Featuring Charts

Chart of the Week: Interest Bearing Accounts

After three flat-to-down years, LP’s look to be gearing up for 2025. Source: Private Equity International’s LP Perspectives 2025 Study

Read MoreChart of the Week: To Co-Invest, or Not to Co-Invest

The majority of GPs in Europe and North America offer equity co-investment programs. Source: Dechert’s 2025 Global Private Equity Outlook. (Past performance is no guarantee of future results.)

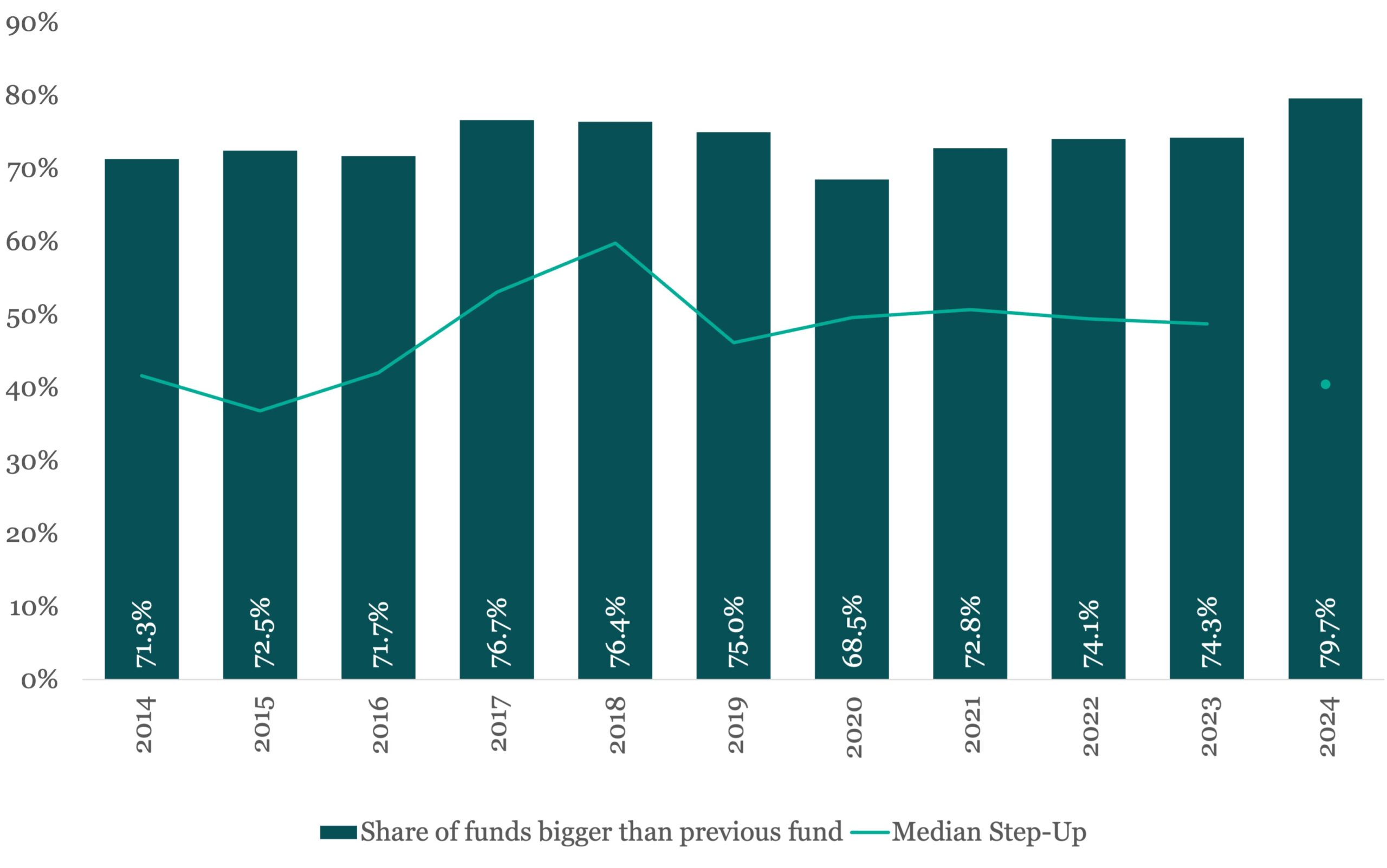

Read MoreChart of the Week: Bigger Brothers

Since 2020 the share of GPs raising larger funds has been growing. Source: PitchBook(Past performance is no guarantee of future results.)

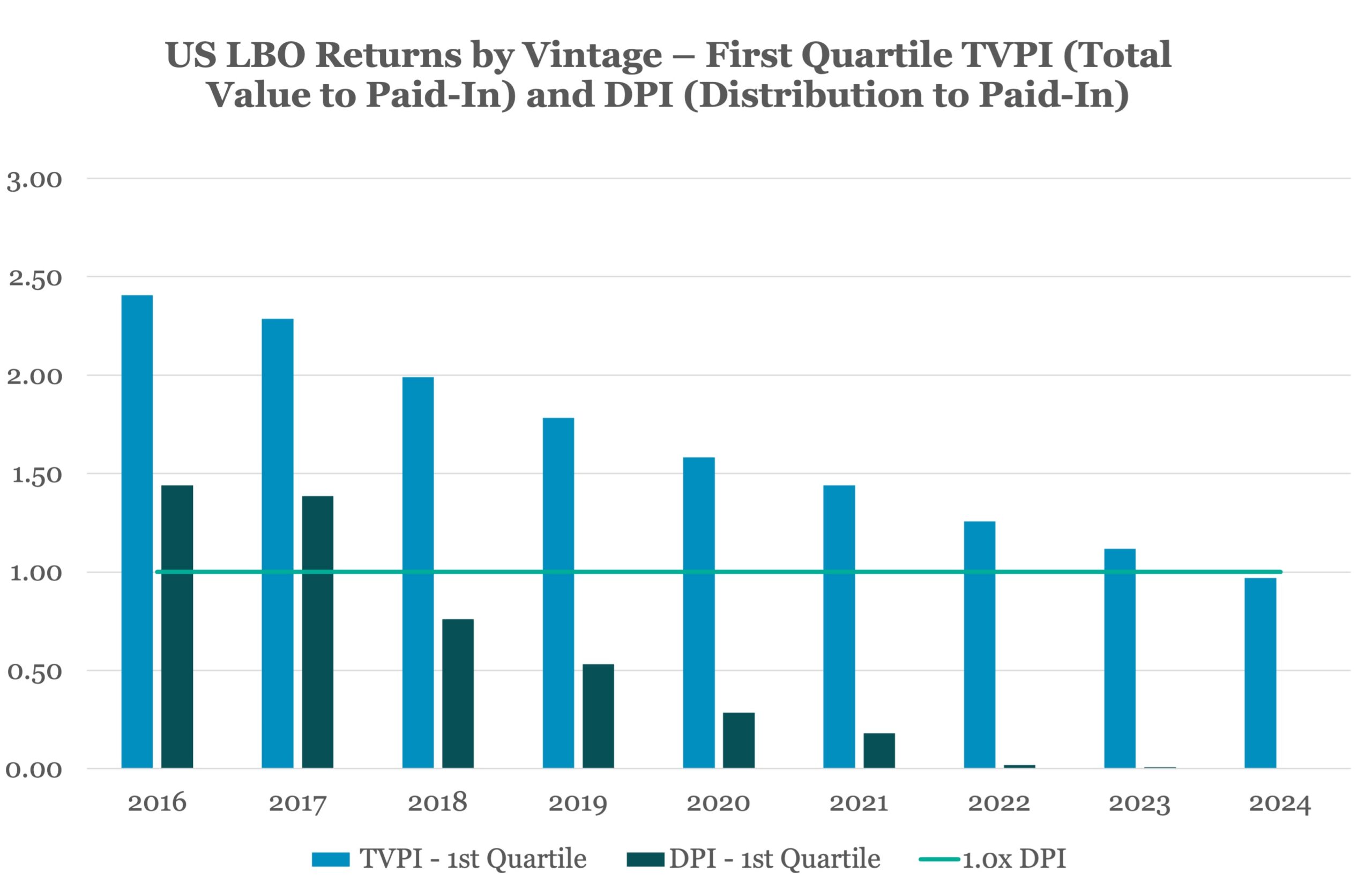

Read MoreChart of the Week: No Money-Back Guarantee

The absence of realizations has hampered distributions to LPs. Source: Burgiss/MSCI(Past performance is no guarantee of future results.)

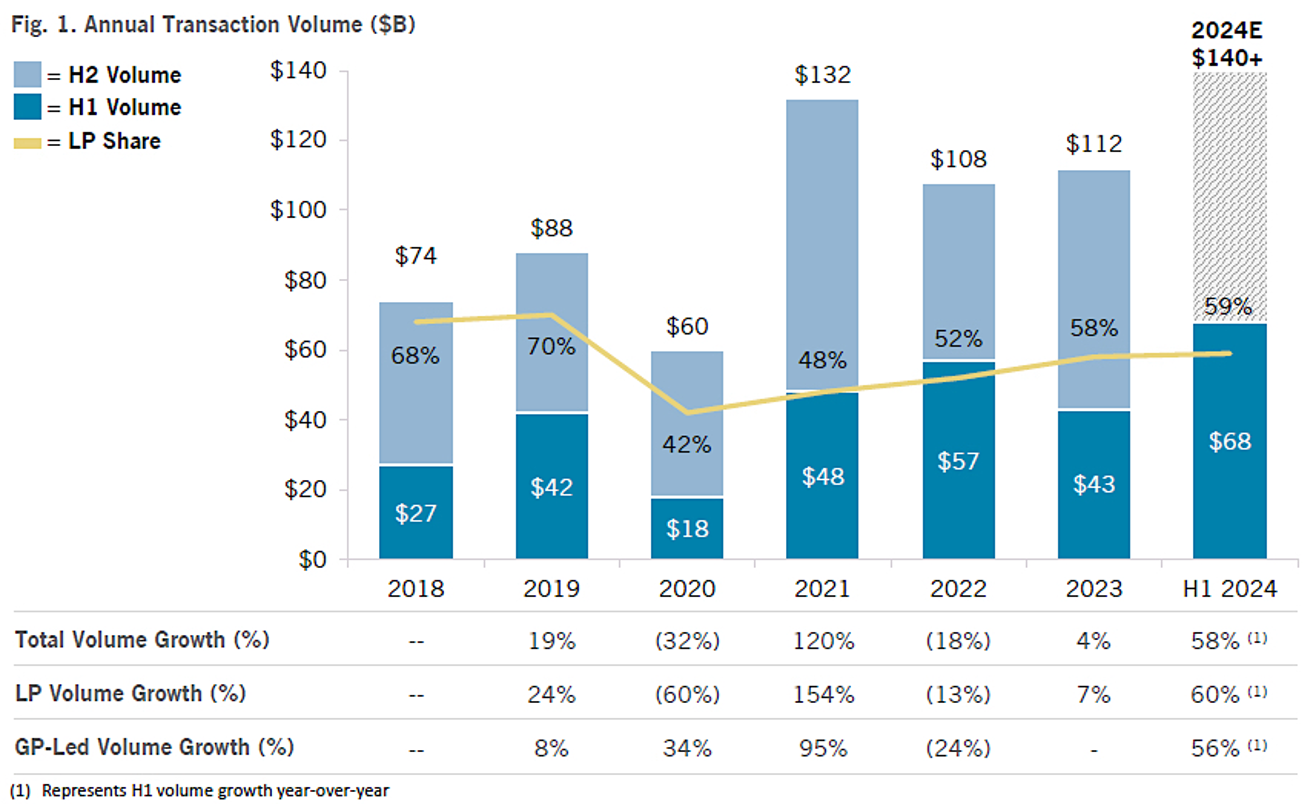

Read MoreChart of the Week: Secondaries on the March

The growth of equity secondaries is fueled by both LP and GP liquidity needs. Source: Jefferies(Past performance is no guarantee of future results.)

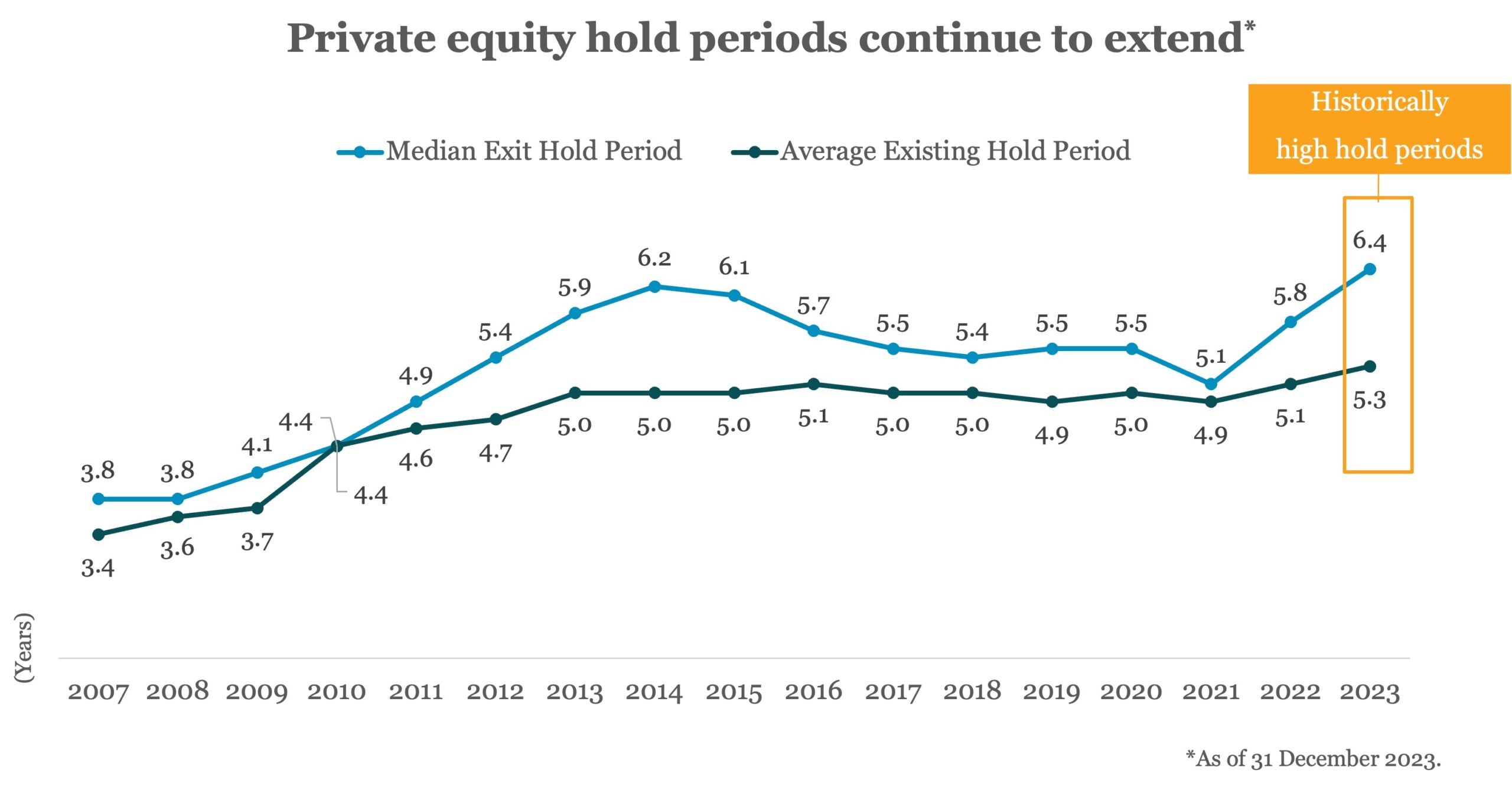

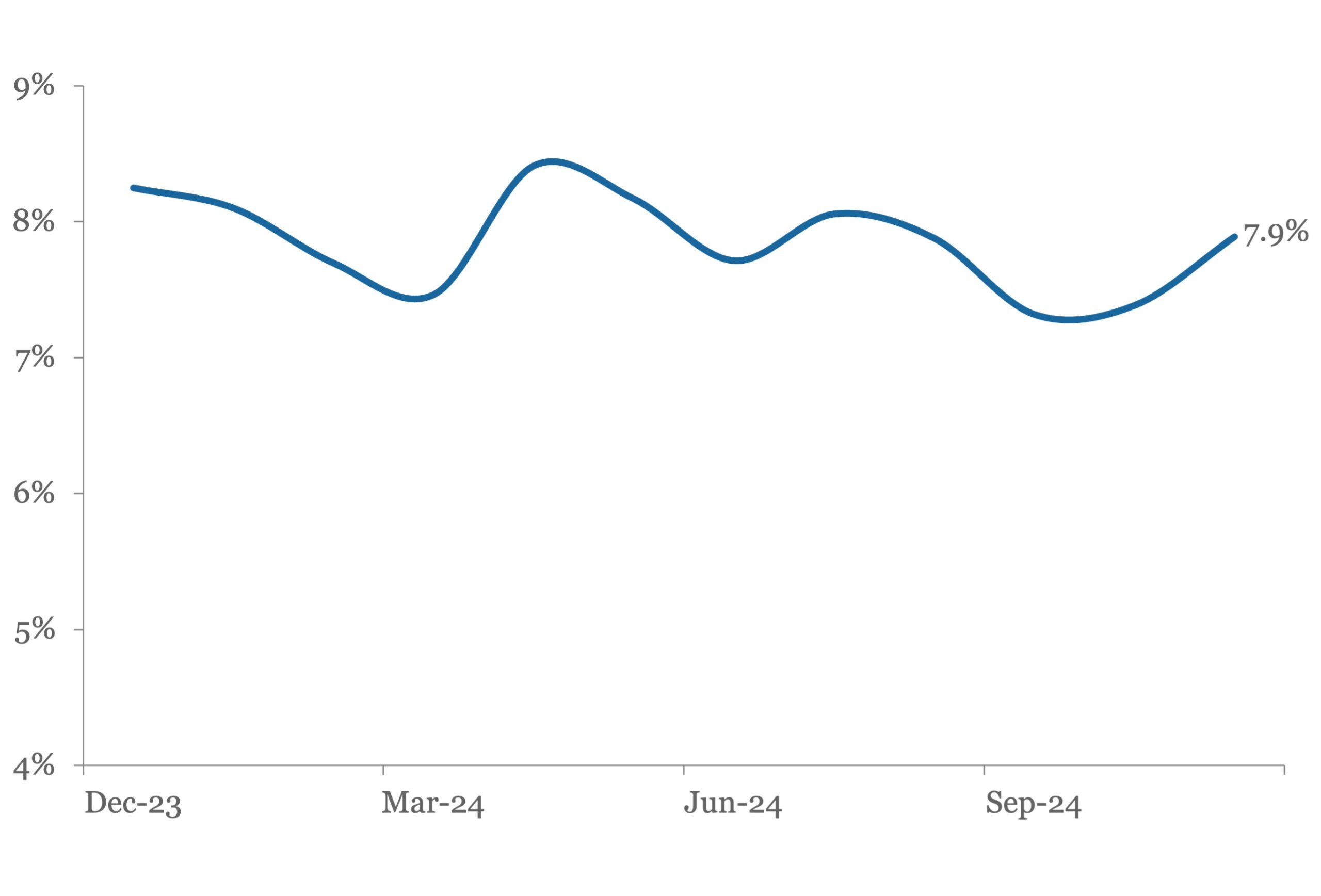

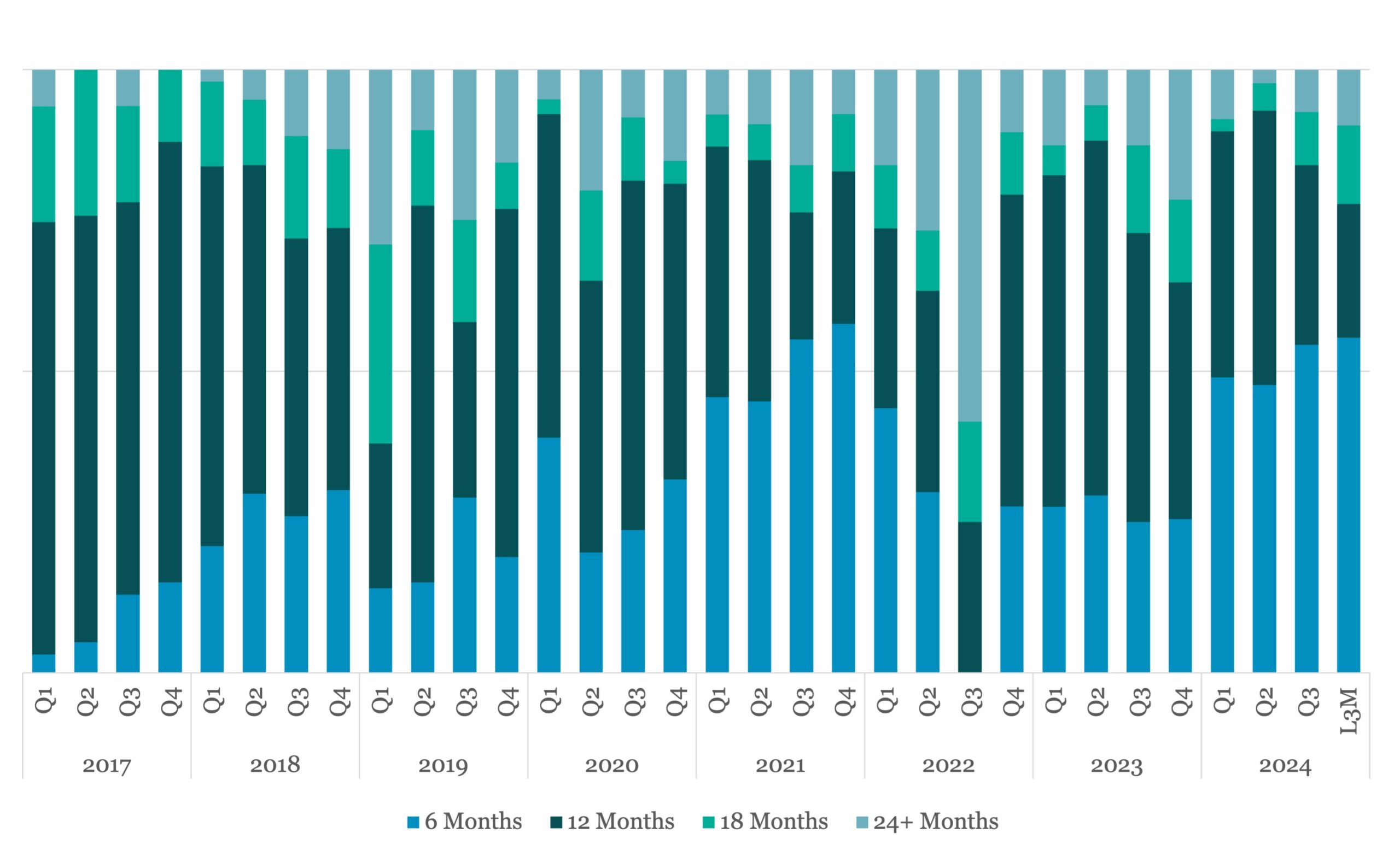

Read MoreChart of the Week: On Holds

In the absence of M&A activity, PE portfolio companies are held for extended periods. Source: PitchBook(Past performance is no guarantee of future results.)

Read MoreSubscribe Now!

Join the leading voice of the middle market. Try us free for 30 days.

Click here to view the Newsletter sample.

What is the Lead Left?

- One-stop source for deals and data

- Market trend commentary and analysis

- Exclusive interviews with thought leaders

View Article By

Features

Private Debt Intelligence – 12/16/2024

Top ten private debt funds hoover up 60% of capital in 2024 Read more in ‘Preqin 2025 Global Report: Private Debt’ The trend of capital consolidation in private capital continues unabated, with emerging managers finding it increasingly hard to raise funds as the vehicles raised by the most-well known and largest managers have drawn in…

Middle Market & Private Credit – 12/16/2024

NAIC Report Puts Smaller CRA Ratings Under the Spotlight Click here to learn more. At end-2023, US insurers held about USD350 billion of privately rated securities. The NAIC has adopted a proposal to contest private ratings from CRAs if their ratings are three notches higher than an assessment from the NAIC’s Securities Valuation Office (SVO)….

The Pulse of Private Equity – 12/16/2024

Oil & gas fundraising activity Download PitchBook’s Report here. Of the six oil & gas funds to close through Q3, three funds raised over $500 million. The largest fund, Carnelian Energy Capital V, raised $975 million, followed closely by EnCap Flatrock Midstream Fund V on $931 million, though this was well below its $3 billion target…

Leveraged Loan Insight & Analysis – 12/16/2024

CLOs ramp to new heights in ’24, new issuance tops US$186bn thanks to bustling November US CLO new issuance totaled US$25.2bn across 54 vehicles in November, marking the busiest month of the year and the second highest monthly tally on record for the asset class…. Subscribe to Read MoreAlready a member? Log in here...

PDI Picks – 12/16/2024

Private debt’s emerging manager problem New GPs face a tough task to attract investor interest, but there are ways of maximising prospects. It feels somewhat Scrooge-like to point it out at this time of year but, for emerging managers, goodwill appears to be in short supply. In our LP Perspectives study – to be published…

Beginning in July 2022 The Lead Left published a series of articles on credit market. This report consolidates those articles.

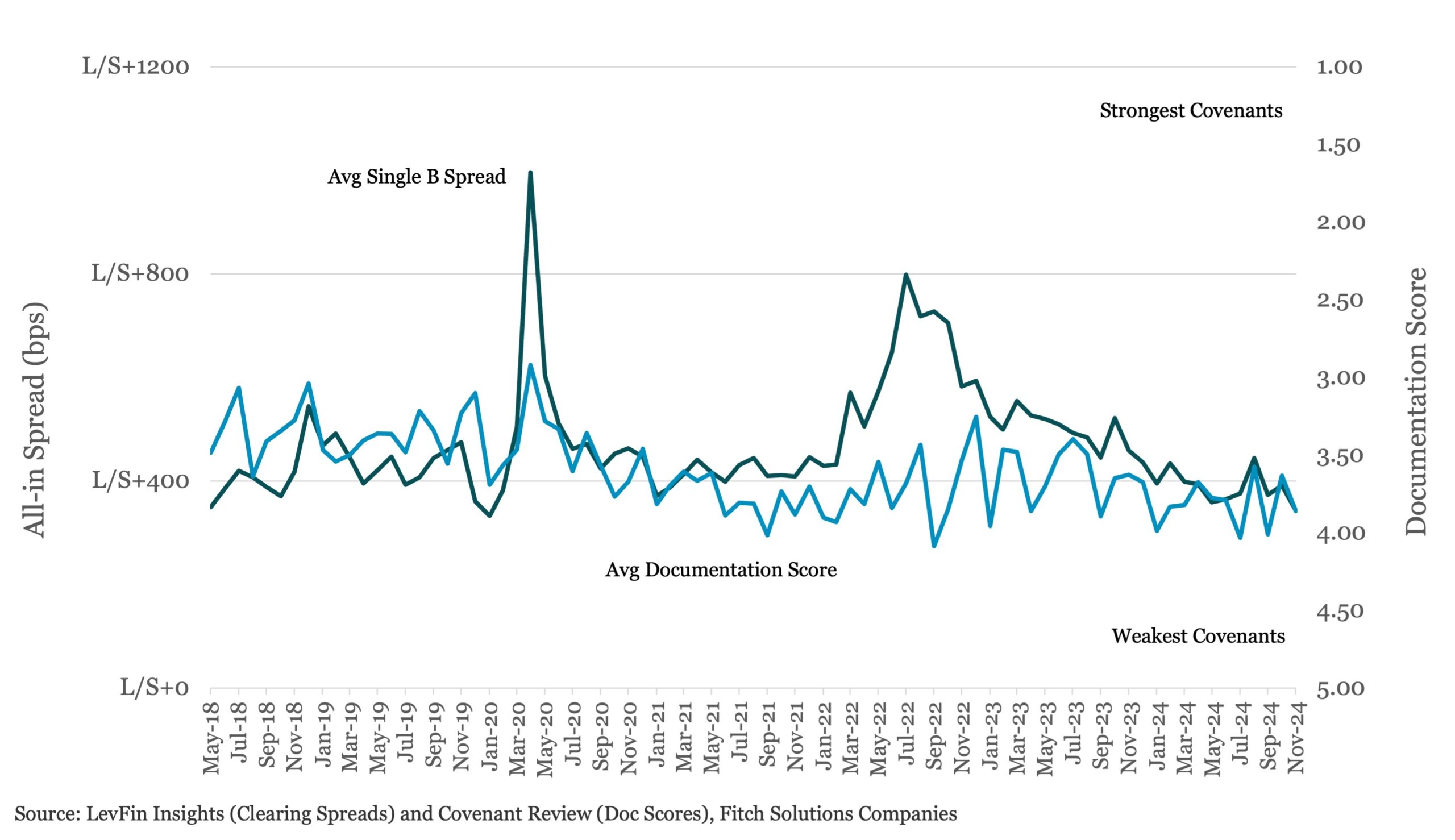

Cov-lite trends Inflation & rising interest rates – LIBOR to SOFR transition Mega-tranche uni trend ESG takes center stage Login to view interactive report and download PDF version. … Subscribe to Read MoreAlready a member? Log in here Related posts: 2H 2021 Midyear Outlook Report State of the Capital Markets – Fourth Quarter 2016 Review and

Beginning in September 2021 The Lead Left published a series of articles on supply chain. This report consolidates those articles.