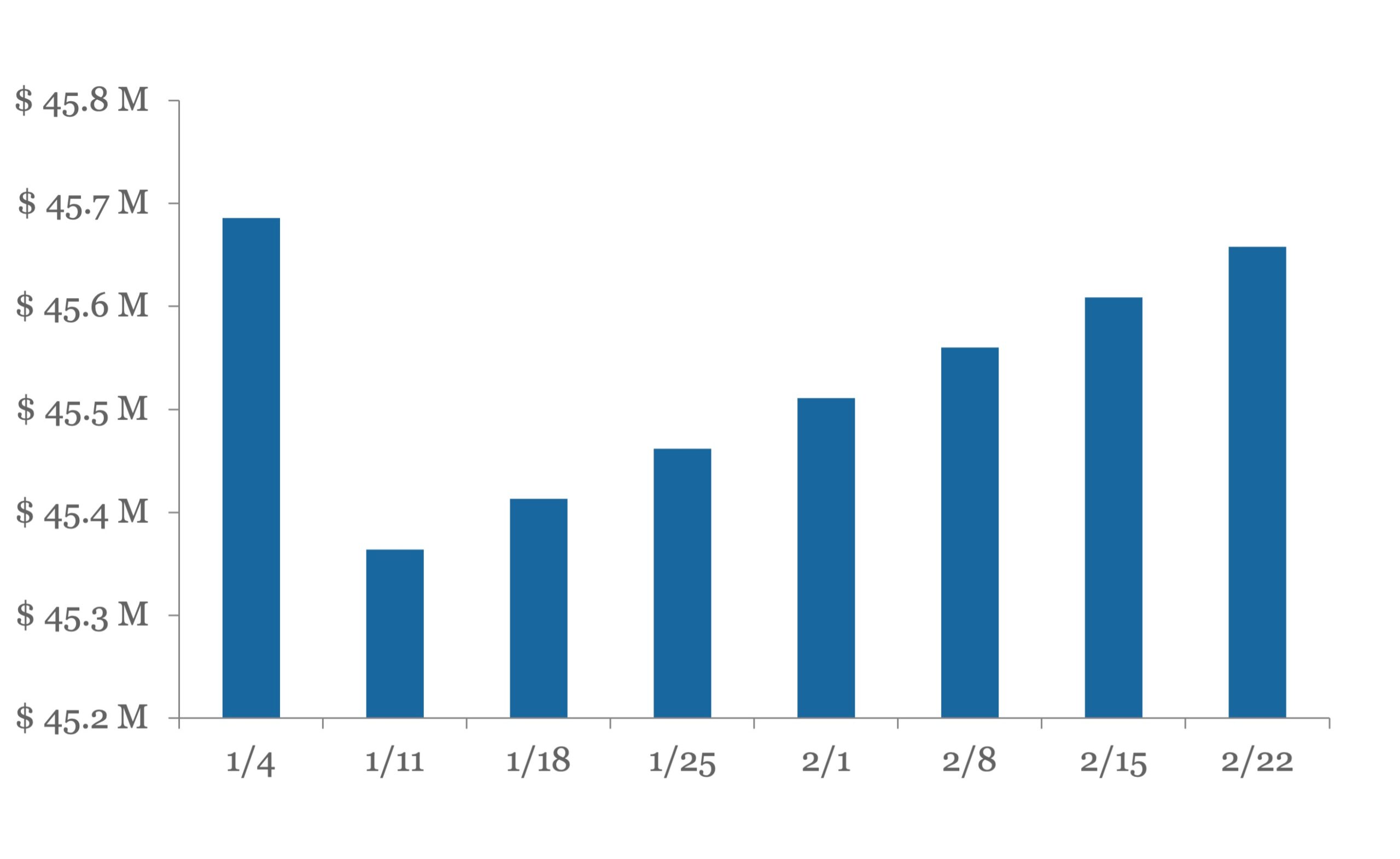

BDC portfolio marks move lower for majority of funds that have reported 4Q24 earnings BDC earnings season is underway, with 50 funds having filed their 4Q24 results as of February 28th. For this cohort of BDCs, portfolio loan valuations have moved lower for nearly 60% funds…. Subscribe to Read MoreAlready a member? Log in here...

PDI Picks – 3/3/2025

Is LatAm worth a second look? It’s one of the most undeveloped private debt regions but demand is there from consumers, SMEs and infrastructure projects. Unlike peers in the US, Latin American institutional investors are under-allocated to alternative assets – but demand is there and so are the opportunities. Challenges, however, include regulation and macroeconomic…

The Pulse of Private Equity – 3/3/2025

Financial leverage for buyout deals by deal year Download PitchBook’s Report here. Greater leverage is another key distinguishing characteristic of buyout-backed companies. Over the past 10 years, the average publicly traded small-cap company has had a financial leverage ratio of total assets to market equity of around 1.4x…. Subscribe to Read MoreAlready a member? Log in

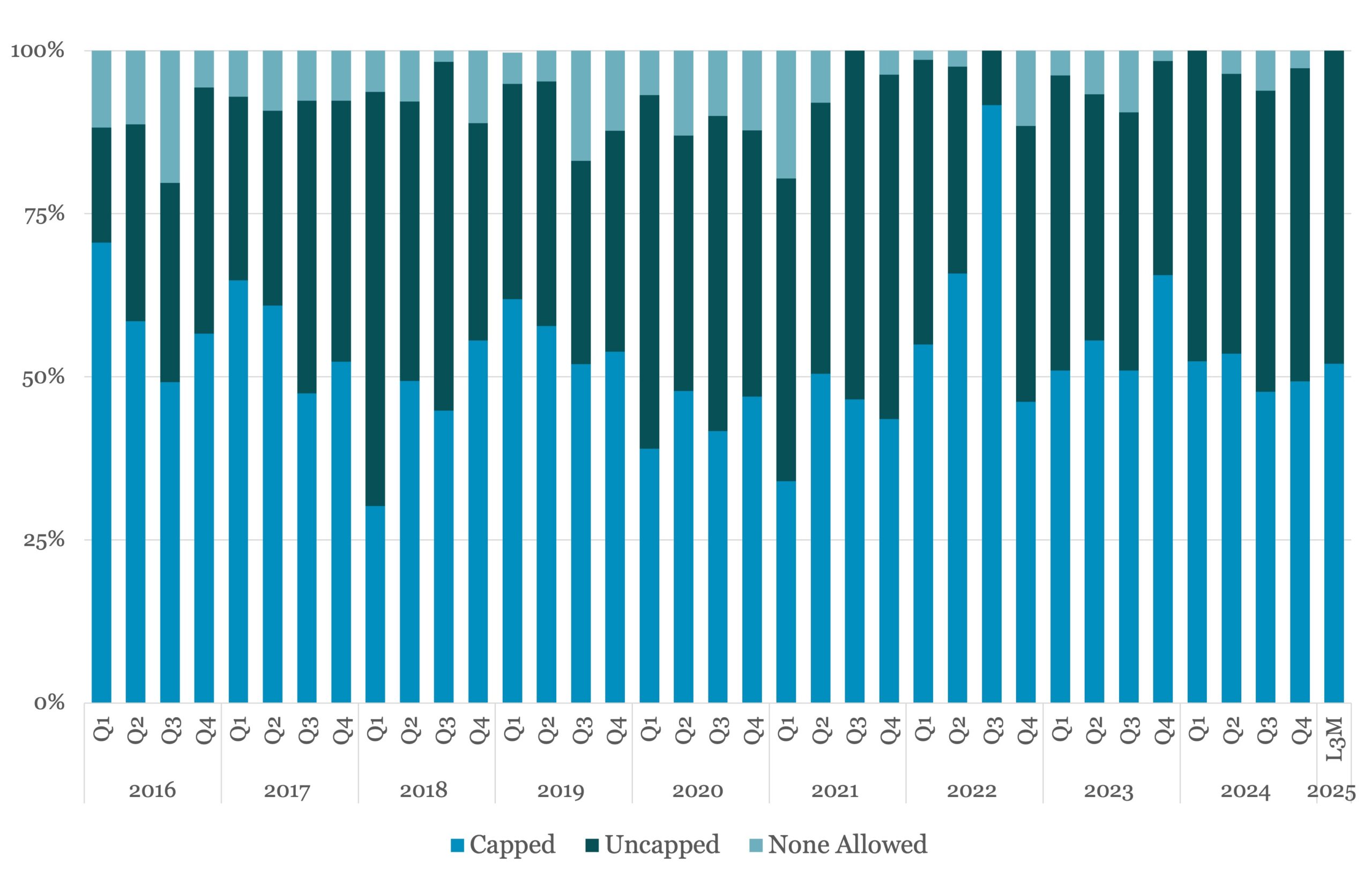

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.