Featuring Charts

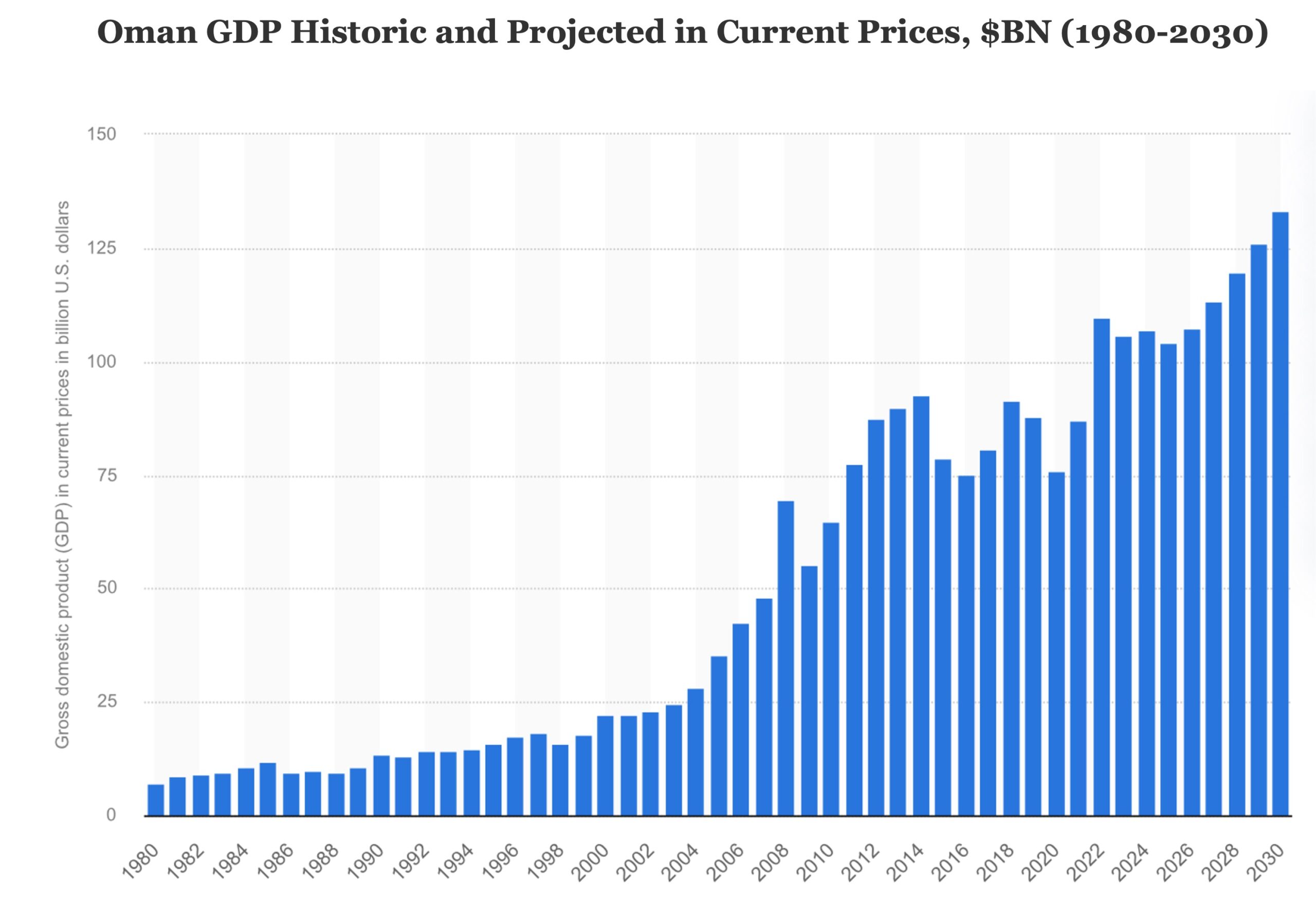

Chart of the Week: Up and To the Right

Oman’s economy is expected to increase steadily through the end of the decade Source: Statista

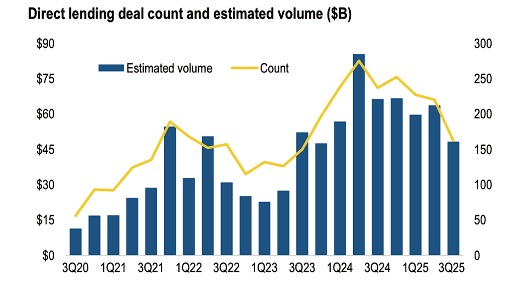

Read MoreChart of the Week: Slow as it Goes

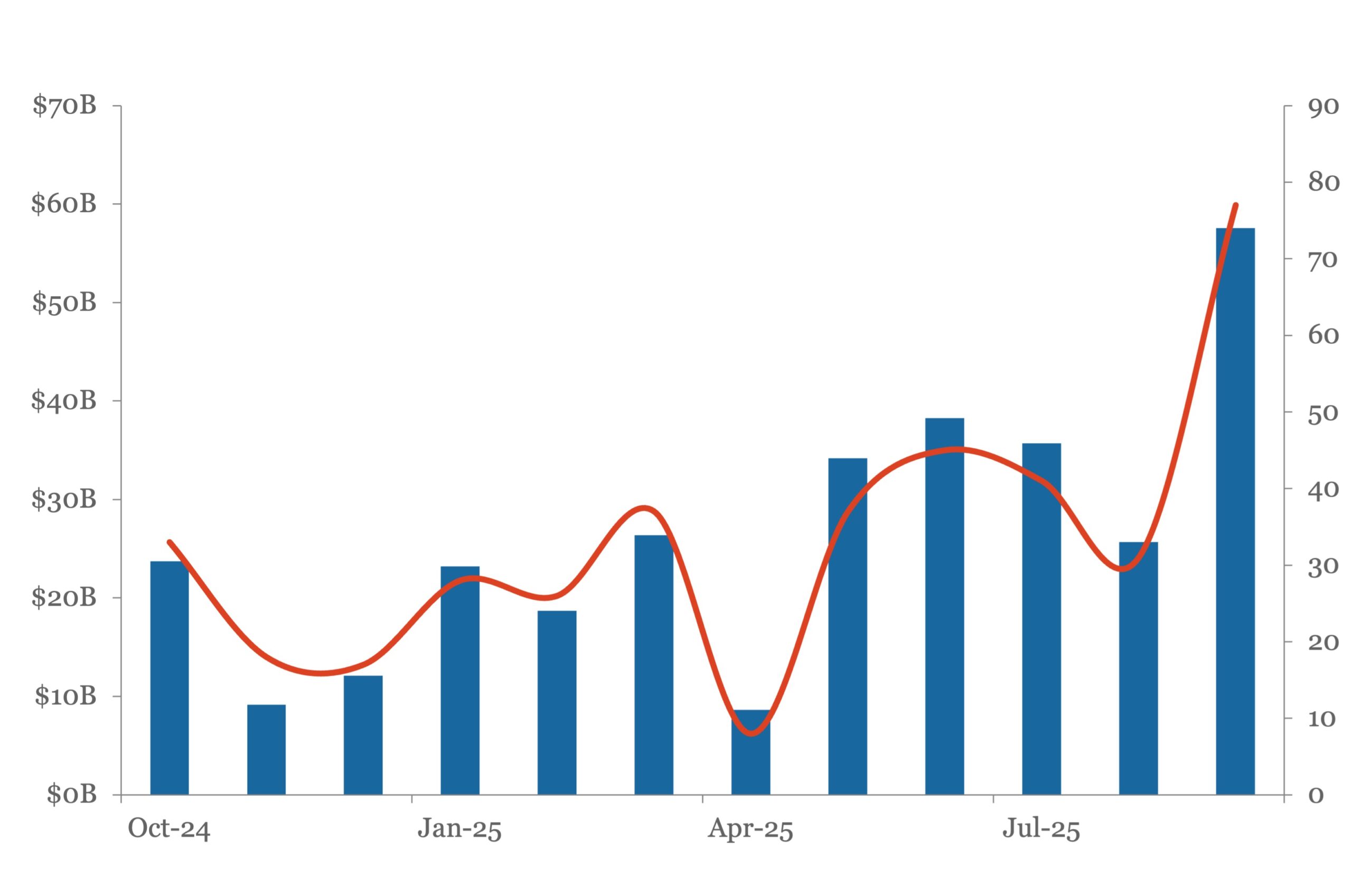

Quarterly direct lending deals peaked 2Q 2024, slowed since. Source: PitchBook LCD, US data through Sept. 16, 2025.

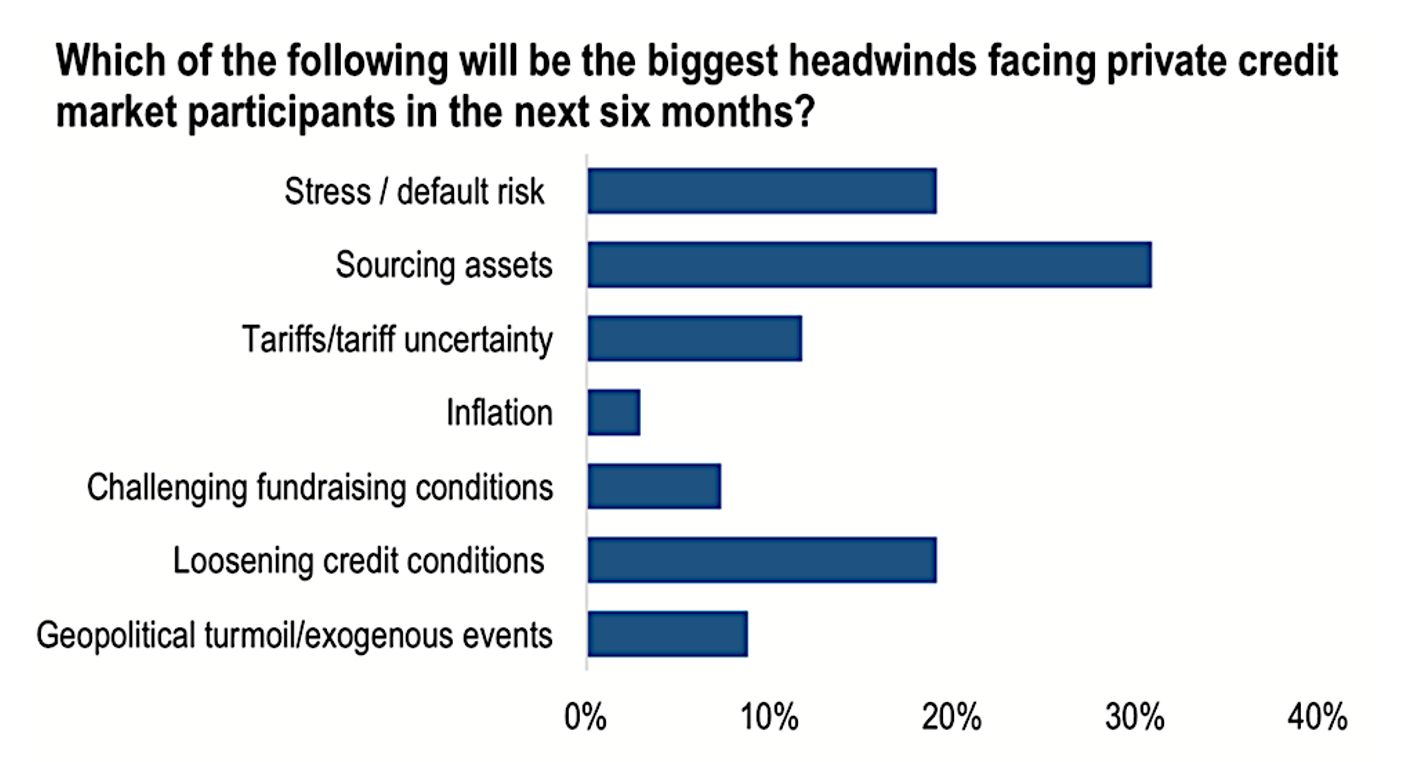

Read MoreChart of the Week: Where’s the Beef?

A PitchBook survey showed private credit participants most worried about finding new deals. Source: PitchBook/LCD, data through Sept. 16, 2025

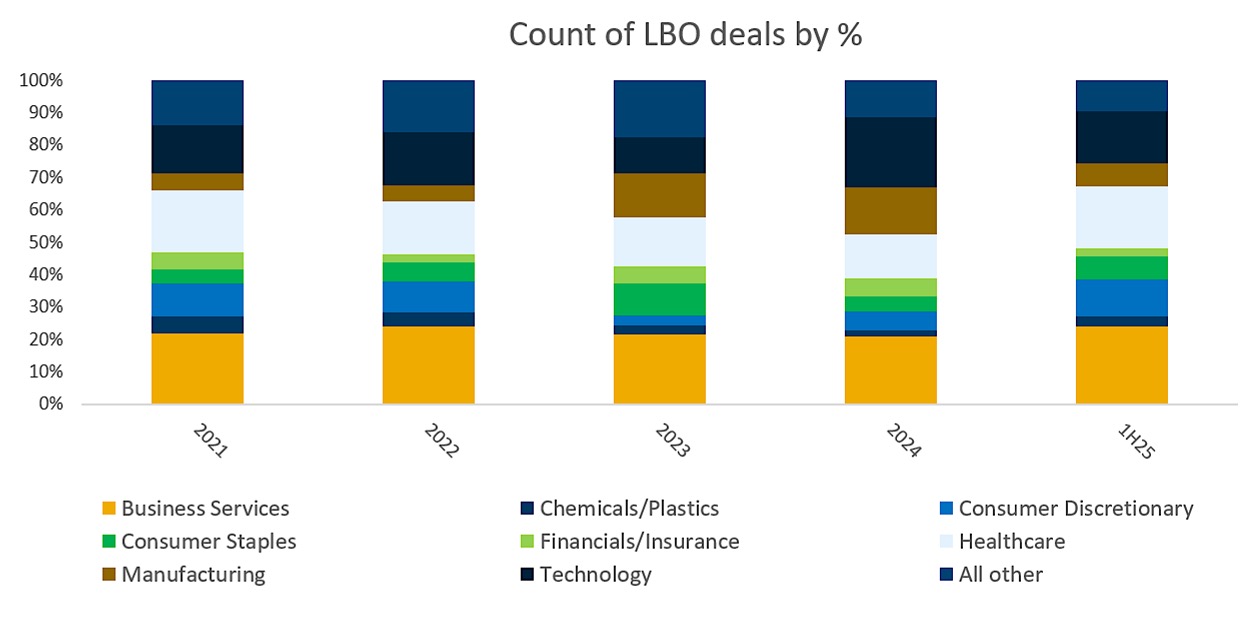

Read MoreChart of the Week: Business Service as Usual

Business services and tech remain strong sectors for LBO candidates. Source: KBRA DLD

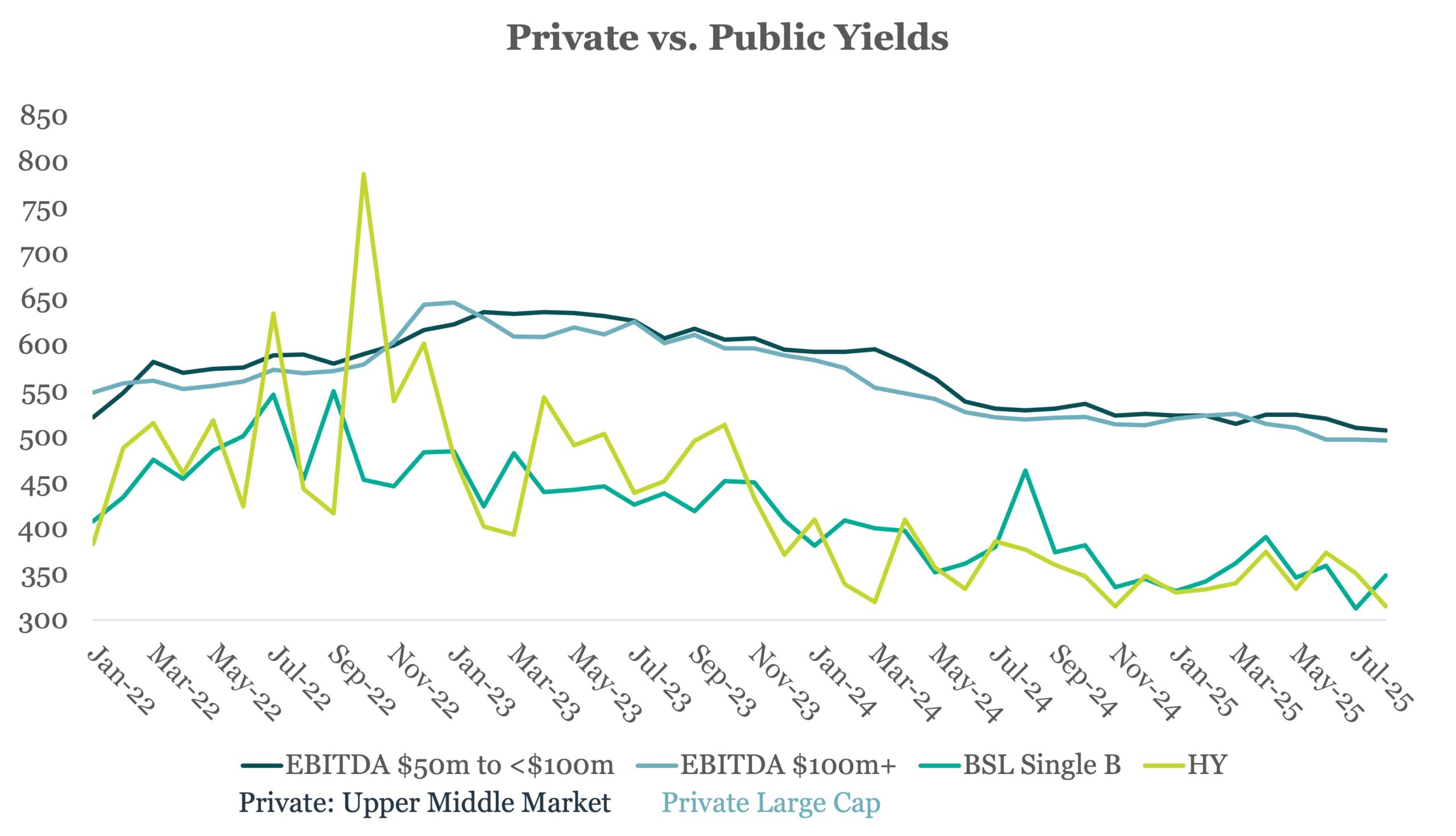

Read MoreChart of the Week: Relative Compression

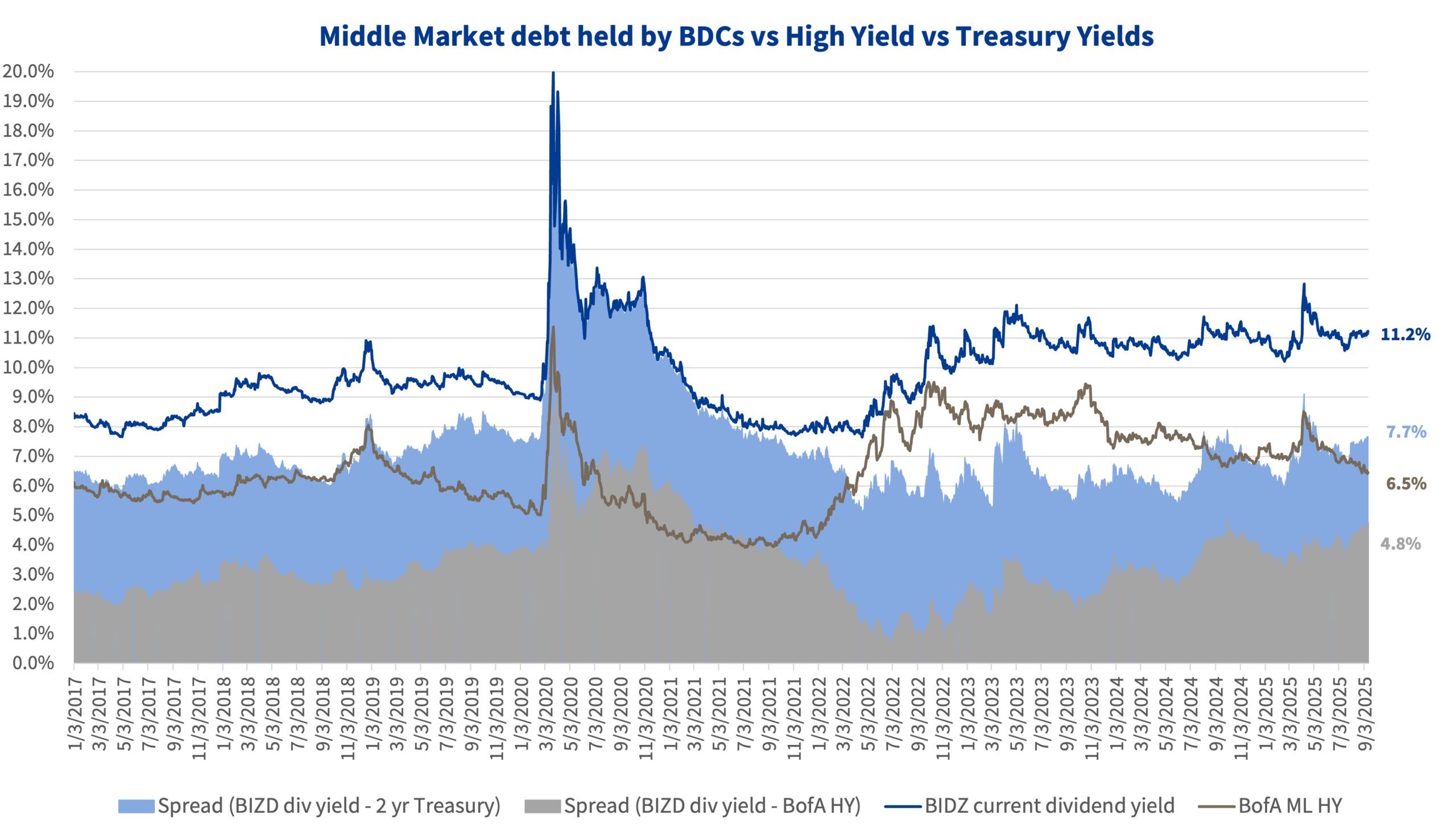

Private credit yields have narrowed since 2023, but less than for single-Bs. Source: KBRA DLD

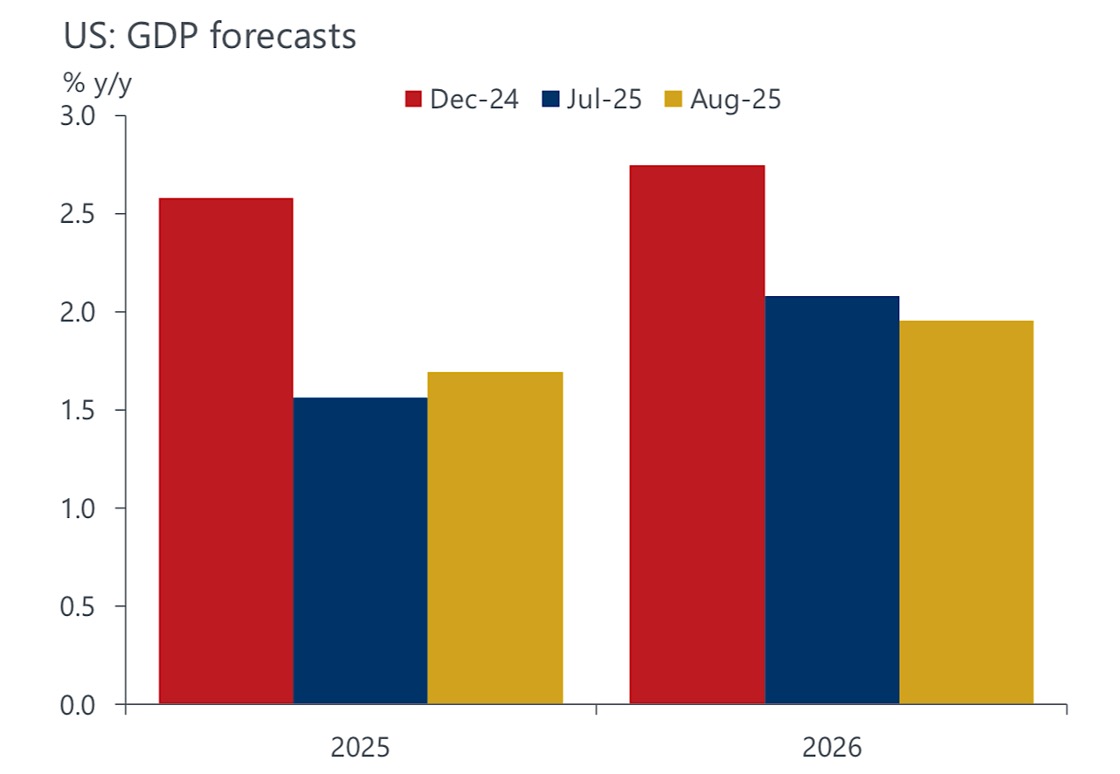

Read MoreChart of the Week: Tariff Drag

Growth forecasts for this year and next are well below last December’s estimates. Source: Oxford Economics/Haver Analytics

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

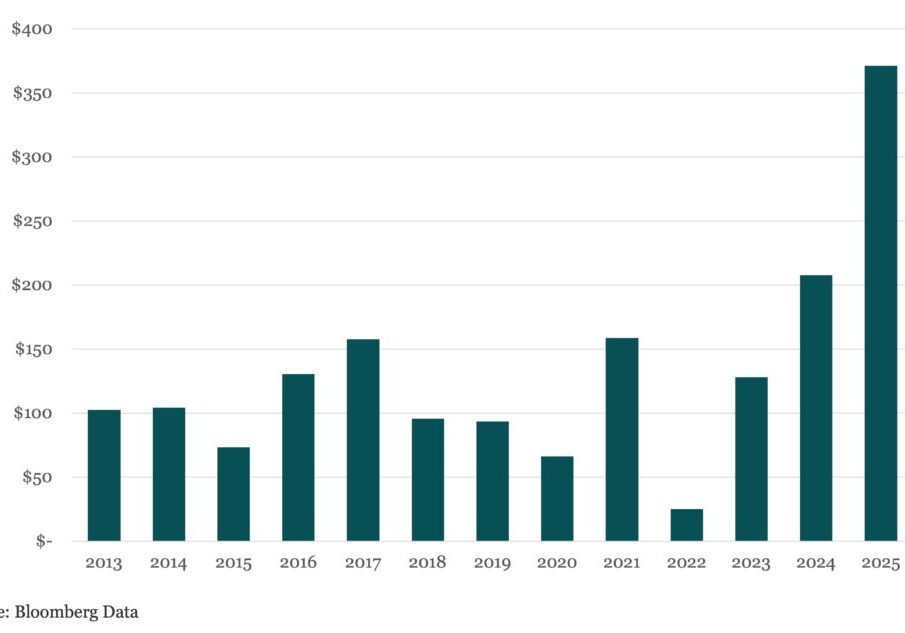

Bloomberg: Leveraged Lending Insights – 10/6/2025

US Leveraged Loans See Busiest Third Quarter on Record Click here to access Bloomberg’s US Leveraged Finance Chartbook September’s US leveraged loan activity totaled 101 deals for $93.2b, representing a $13.6b increase (17.1%) over August’s $79.6b. However, this marked a $4.2b decline compared to September 2024…. Subscribe to Read MoreAlready a member? Log in here...

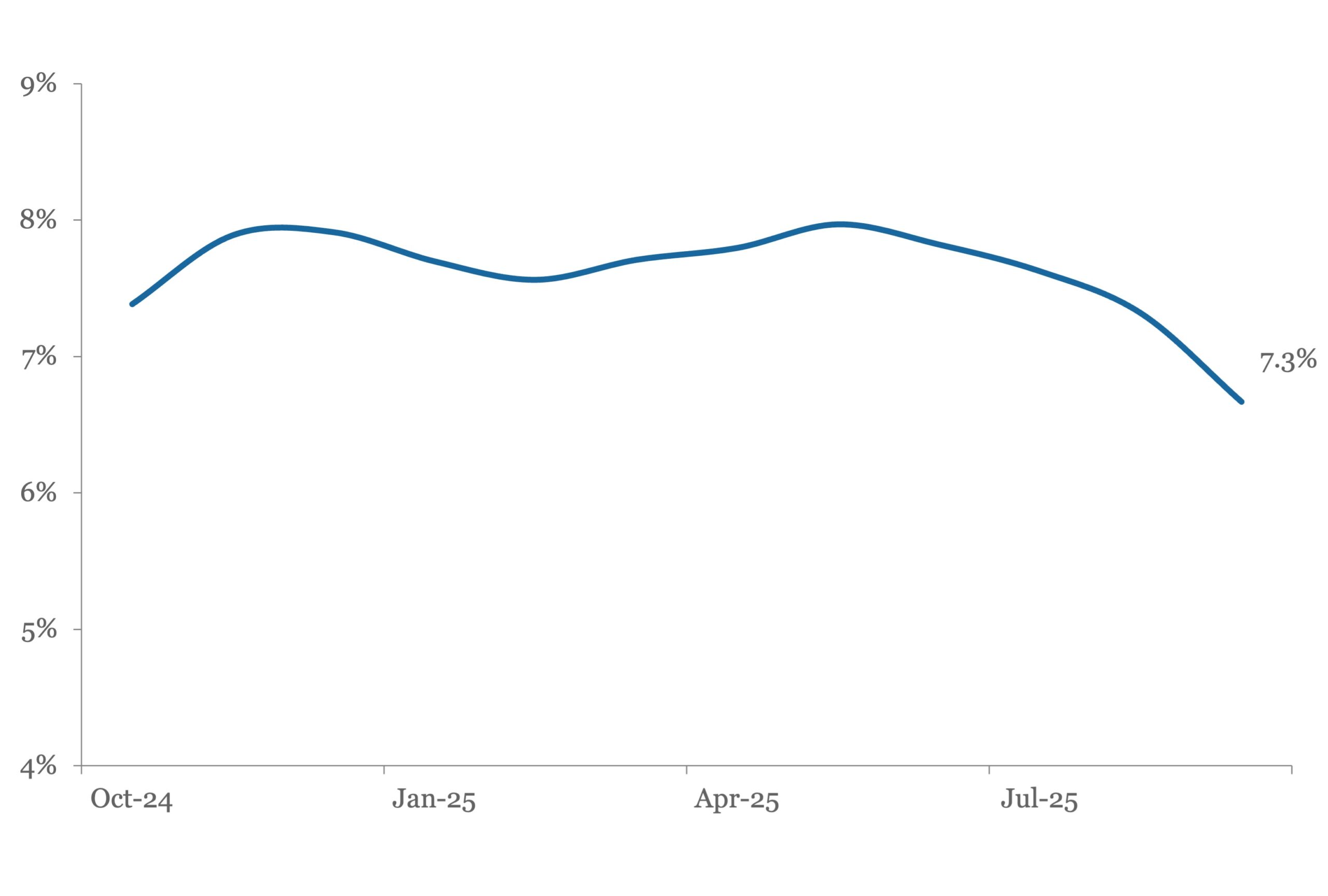

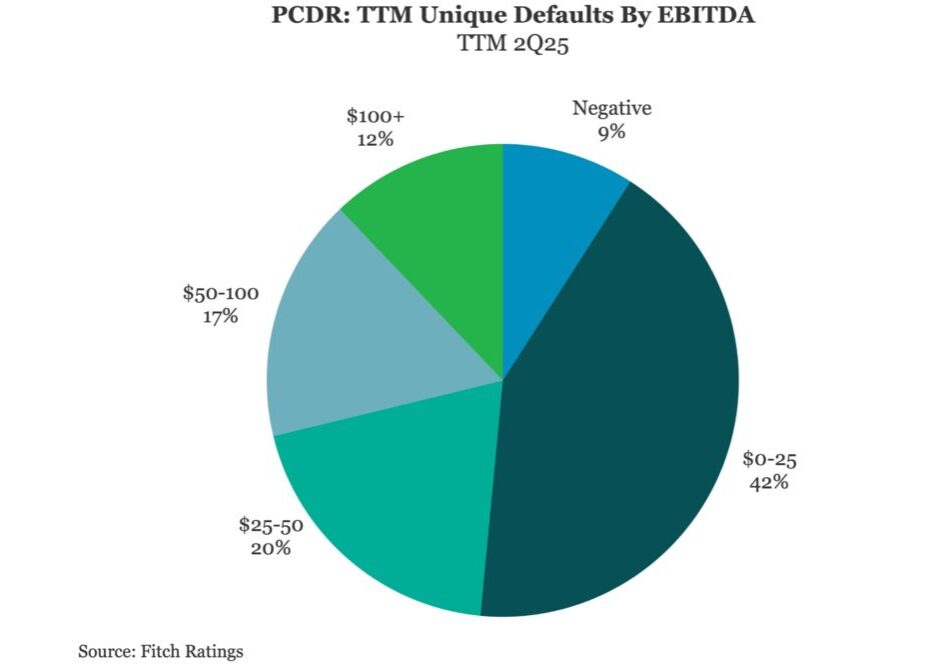

Middle Market & Private Credit – 10/6/2025

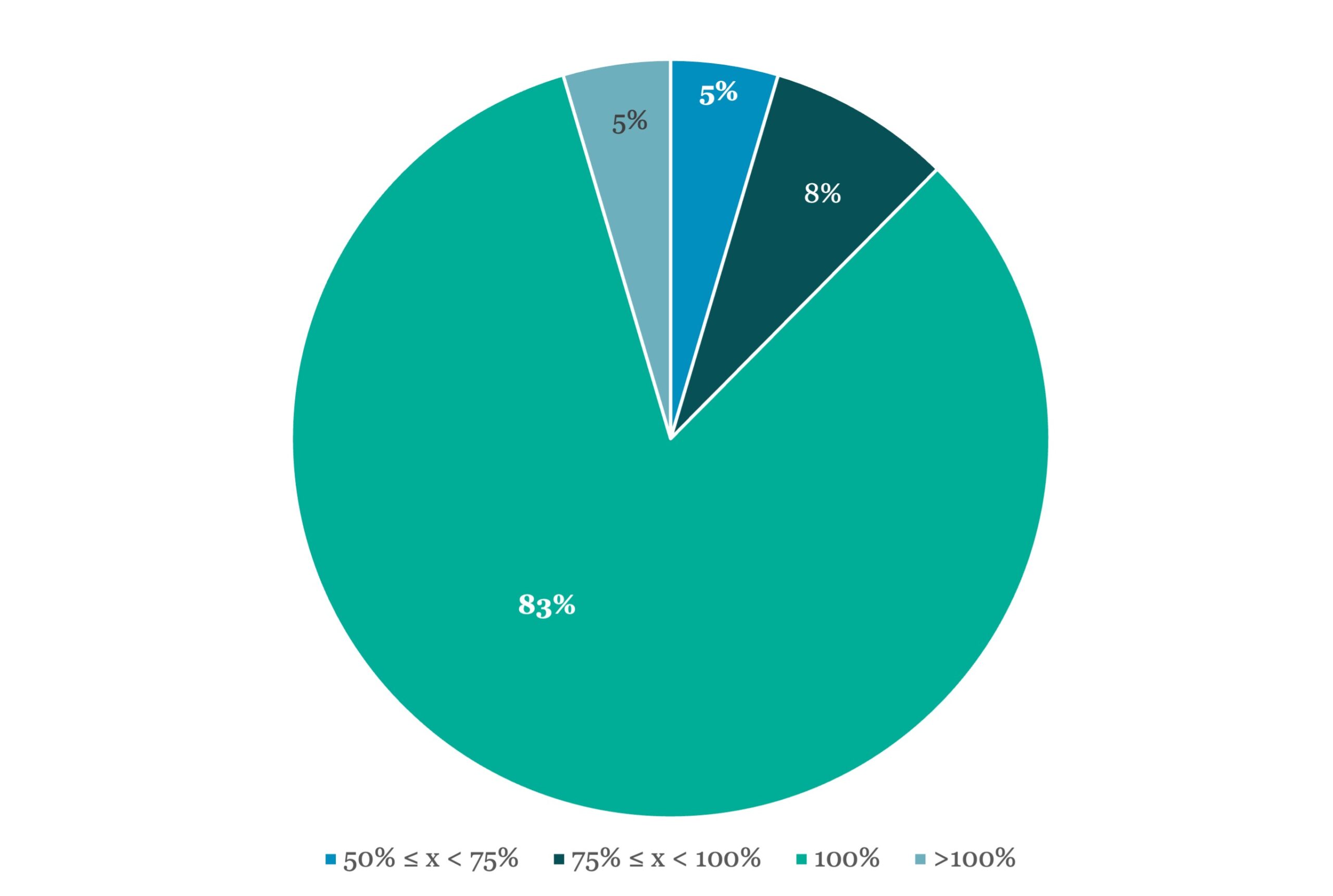

U.S. Private Credit: Sizing Up Defaults Click here to download report. Issuers generating less than $25 million EBITDA defaulted at more than twice the rate of larger companies over the TTM ending 2Q25…. Subscribe to Read MoreAlready a member? Log in here...

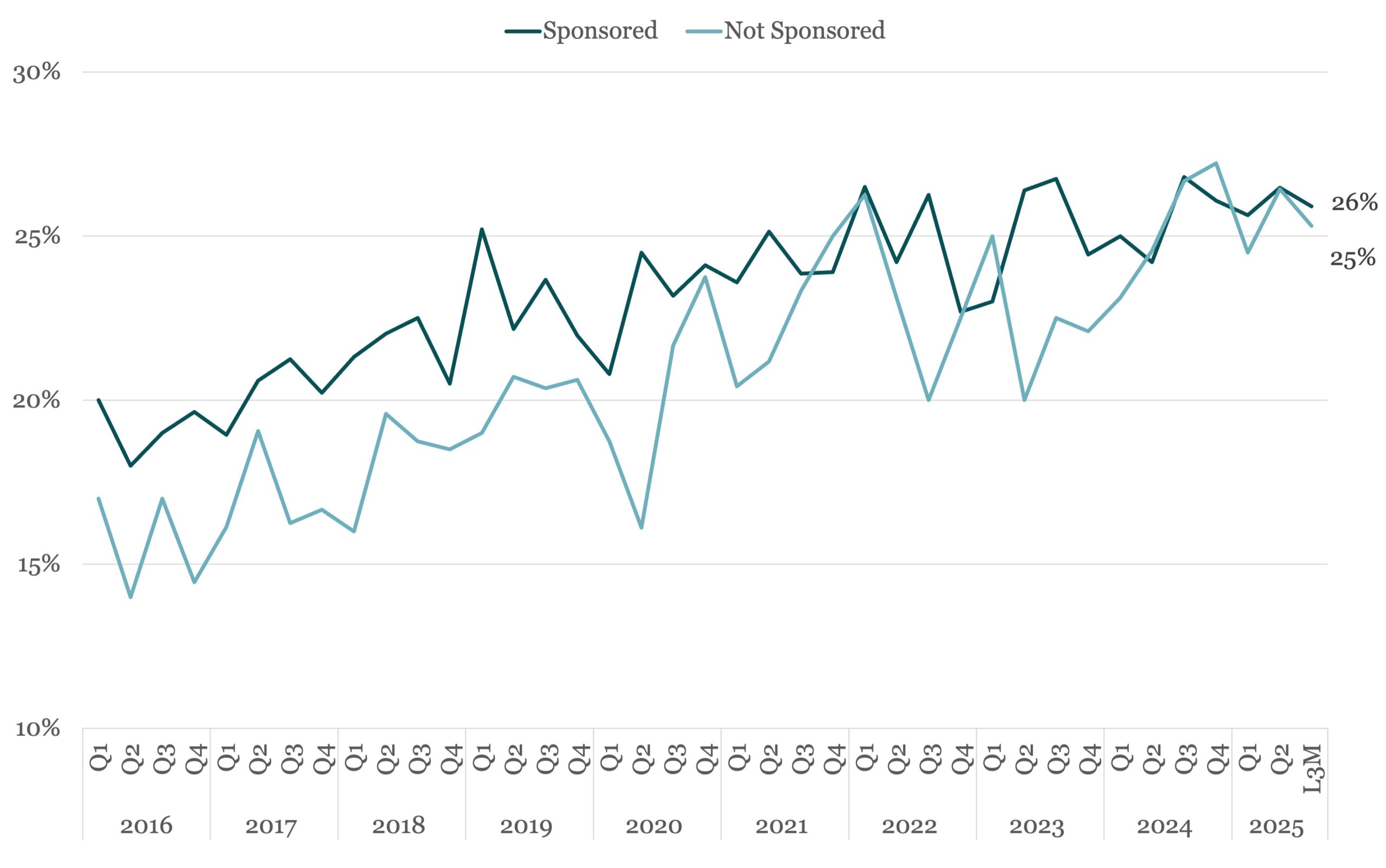

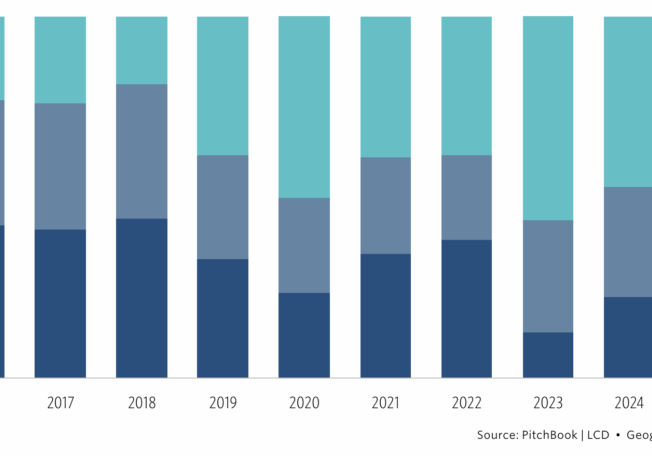

The Pulse of Private Equity – 10/6/2025

Share of BSL-financed LBO count by equity contribution Download PitchBook’s Report here. Since rate hikes began in 2022, buyouts under $1 billion have virtually disappeared from the BSL market…. Subscribe to Read MoreAlready a member? Log in here...

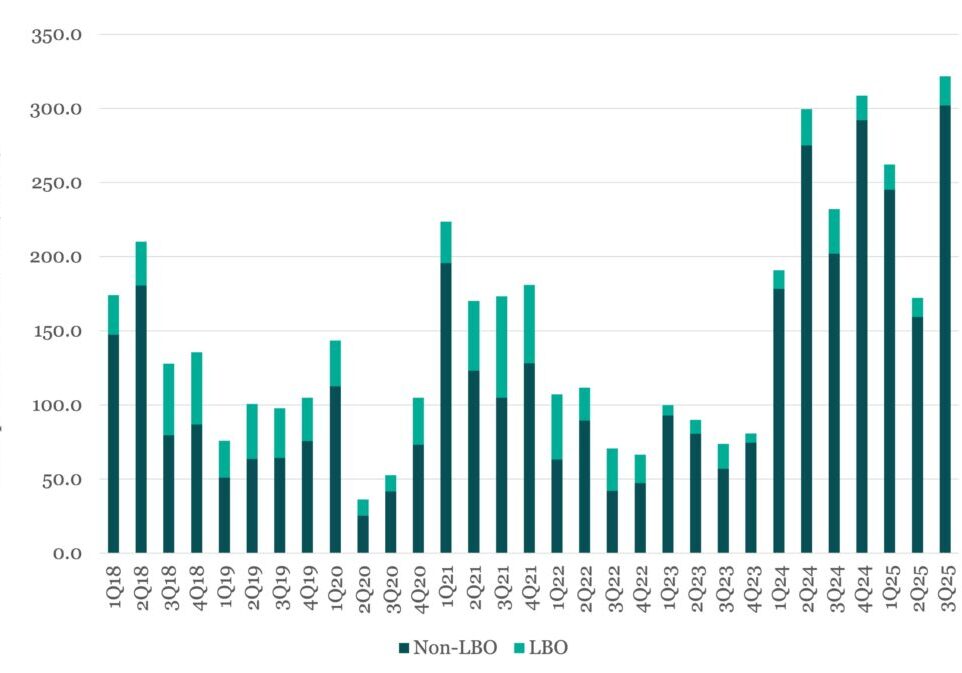

Leveraged Loan Insight & Analysis – 10/6/2025

3Q25 LBO volume down over 34% year over year; Total sponsored volume up nearly 39% US lenders committed almost US$20bn in LBO loan volume in 3Q25, up modestly compared to 2Q25 results (which came in at just under US$13bn) but down 34% year-on-year…. Subscribe to Read MoreAlready a member? Log in here...

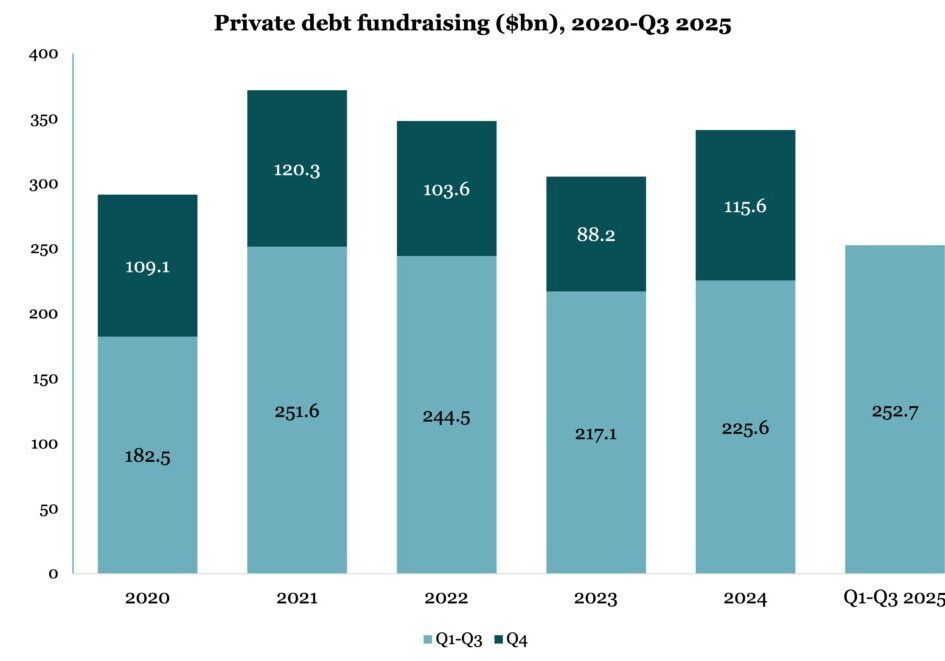

PDI Picks – 10/6/2025

Fundraising puts on a surge in Q3 The Liberation Day announcement put the brakes on capital accumulation in Q2, but it’s come roaring back. Having looked on course for an average year of fundraising at the halfway mark, private debt managers are now on target to have their most fruitful 12 months of the last…

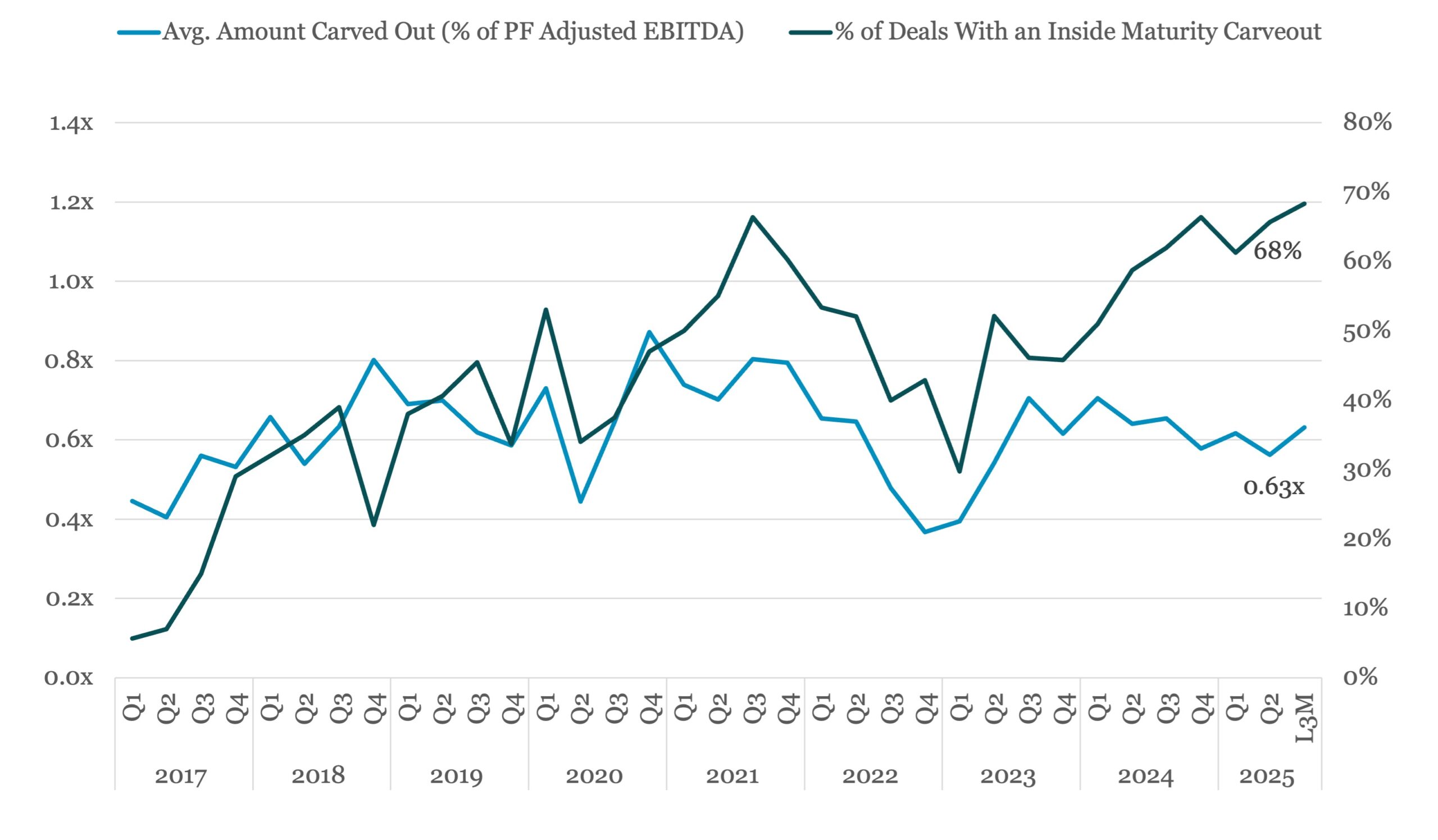

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.