Featuring Charts

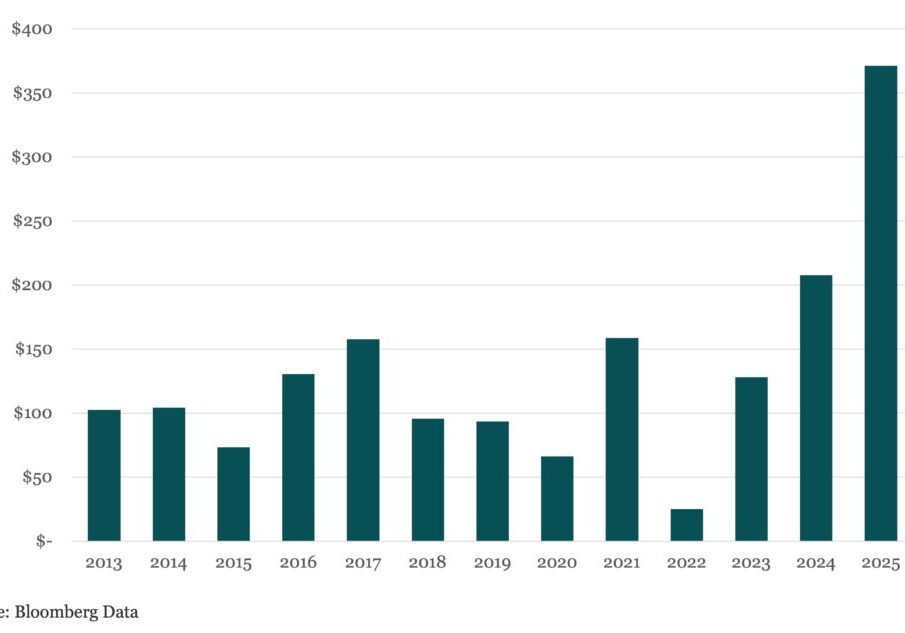

Chart of the Week: MENA Wealth

Of the top ten largest sovereign wealth funds in the world, four are Middle Eastern. Source: Bloomberg

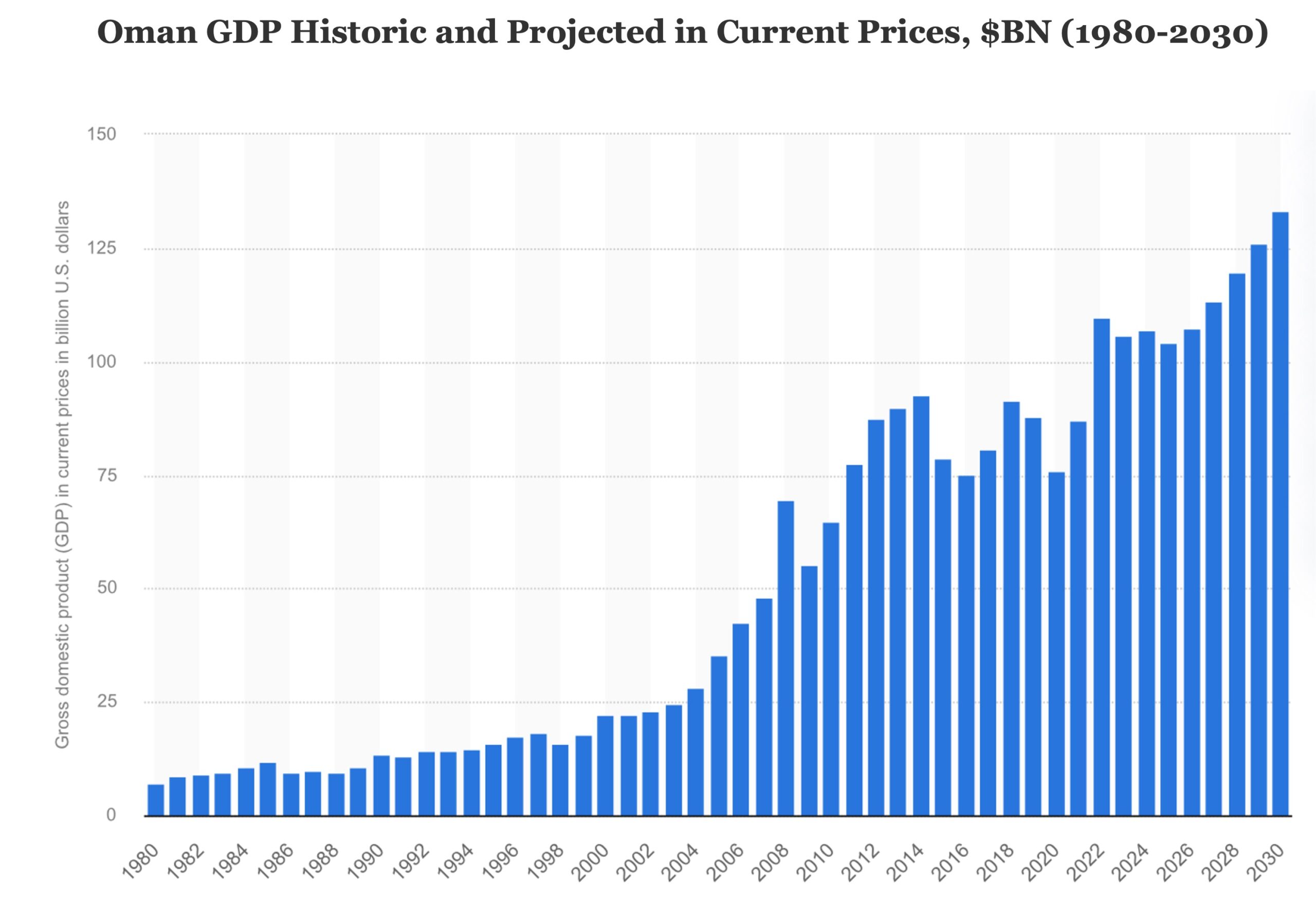

Read MoreChart of the Week: Up and To the Right

Oman’s economy is expected to increase steadily through the end of the decade Source: Statista

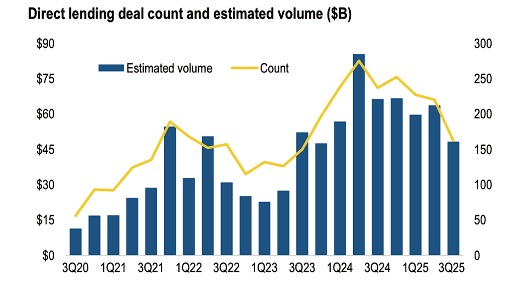

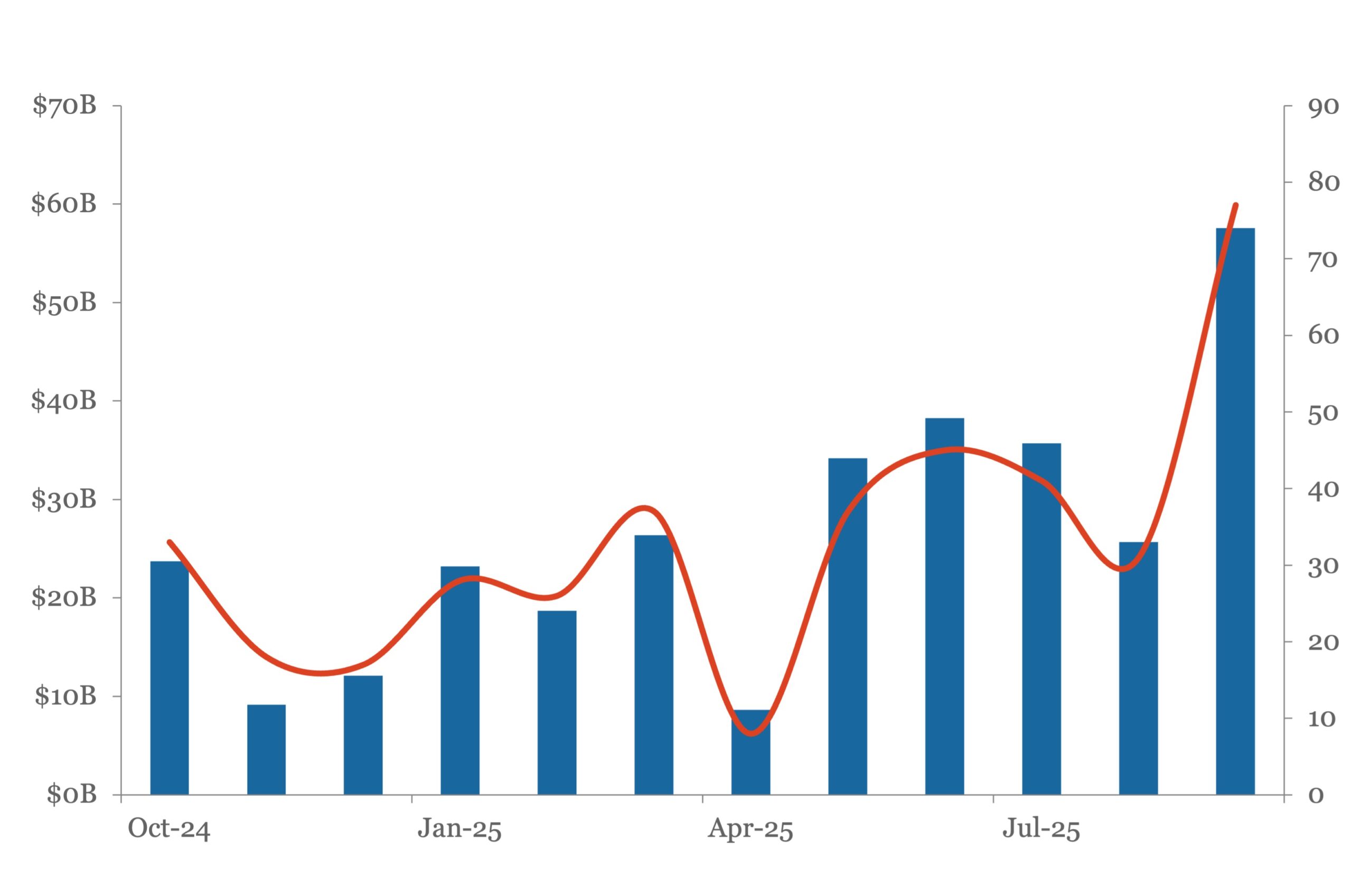

Read MoreChart of the Week: Slow as it Goes

Quarterly direct lending deals peaked 2Q 2024, slowed since. Source: PitchBook LCD, US data through Sept. 16, 2025.

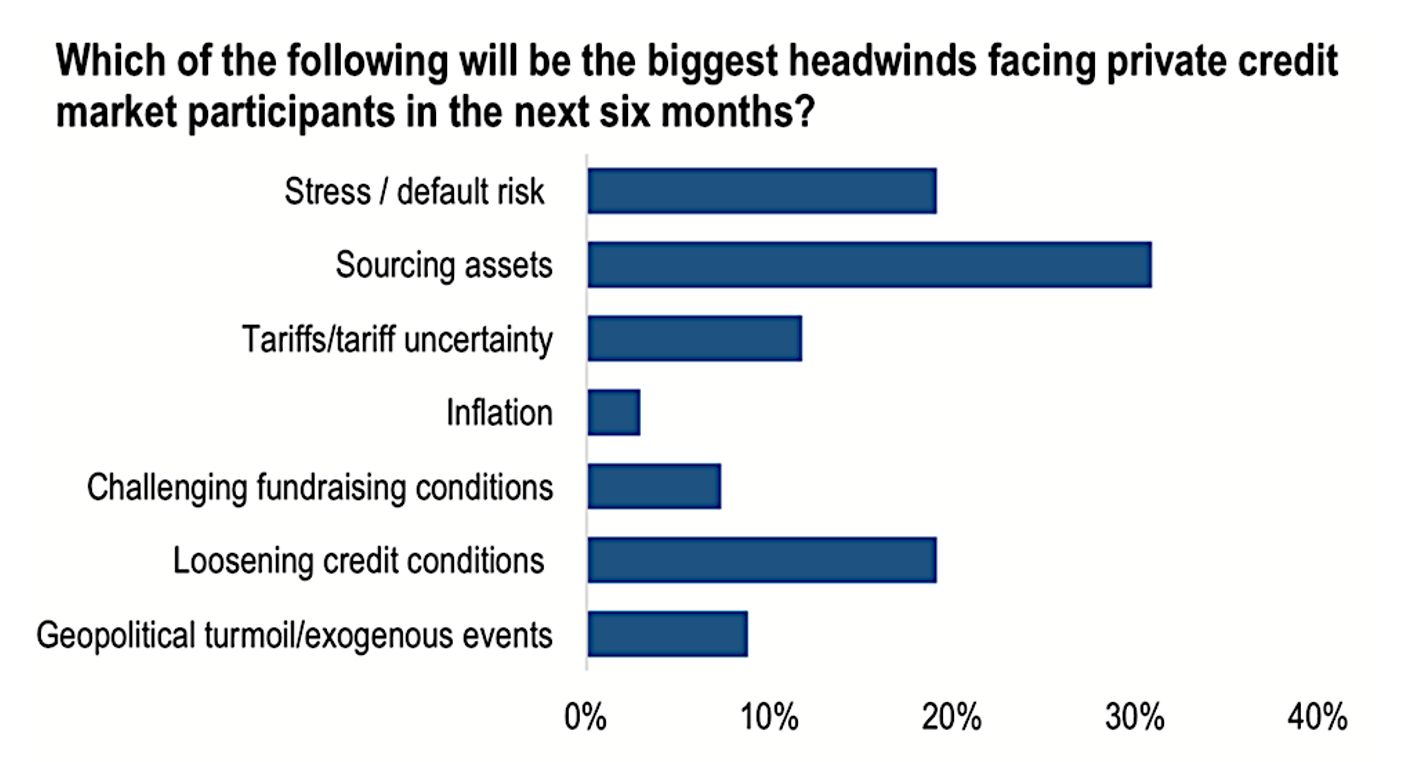

Read MoreChart of the Week: Where’s the Beef?

A PitchBook survey showed private credit participants most worried about finding new deals. Source: PitchBook/LCD, data through Sept. 16, 2025

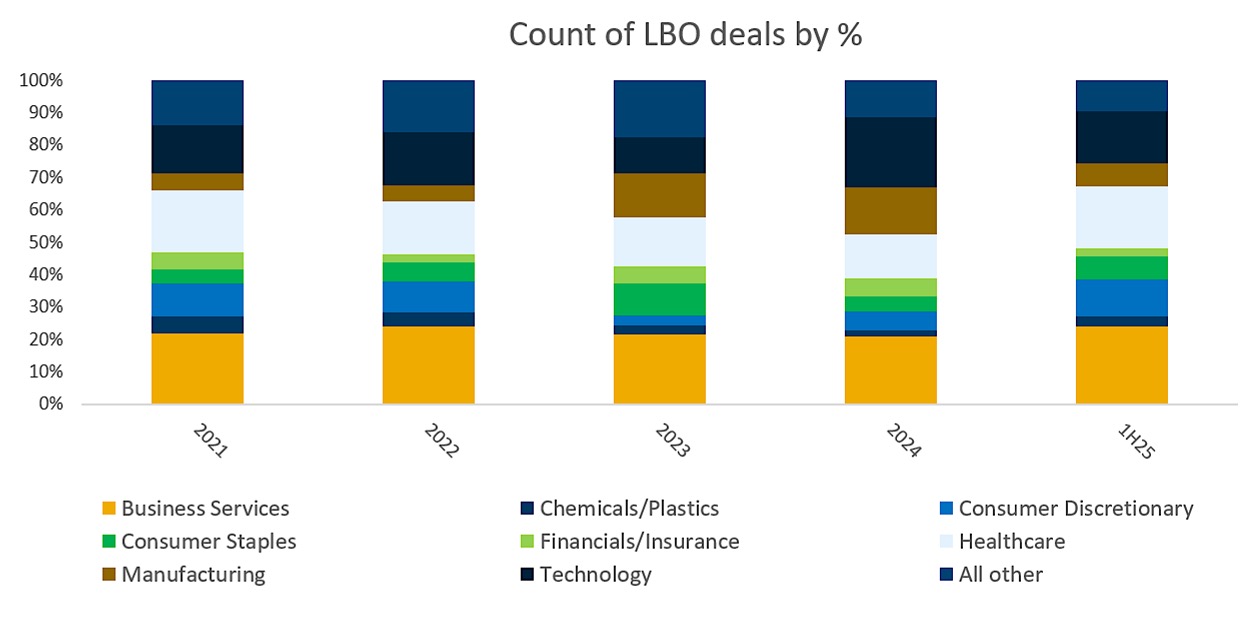

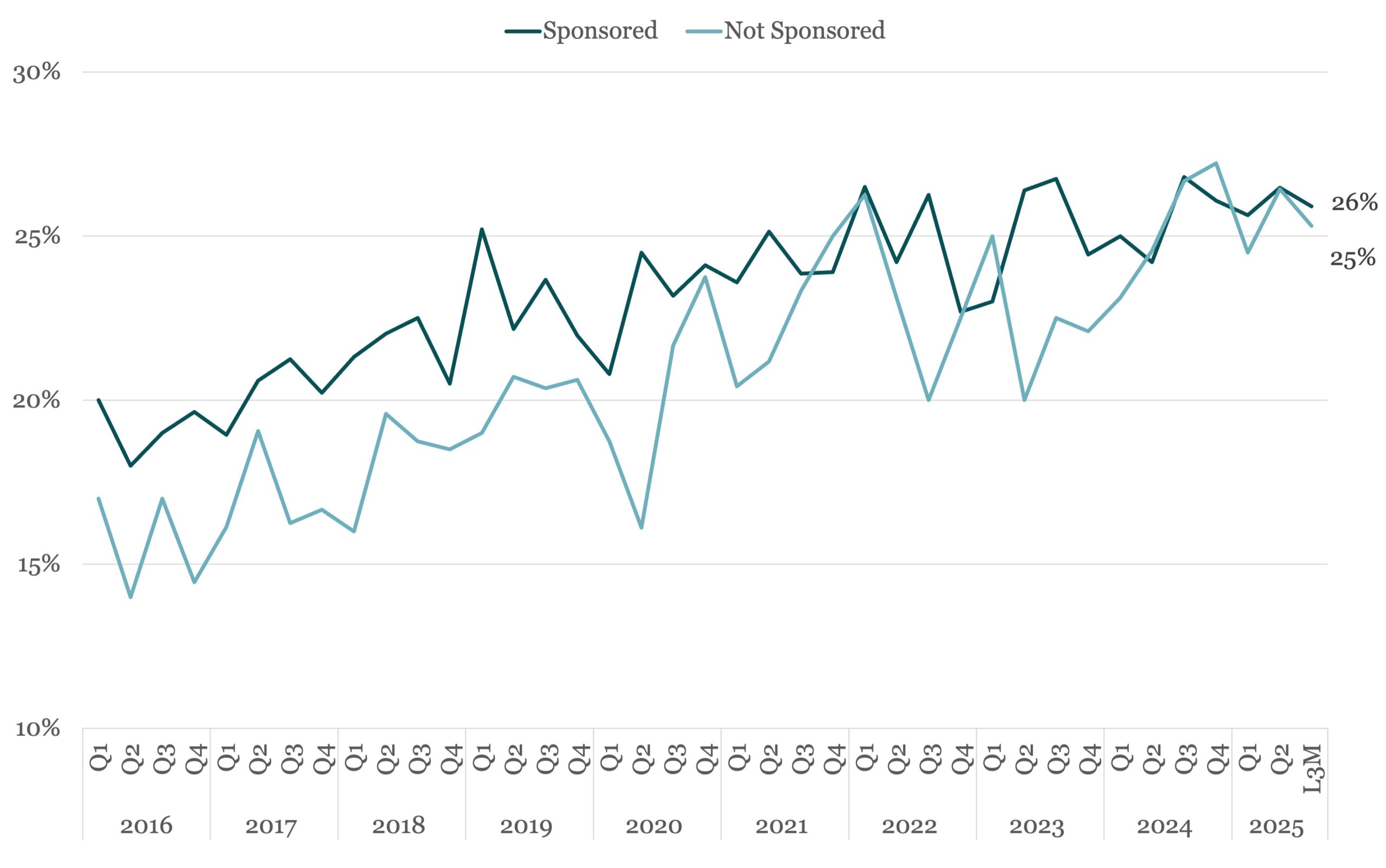

Read MoreChart of the Week: Business Service as Usual

Business services and tech remain strong sectors for LBO candidates. Source: KBRA DLD

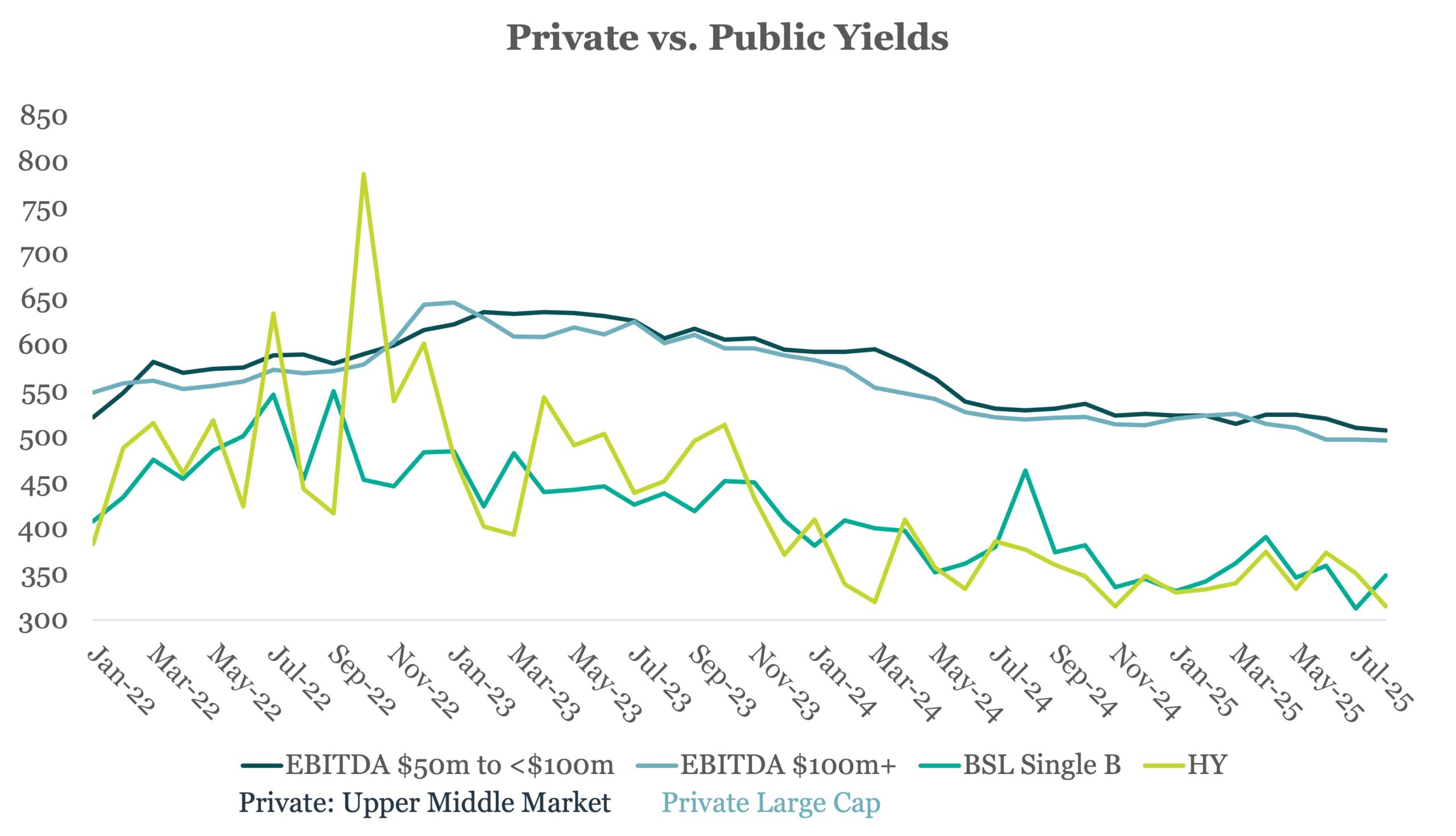

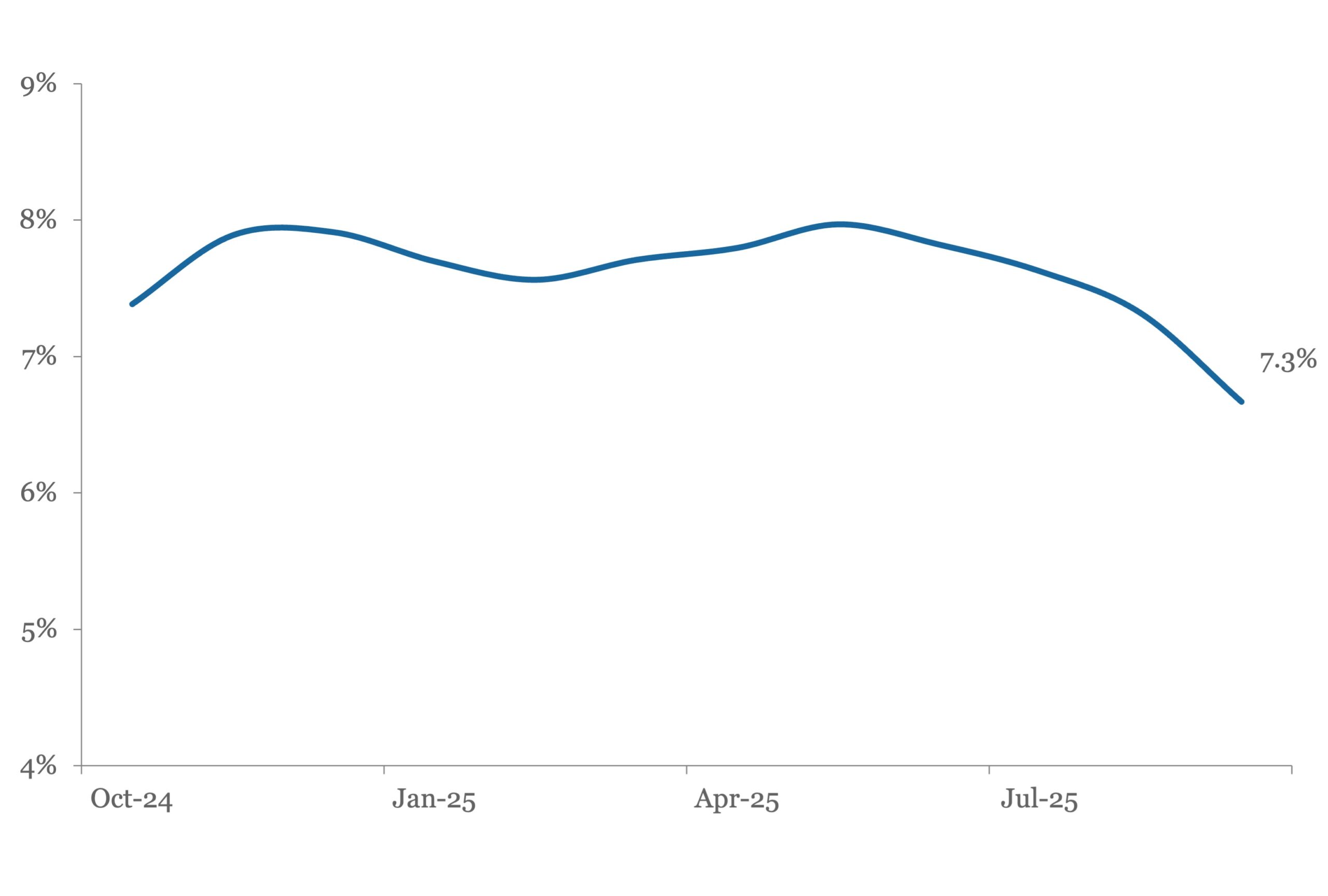

Read MoreChart of the Week: Relative Compression

Private credit yields have narrowed since 2023, but less than for single-Bs. Source: KBRA DLD

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

Bloomberg: Leveraged Lending Insights – 10/13/2025

US Leveraged Loans Return 4.38% Through September Click here to access Bloomberg’s latest Global Leveraged Loan Index Report The Bloomberg US Leveraged Loan Index (Ticker: LOAN) returned 0.37% in September, bringing its year-to-date return to 4.38% through the third quarter. Average secondary market prices on US leveraged loans were 96.84 on September 30th after declining…

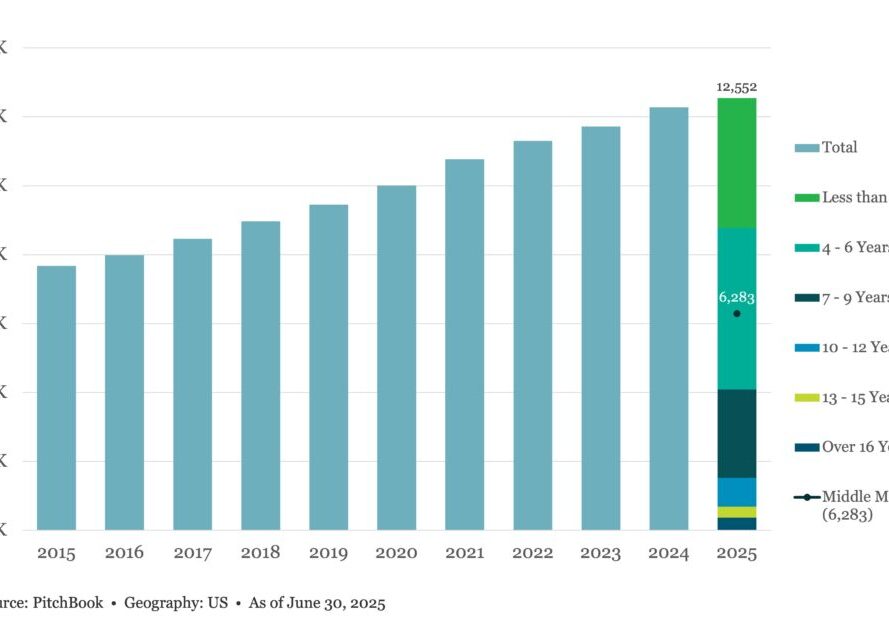

The Pulse of Private Equity – 10/13/2025

PE-backed company inventory by age of investment Download PitchBook’s Report here. Smaller companies, less reliant on global exposure, remain attractive to strategic buyers seeking bolt-ons and niche capabilities…. Subscribe to Read MoreAlready a member? Log in here...

Middle Market & Private Credit – 10/13/2025

Systemic Shock Could Expose Private Credit’s Broad Reach Click here to download report. A shock to the financial system that impacts the private credit sector could reveal the extent that it has moved from a niche product for sophisticated investors to an increasingly relevant component of the global capital markets…. Subscribe to Read MoreAlready a

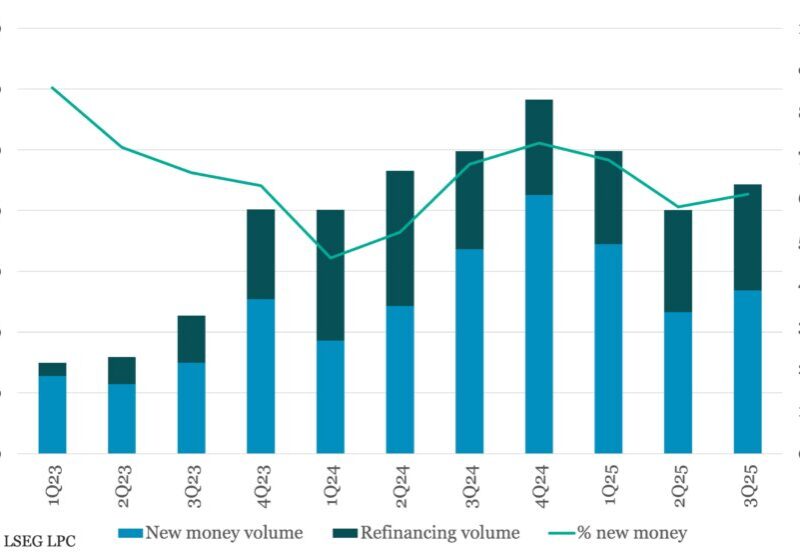

Leveraged Loan Insight & Analysis – 10/13/2025

3Q25 US direct lending loan volume up 10.5% Q-o-Q amid flush of new money activity US lenders placed a combined total of nearly US$87bn of direct lending loan volume in 3Q25 for large corporate and middle market borrowers, an increase of 10.5% compared to 2Q25 results…. Subscribe to Read MoreAlready a member? Log in here...

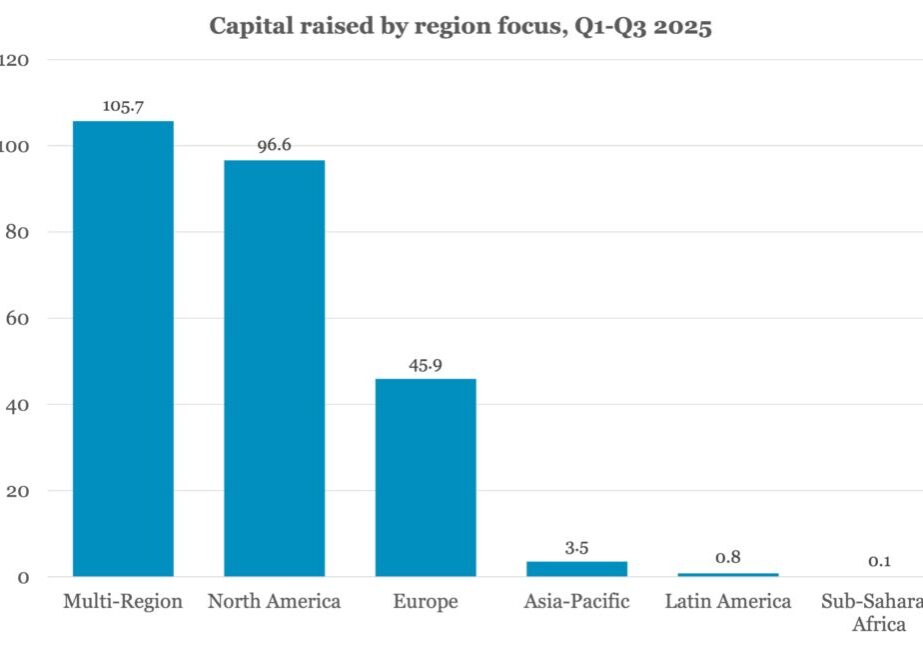

PDI Picks – 10/13/2025

Multi-regional funds and secondaries on the rise Two trends have emerged from our latest fundraising data to the end of Q3. The US is no longer the capital magnet it used to be. The April ‘Liberation Day’ tariffs were perhaps the biggest shock among the political turbulence that has been unsettling financial markets throughout the…

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.